Credit agency lifts Greece out of default territory with B-rating on optimism that debt swap and reforms will ease economy problems.

Eurozone finance ministers approve second bailout for Greece but demand Spain acts urgently to deal with tight deficit target.

As ministers meet to finalize the Greek payout, concerns have been raised that Spain may become the next challenge for the Union as it struggles to keep its debt-ridden Southern members afloat.

Greek Finance Minister Evangelos Venizelos will run unopposed for the leadership of the Socialists, party officials said Sunday, as the political focus shifts towards a parliamentary election now that Athens has secured a bond swap deal.

Greek officials say the deal eases their country's debt burden by €105 billion. Next up: Action by the European Union to determine if Athens will get emergency loans to help avert a default.

A lack of policy direction in North Africa is jeopardizing the already-sluggish economic recovery according to a report by Capital Economics.

Greece had until Thursday afternoon to persuade at least 70 percent of private holders of its government debt to accept a swap that includes losses of up to 74 percent.

Greece moved closer on Thursday to concluding a bond swap deal with private creditors that it desperately needs to stave off a messy default and buy time to repair its exhausted economy.

The European Commission may on Wednesday tell Hungary it still has concerns over disputed laws, potentially further delaying new talks on an aid deal needed to keep the country solvent.

Myanmar will begin a managed float of its currency in the fiscal year starting in April and wants to develop an interbank money market to end a black-market currency system that critics say deters investment and abets kleptocracy.

Greece's major bondholders voiced their support on Monday for a deal that will halve the value of their debt holdings and aims to put the country back on a sustainable debt-repayment footing.

Despite agreeing to the new European Union fiscal stability pact, Spain has autonomously decided to defy the established deficit target. Spain will not reach the previously set deficit target of 4.4 percent of gross domestic product (GDP) and instead opts for more flexibility, setting a new target of 5.8 percent of GDP.

The U.S. economic recovery could be dented by a renewed drop in housing prices in the short term and the country lacks a credible, comprehensive fiscal plan, posing a major medium-term economic risk, a top IMF official said.

Bloc leaders on Friday signed a new pact to allow for faster transfer of capital to the EU's planned permanent €500 billion ($660 billion) bailout fund and to set strict rules on member states' debt.

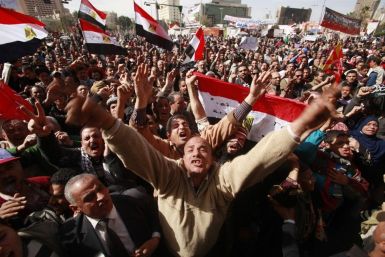

Comments made by Saudi Arabia, that its promises of financial aid to Egypt have been held back by the latter, are at odds with earlier remarks from the Egyptian Prime Minister, which lambasted foreign donors for failing to honor their pledges, according to a report.

Greece has approved pension and health care cuts as part of the reforms agreed in return for the 130 billion euro ($171 billion) bailout deal approved by the Eurozone.

Ireland may need to make further changes to its budget this year if the economy continues to deteriorate, the European Commission said on Wednesday in a draft of a report obtained by Reuters.

China's engagement in resolving the euro zone debt crisis has been a topic of contention. High-profile Chinese leaders, such as Vice Premier Wen Jiabao and Vice President Xi Jinping, have reassured the European countries that China would invest in alleviating the debt. However, a financial plan has yet to be communicated.

Saudi Arabia said on Wednesday it will honor the commitment of $3.75-billion financial aid to Egypt, responding to complaints from Egyptian Prime Minister Kamal Ganzouri.

Standard & Poor's has announced that its rating on Greek sovereign debt has been downgraded to selective default, subsequent to agreement by banks to write off more than half of their Greece debt holdings.

Germany, the chancellor says, is willing to put €11 billion ($14.7 billion) into the euro zone's main bailout fund this year and next -- as long as its currency partners do the same.

Leading economies told Europe it must put up extra money to fight its debt crisis if it wants more help from the rest of the world, piling pressure on Germany to drop its opposition to a bigger European bailout fund.