Hulu, the popular online video service, has taken another step to becoming a full-fledged alternative to cable television by commissioning its first scripted original TV show to go live next month.

The euro zone's bailout fund can hold onto its AAA rating with Standard & Poor's through higher guarantees from the euro zone's remaining triple A countries or lower lending capacity, a senior euro zone official said Sunday.

Advanced Micro Devices' (AMD) stock, after meandering at $5 for much of the fall, has pushed above $5. What's that mean for the stock, moving forward?

French haute couture fashion designer Jean-Paul Gaultier has reportedly provided a fashionable way for bullion investors to diversify holdings and hedge against inflation.

Chinese Premier Wen Jiabao pressed Saudi Arabia to open its huge oil and gas resources to expanded Chinese investment, media reports said on Sunday against a backdrop of growing tension centered on Iran and worries over its crude exports to the Asian power.

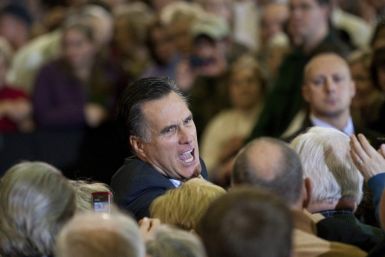

Mitt Romney is being maligned as a vulture capitalist who enjoyed firing workers -- while amassing his own huge fortune -- but rivals' attacks on the former private-equity player's business record may be one of the best things that ever happened to his presidential campaign.

Newt Gingrich might have denounced the errors in a Super PAC (political action committee) advertisement on Mitt Romney and asked them to withdraw it, but the trailer and the documentary titled King of Bain - When Mitt Romney Came to Town is still going viral on the Internet. The ad in the form of a 28-minute documentary was released by Winning our Future, a Super PAC that supports Gingrich.

A Japanese banker who is a key figure in the Olympus Corp. accounting fraud came into public view for the first time since the scandal broke, appearing on Friday at his divorce hearing in a Florida court.

A whopping 44 percent of all mutual-fund shareholders are baby boomers, according to an Investment Company Institute report. As they take withdrawals from their retirement kitties over the next couple of decades, you're looking at a major, potentially market-altering event.

A Japanese banker who is a key figure in the Olympus accounting fraud came into public view for the first time since the scandal broke, appearing on Friday at his divorce hearing in a Florida court.

Standard & Poor's downgraded the credit ratings of nine Eurozone governments on Friday, an unprecedented relegation that included France and Austria but spared Germany.

Art Laffer is named in a lawsuit from a group of investors who say he lent his name to investment funds that ran a Ponzi scheme through a talk radio business.

There has always been economic disparity and there always will be.

U.S. stocks were on track to end the week with modest gains as major indexes pulled back from session lows after falling more than 1 percent on Friday on talk that Standard & Poor's was ready to downgrade ratings on several euro-zone countries.

London developers are shifting their focus toward super-sized luxury flats to keep pace with the growing wealth of overseas buyers seeking a safe haven for their cash, charging them up to 70 percent more for the privilege.

Investors have approved a year-long extension of a $4.7 billion property megafund from Morgan Stanley , a company spokesman told Reuters on Friday.

Goldman Sachs said it expected upside in prices of oil, gold and copper this year, citing greater supply risks and stronger fundamentals.

Shares in Research In Motion climbed nearly 4 percent on Thursday on market speculation the BlackBerry maker had hired investment bank Goldman Sachs to explore strategic options.

JPMorgan Chase & Co Chief Executive Jamie Dimon announced on Thursday that long-time colleague Jay Mandelbaum is leaving the company and that he is shifting the responsibilities of several operating executives.

Royal Bank of Scotland Group Plc (NYSE: RBS), Britain's biggest state-owned bank, has became the latest major bank to succumb to the global squeeze on financial institutions trying to juggle shareholder pressure and worsening economic prospects.

It’s question that dominates the suburban dinner-party set these days, or so it seems: where are U.S. home prices headed?

Few companies embody the highs and lows of turbo-charged modern finance better than Ferretti.