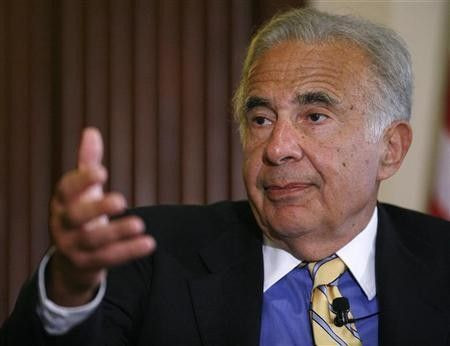

Transocean Has Bittersweet News For Carl Icahn: Shareholders Reject Carl Icahn's Big Dividend Proposal But Oust Chairman

A sweeping majority of Transocean Ltd. (NYSE:RIG) shareholders voted against activist investor Carl Icahn’s $4 a share dividend proposal on Friday and ousted longtime chairman Michael Talbert.

At its annual shareholder's meeting held in Zug, Switzerland, the offshore drilling company said that nearly 75 percent of its holders, excluding Icahn’s shares, voted down the billionaire investor's dividend proposal in favor of the board-proposed dividend of $2.24 a share. In January, Icahn disclosed a 5.6 percent stake in Transocean and set out on a bid to shake up the board and net a higher dividend, which the board countered and called "unsustainable."

UBS analysts said in a note on Monday that Icahn appeared to be most focused on pushing out Talbert. The 66-year-old executive said earlier this week that if he won re-election, he'd quit as chairman by November and completely step down from the board by this time next year.

The move was meant to prevent any of Icahn’s nominees from reaching the board, an unnamed source told the Wall Street Journal, which noted that several energy companies have taken similar steps amid increased pressure from activist investors to focus on shareholder returns.

Transocean had criticized Icahn’s picks for being too close to him and lacking the necessary experience to guide the company; however, shareholders elected Sam Merksamer, one of three Icahn-backed candidates to its board of directors, bringing the total number to 14.

Talbert, who served as CEO from 1994 to 2002, had served on the board for two decades.

"We also recognize and express our gratitude to Mike Talbert for his many years of exceptional service to Transocean, its employees, and its shareholders,” the company said in a statement.

Icahn had pitched a hefty shareholder dividend, arguing that Transocean was underperforming its rivals in shareholder returns over the past five years. He blamed the 2010 Deepwater Horizon accident, in which a rig in the Gulf of Mexico exploded, killing 11 and causing the largest-ever oil spill in U.S. waters.

He also pointed to two acquisitions that, to him, seemed poorly planned. Icahn said the company overpaid when it bought competitor Global Santa Fe in 2007 and shouldn't have issued debt and equity to cover the 2011 acquisition of Aker Drilling.

Shares of Transocean fell 88 cents, or less than 2 percent, to $53.83 in midday trading on Friday.

© Copyright IBTimes 2024. All rights reserved.