Ukraine Crisis: Banking Sector Still The Economy’s Weakest Link

Ukraine’s banking sector has withstood the political crisis in better shape than feared, but it remains the economy’s weakest link, according to Capital Economics.

“Credit conditions are likely to tighten sharply over the coming months, but a messier outcome seems to have been averted,” William Jackson and Liza Ermolenko, London-based emerging-markets economists at Capital Economics, wrote in an e-mailed report Tuesday.

“Recent progress towards securing external financial support from the IMF/EU should reduce this risk further,” they added. “But if this financing is delayed or the political crisis escalates, the banking sector could still prove to be the economy’s weakest link.”

The crisis began in last November with the decision of Ukraine’s then president, Viktor Yanukovych, to pull out of a trade deal with the EU and accept a $15 billion bailout from Russia. That prompted three months of street protests, leading to the toppling of Yanukovych on Feb. 22. Moscow halted disbursement of the rescue package after Yanukovych fled office.

In late February, Russian troops seized the Crimean peninsula, a strategic piece of land in southeastern Ukraine that juts into the Black Sea. Crimea will hold a referendum Sunday on whether the peninsula should become a part of Russia or remain within Ukraine. Ukraine said Tuesday it would raise a new national guard force in response to Russian attempts to annex Crimea.

Jackson and Ermolenko noted that Ukraine’s banking sector was in a precarious state, even before the country became engulfed by the political crisis last month. “A credit bubble came to a messy end in 2008 as output collapsed and the hryvnia fell by 40 percent against the U.S. dollar. Nonperforming loans surged to around 40 percent of total loans, according to unofficial estimates, and things have hardly improved since then,” they said.

Although it seems that the banking sector hasn’t suffered too badly so far, large vulnerabilities remain, Jackson and Ermolenko noted.

First, the economic downturn resulting from the crisis will cause nonperforming loans to rise further, thus eroding banks’ capital. As a result, banks are likely to restrict credit, and the government could, potentially, be forced to recapitalize the sector.

Second, if the crisis escalates further, this could trigger bank runs and a liquidity crisis. According to Ukraine’s newly appointed central bank governor, Stepan Kubiv, 7 percent of deposits, or 30 billion hryvnias ($3.3 billion), were lost in just 3 days, when Yanukovych was overthrown.

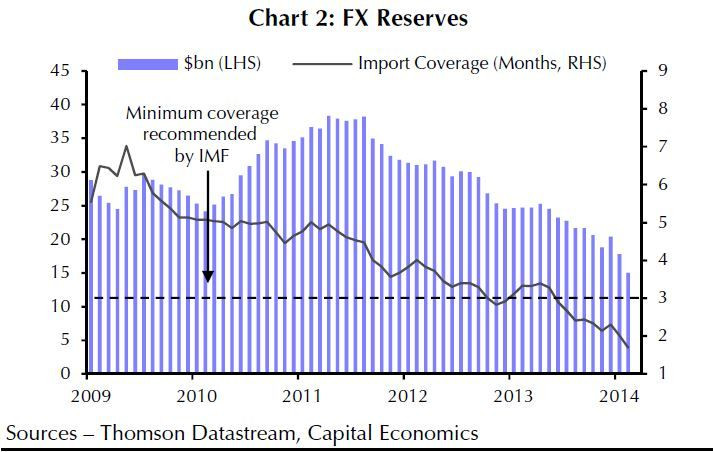

There is little Ukraine’s central bank can do to help banks access hard currency since the NBU has extremely low foreign exchange reserves.

“As a result, banks would have to shrink their balance sheets, resulting in a credit crunch. What’s more, as banks would need to sell hryvnia assets to repay FX liabilities, this would put the currency under pressure,” Jackson and Ermolenko said.

To make matters worse, around 35 percent of total bank lending consists of FX loans to households and companies. “As such, a weaker currency will raise the hryvnia cost of servicing these debts, which risks causing loans to sour in even greater numbers,” they added.

The hryvnia slid past 10 per dollar for the first time as Ukraine’s central bank ended support for the currency to shore up reserves amid political turmoil in late February. While the hryvnia has strengthened against the dollar from its recent trough, a fall looks inevitable given Ukraine’s substantial current account deficit, which stands at 9 percent of gross domestic product (GDP).

On a positive note, Ukraine has made some progress toward securing support from the IMF and EU. Ukrainian Finance Minister Oleksander Shlapak said Monday Kiev hoped to receive the first tranche of a financial aid package, which it is negotiating with the International Monetary Fund, in April.

Also on Monday, the World Bank said it plans to provide Ukraine with up to $3 billion in 2014 to support the country's new government in the midst of its current crisis, though only part of the money would be new.

“We are committed to supporting the people of Ukraine in these difficult times and very much hope that the situation in the country stabilizes soon,” World Bank President Jim Yong Kim said in a statement. “We are moving forward with our pipeline of projects and aim to support the government to undertake the reforms badly needed to put the economy on a path to sustainability.”

“Nonetheless, if this [aid] falters, the first signs of strain are likely to emerge in the banking sector,” Jackson and Ermolenko warned.

© Copyright IBTimes 2024. All rights reserved.