Shares of Apple (Nasdaq: AAPL) set another record high Tuesday after three more analysts boosted their targets, although none as high as the $1,001 set Monday by Brian White of Topeka Capital Markets.

Chevron (NYSE: CVX) and Transocean (NYSE: RIG) will soon know which Brazilian court will preside over a criminal trial stemming from a November 2011 oil spill.

Ongoing fiscal troubles in the 17-state currency area have cut share prices of numerous European companies, making them attractive to suitors from abroad.

Shell is moving closer to the date when it can start drilling for oil in Arctic waters off Alaska. The company may soon get the Department of the Interior's approval and could begin operations by year's end.

More than 100 advertisers, including all his technology advertisers except for LifeLock, withdrew their commercials from “The Rush Limbaugh Show” in the past five weeks.

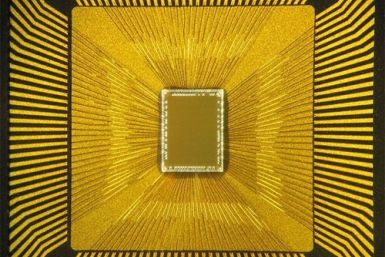

Chip stocks eased Tuesday after the Semiconductor Industry Association published data showing sales increased for the three months ended in February.

Molson Coors Brewing Company (NYSE: TAP), a North American brewer that owns popular brands like Coors and Molson Canadian, has struck a deal to buy StarBev L.P., a leading Eastern European brewer, in a bid to expand its presence in that region.

One of the world's largest exporters of raw materials is working to introduce a steep tax on just such shipments this year, Reuters is reporting, a move that is catching foreign investors and major trading partners by surprise.

A day after Iraq's oil minister announced Exxon Mobil (NYSE: XOM) confirmed it was freezing a controversial exploration deal in Kurdistan, the autonomous region's natural resource minister said Baghdad is lying.

The top aftermarket NYSE gainers Monday were: Annie's, Fortune Brands Home & Security, 3D Systems, Gafisa SA, Frontline and Armstrong World Industries. The top aftermarket NYSE losers were: Rockwood Holdings, Guidewire Software, Flotek Industries, Vocera Communications and ITT Corp.

Despite the collapse of Eastman Kodak (Pink: EKDKQ) because it couldn’t sell its valuable patents last year, the market for intellectual property remains red hot and growing, a leading IP banker said.

The U.S. government has until Thursday to respond to BP's accusation that it is withholding information on the size of the Deepwater Horizon oil spill in 2010.

IBM (NYSE: IBM) and the Netherlands Institute for Radio Astronomy announced a five-year deal for computer support for the world’s most sensitive telescope.

PepsiCo Inc. (NYSE:PEP), the world's second-largest food and beverage company, claimed the No.784 spot on the IBTimes 1000 list by expanding aggressively in emerging markets and catering to consumers' demand for healthier food and beverages.

Could Apple (Nasdaq: AAPL) shares trade at $1,001? Analyst Brian White of Topeka Capital Markets see that within 18 months when Apple closes its fiscal 2013.

The Federal Trade Commission has approved the $29-billion blockbuster merger of Express Scripts, Inc. (NASDAQ: ESRX) and Medco Health Solutions Inc. (NYSE: MHS), two pharmacy benefit managers, or PBMs.

Exxon Mobil (NYSE:XOM) has confirmed its intention to freeze a controversial deal with the Kurdish government. That may lead Baghdad to let the U.S. company compete again for exploration contracts.

International trade groups are warning a proposal that would allow India's government to retroactively tax foreign companies could discourage investment.

Kohlberg Kravis Roberts & Co. (NYSE: KKR) said Monday it agreed to buy natural gas properties in Texas and Oklahoma from WPX Energy Inc. (NYSE: WPX) for $306 million, the latest in the private-equity's spate of U.S. energy acquisitions.

Friday, the Dow gained 66.22 points, or 0.50 percent, to 13,212.04 at the close. The S&P 500 Index gained 5.19 points, or 0.37 percent, to 1,408.47, while the Nasdaq Composite dipped 3.79 points, or 0.12 percent, to 3,091.57. The uptick capped U.S. stocks' strongest quarter in more than two years.

The top aftermarket NYSE gainers Friday were: Roundy's, Rouse Properties, Genco Shipping & Trading, Delek US Holdings, USG Corp and MEMC Electronic Materials. The top aftermarket NYSE losers were: Pioneer Natural Resources, Dean Foods, ExactTarget, Drew Industries, Praxair and Drew Industries Inc.

Friday's surge may have been a reaction to RIM's new CEO, Thorsten Heins, who said he's conducting a strategic review of the company, indicating a sale of some or all of its assets is possible.