Molycorp Inc (MCP.N) said on Friday it has broken off talks with Japan's Sumitomo Corp with regard to a financing deal, as the investment is no longer necessary for the implementation of its business plan.

The cost to install solar power in the United States fell by 17 percent in 2010 and is on pace to drop even faster this year, according to a new report issued by the Lawrence Berkeley National Laboratory.

Gold prices rebounded Friday, along with other safe-haven investments, literally hours after dropping sharply on word that the world's biggest central bankers were jointly moving to protect the eurozone's commercial financial institutions.

A strike involving thousands of workers at Freeport McMoRan's Indonesian copper mine and port has delayed around 133,000 tonnes of copper ore concentrate shipments, industry officials said on Friday.

Treasury Secretary Timothy Geithner pressed euro zone ministers on Friday to leverage their 440 billion euro bailout fund and free up more resources to tackle a two-year-old debt crisis, a senior euro zone official said.

Tokyo Game Show (TGS), Japan's biggest gaming event which began Thursday at Chiba's Makuhari Messe convention center, will continue through Sept. 18.

Gold and silver prices moved higher late Thursday after posting big losses in the New York futures market.

Investors obviously applauded the move, sending Morgan Stanley shares up 7.2 percent in Thursday’s trading.

South African energy minister Dipuo Peters said on Thursday she had signed off on a proposal for new nuclear power plants, likely worth tens of billions of dollars, and said it would be presented to cabinet soon.

Gold and silver fell hard Thursday after five major central banks announced a coordinated plan to inject U.S. dollars into European banks straining under the load of the continent's sovereign debt crisis.

Sales jumped 2.7 percent in the month to C$46.7 billion ($46.7 billion) following three straight months of declines and beating estimates of a 1.3 percent gain, Statistics Canada said on Thursday.

Apple is known for improving the iPhone experience with the launch of new iPhone versions year after year. This year looks no different if rumors are to be believed. Both hardware and software improvements are expected this year as well.

The world's major central banks, led by the European Central Bank and the U.S. Federal Reserve, in a coordinated effort Thursday intervened to provide dollar loans to commercial banks in an effort to maintain liquidity in Europe and check institutional investor concern about Europe's private sector banks. What will be the impact on U.S. stocks?

With precious little time to rest after their brutal U.S. Open final, world number one Novak Djokovic and Rafa Nadal will be energized by national pride this weekend as they lead their countries into battle in the Davis Cup semi-finals.

The new loan offers will be conducted in October, November and December.

Adobe Flash has finally come to Apple Inc.'s iPad, iPhone, iPod Touch, not directly supported but just that the new app tools will be able to export Flash content as an HTML5-supporting format.

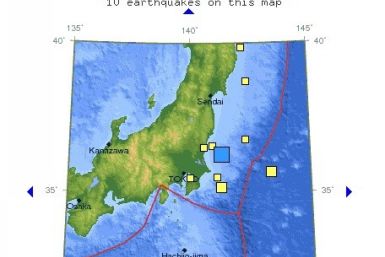

There were at least four earthquake with magnitudes of 3.0 or higher on Thursday. Is that something the world needs to worry about?

While public schools have focused their energy on training students in math and reading since the passage of No Child Left Behind, the College Board announced SAT scores in combined reading and math this year have dropped to their lowest point since 1995.

World Bank President Robert Zoellick said on Wednesday the world had entered a new economic danger zone and Europe, Japan and the United States all needed to make hard decisions to avoid dragging down the global economy.

Sony has announced 26 game titles that will arrive with the launch of the PlayStation Vita.

Japanese manufacturing confidence improved for a fifth straight month in September but the pace of recovery slowed to a crawl, with a strong yen and faltering global growth starting to take a toll on the world's No.3 economy, a Reuters poll showed.

Asian stocks bounced on Thursday after tentative steps by euro zone policymakers to tackle a crippling debt crisis, but investors remained wary that obstacles the bloc's leaders face could weigh on the euro and Asian currencies in the medium term.