UK Autumn Statement Preview: Better Q3 GDP, Dip In Deficit To Help George Osborne

U.K. Chancellor George Osborne will undoubtedly have some good economic news to offer up when he gives his annual Autumn Statement to Parliament on Dec. 5. Economists say the improvement in Britain's public finances may tempt the Chancellor to ease off his austerity drive in a bid to win voters' appeal.

The statement provides an update on the government’s plans for the economy based on the latest forecasts from the Office for Budget Responsibility. The office will publish fresh borrowing forecasts on Dec. 5, alongside Osborne's latest tax-and-spending plans.

With only 18 months to go until the next election, Osborne therefore faces something of a quandary. Should he maintain his focus on eliminating the fiscal deficit as quickly as prudently possible, or should he switch his attention to addressing his party’s electoral deficit instead?

“Sticking rigidly to his austere fiscal plans would be quite a gamble, given the absence of signs that pay growth will strengthen significantly soon,” Samuel Tombs, UK economist at Capital Economics, wrote in a note. “As a result, the Chancellor may feel he needs to boost living standards directly by loosening the fiscal purse strings.”

Osborne certainly will have the resources to do so. After all, the budget office is likely to revise up its forecasts for gross domestic product growth and to pull down its borrowing forecasts for the next five years significantly, perhaps by up to 100 billion pounds ($162 billion) in total, according to Tombs.

“One should never forget that the Budget and the Autumn Statement are not just presentations of fiscal performance, they are also political theater,” Societe Generale economist Brian Hilliard wrote in a note. “Osborne will certainly try to pull some rabbit out of the hat, for example further commitments to freeze fuel duties, but we do not expect him to seriously exploit the better than expected deficit figures.”

Dip In Deficit

The UK's budget deficit is finally moving in the right direction.

“The Chancellor must be feeling an awful lot happier about life now than when he was preparing his Autumn Statement last year,” Howard Archer, chief UK and European economist at IHS Global Insight, wrote in a note.

Britain's Office for National Statistics said on Thursday that faster growth helped the UK's budget deficit to narrow in October to 8.1 billion pounds, compared with a deficit of 8.2 billion pounds in the same month a year earlier.

The figures suggest Osborne remains on track to borrow less this fiscal year than the 120 billion pounds the independent Office of Budget Responsibility predicted he would in March.

In terms of government spending, here’s a nice breakdown:

UK govt. spending per head 12/13: £8,788 (England - £8,529; Wales - £9,709; Scotland - £10,152; N.Ireland - £10,876) pic.twitter.com/Pgc2DJF4r0

- HM Treasury (@hmtreasury) November 21, 2013Economic Recovery

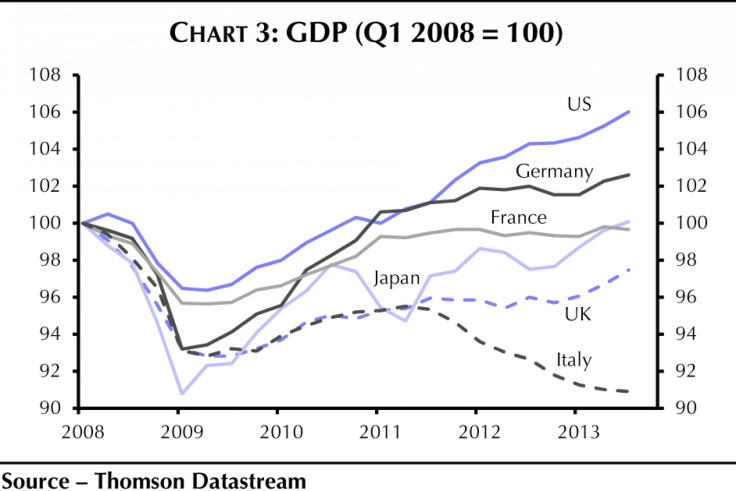

Next week’s second estimate of the UK’s third-quarter GDP looks set to underline the remarkable transformation of the British economy from one of the slowest growing G7 economies to the fastest, Tombs projected.

Recent revisions to the industrial production and construction figures haven't been big enough to suggest that the first estimate of a 0.8 percent rise in GDP will be altered. So as things stand, next week’s figures look set to show that the UK has recorded its fastest growth since the second quarter of 2010 and the strongest growth among the six G-7 nations that have released figures so far.

In addition, there are signs that the recovery has gathered more pace in the fourth quarter and has broadened out to all parts of the UK economy.

Meanwhile, the Organization for Economic Cooperation and Development last week joined the swelling number of forecasters who have revised up their growth projections. While it lowered its global growth forecast, its projection for UK growth next year was revised up by almost a percentage point to 2.4 percent -- the largest upgrade to the growth forecast for any OECD country.

That said, the recent improvement in the British economy has yet to make up for many years of underperformance. GDP is still 2.5 percent below its prerecession peak. To put things into perspective, Tombs pointed out that at the same stage in recoveries in the 20th century, UK’s GDP was between 6 percent and 13 percent above its former peak.

Bank of England's chief economist Spencer Dale told BBC on Thursday that he thought the economy was moving in the right direction but the country “had a very deep recession” and the economic recovery will take “a number of years.”

Dale also said that interest rates would remain low for what he termed a “sustained period.”

Indeed, the minutes of the November Monetary Policy Committee minutes support the view that the central bank remains in no hurry whatsoever to raise interest rates.

IHS Global Insight’s Archer expects the Bank of England to start to raise interest rates gradually in the second half of 2015.

© Copyright IBTimes 2024. All rights reserved.