Rajat Gupta's arrest is the latest in the unscrupulous world of insider trading. Here are five more recent cases:

In the largest penalty of its type, UBS AG was fined $12 million by a U.S. brokerage regulator over the Swiss bank's systemic failure to properly handle millions of short-sale orders.

Swiss bank UBS AG overcame a 1.8 billion Swiss franc ($2 billion) rogue trading loss to post a smaller than forecast fall in third quarter net profit on Tuesday as its core wealth management business performed well.

Swiss bank UBS AG overcame a 1.8 billion Swiss franc ($2 billion) rogue trading loss to post a smaller than forecast fall in third quarter net profit on Tuesday, salvaged by a one-off accounting gain.

Francois Gouws and Yassine Bouhara, the co-heads of UBS’ global equities, handed in their resignations, apparently taking responsibility for the actions of the London rogue trader who perpetrated illegal trades.

“Europe was, of course, not particularly successful in the last few months.”

UBS AG interim Chief Executive Sergio Ermotti appealed to staff in an internal memo to back efforts to make the bank less complex and risky, following a $2.3 billion loss from unauthorized trading.

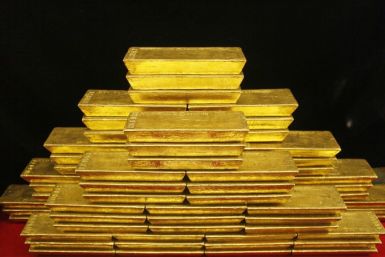

Gold prices recovered from huge overnight losses Monday before paring losses to about 1 percent. Still in the last three days the precious metal has now lost more than 9 percent of its value in its biggest three-day drop since 1983.

UBS has said that Sergio Ermotti will be the caretaker chief executive following the resignation of Oswald Gruebel last week.

The top after-market NYSE gainers on Friday are: ING Group, Basic Energy Services, American Eagle Outfitters, Noah Holdings Ltd and Jabil Circuit. The top after-market NYSE losers are: Sunrise Senior Living, American Axle & Manufacturing, Moneygram International, Clorox and Korn/Ferry International.

Adoboli is hardly the first UBS employee to engage in questionable conduct.

Stock index futures fell on Friday as talk of a Greece default gained pace and a day after markets spiraled downward on deepening worries about global economic stagnation.

UBS AG Chief Executive Oswald Gruebel will seek a vote of confidence at a board meeting in Singapore for plans to slash the investment banking division that caused a $2.3 billion loss due to unauthorized trading, a Swiss newspaper reported on Tuesday.

UBS, it appears, had no idea that accused rogue trader Kweku Adoboli might be messing around with unauthorized risks in its London office, losing $2 billion. It's shocking that $2 billion could slip away so easily, but that's apparently what happened. The bank's analytics simply never caught on, and by now, you know what happened from there -- $2 billion is gone, and the 31-year-old Adoboli has been arrested by London police and charged with three counts while UBS, the Swiss bank with ...

Charged UBS rogue trader Kweku Adoboli wept in court Friday during a 15-minute hearing in London over a charge of fraud and two charges of false accounting involving a $2 billion loss for the Swiss-based bank.

Kweku Adoboli has been charged with fraud and false accounting by London police in connection with unauthorized trades at UBS that caused the bank a $2 billion loss. Adoboli has also reportedly admitted to the bank he caused the losses. His father, a retired United Nations employee living in Ghana, said his son made a mistake.

Continued losses in the investment bank arena could lead to more restructuring and another round of job cuts to be unveiled in November.

Arrested at his UBS trading desk, rogue trader Kweku Adoboli allegedly told the bank about his unauthorized trading that resulted in a nearly $2 billion loss.

UBS said it may report a third-quarter loss after it suffered a $2 billion loss due to unauthorized trading by a trader in its Investment Bank.

Swiss bank, UBS AG, said it has suffered a $2 billion loss due to rogue trading and the London police arrested a 31-year-old man on suspicion of fraud.

Colleagues at UBS called Kweku Adoboli, the trader arrested in connected with a $2 billion loss due to unauthorized trading at the bank, up and coming and someone who worked hard...played quite hard too. Adoboli, 31, was arrested on Thursday by London police on suspicion of fraud by abuse of position and being held in custody at Bishopsgate police station. A graduate of Nottingham University who was born in Ghana, Adoboli studied computer science in college and went to work at UB...

Kweku Adoboli, the 31-year-old London man accused as the rogue trader who cost Swiss banking giant UBS an estimated loss of $2 billion, is a "well-dressed quiet man" of African origin who wasn't the "tidiest" but is very "well spoken," according to a former landlord.