If, as a stock investor, you're a little jittery following Standard & Poor's downgrade of the U.S. Government's credit rating, you're not the only one. The stock market has tumbled, and more declines may be ahead. Even so, keep in mind that a good portion of the money made in stocks stems from not panicking.

Trump believes the whole thing is a ?publicity stunt? by S&P.

In 1986, Moody?s and Standard & Poor?s cut Australia?s debt rating, prompting the Canberra government to impose strict budget cuts.

Toronto's main stock market index sank more than 3 percent to its lowest point in nearly a year on Monday as a downgrade of the U.S. credit rating shook investor confidence globally and drove commodity prices sharply lower.

Shares of major gold mining companies notched fresh gains in midday trading Monday as the price of the precious metal topped $1,700 per ounce.

The United States is unlikely to get its AAA rating back any time soon, and if Washington fails to follow through on spending cuts, the nation faces an even further downgrade, two Standard & Poor's execs said Monday.

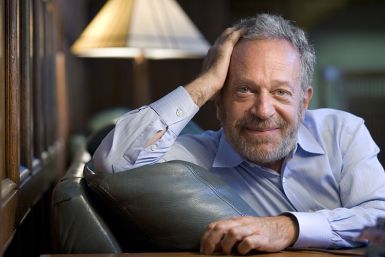

The former labor secretary described S&P?s downgrade maneuver as an ?ironic? intrusion into American politics.

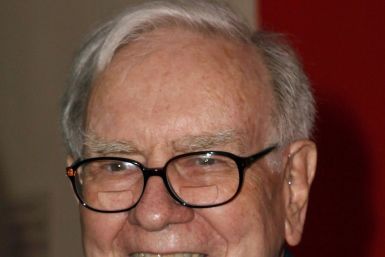

Buffett also pointed out that his company?s exposure to US Treasuries is quite significant.

These institutions process trades and are key to the daily operation of the U.S. financial markets.

Credit ratings agency S&P threw a monkey wrench in the works by downgrading its long-term credit rating for the U.S. from AAA to AA+, just days after President Obama signed a debt-limit compromise.

Standard & Poor's downgrading in the U.S. continued Monday, as the ratings agency lowered Fannie Mae and Freddie Mac, which own or guarantee roughly half of all mortgages in America.

It looks like the U.S. Government isn't the only one taking a ratings hit. Standard & Poor's cut Freddie Mac's and Fannie Mae's long-term ratings one notch on Monday.

Standard & Poor's lowered its long-term debt rating for the U.S. to AA+, while Moody?s and Fitch maintained their ratings.

U.S. stock index futures tracked a sharp drop in global equity markets on Monday after rating agency Standard & Poor's cut the top-tier AAA credit rating of the United States, rattling already-jittery investors.

The U.S. budget deficit was $1 trillion before he took the oath of office, he inherited a nation in deep recession, with a banking crisis, two wars, and now there's a credit downgrade stemming from decades of debt incurred before he was on the scene, but make no mistake about it, President Barack Obama has to create a lot of jobs for his presidency to succeed.

On Friday, S&P reduced the U.S. credit rating by one notch from the highest rating of AAA to AA+, with a negative outlook.

After considering a resignation once a debt deal was reached, U.S. Treasury Secretary Timothy Geithner confirmed on Sunday that he will remain at his post at President Barack Obama's request, making him Obama's longest-serving economic adviser after the first-ever U.S. credit downgrade.

In opening minutes of trading, the Dow Jones Industrial Average is down 1.2 percent, S&P 500 has slid 2.2 percent and Nasdaq has fallen 3.1 percent.

The market's stance heading into the new week is one of caution, following S&P's stunning and controversial downgrade of the U.S. Government's credit rating. Essentially, Wall Street has to figure out if S&P was ahead of the curve, or was remarkably off-base in its analysis, and it's too soon to tell which view will prevail.

At one time during the trading session, the Kospi index was down by as much as 7.4 percent.

The U.S. credit rating downgrade could have easily been avoided, but political power struggles in Washington got in the way. Now, markets are reeling and damage has been done. But it's not too late to fix the problem, so that Moody's and other ratings agencies keep the U.S. with a AAA rating.

FBR Capital Markets expects the S&P's downgrade of the United States' debt will actually have a more negative impact on the commercial aerospace names as compared with its defense names.