Ukraine Crisis May Slow, But Not Stop, Fed Hiking

The U.S. Federal Reserve's battle against inflation, already complicated by the unpredictable impact of a once-in-a-century pandemic, now faces a likely energy price shock and another layer of uncertainty following Russia's military move into Ukraine.

Oil prices spiked overnight, with U.S. crude oil futures topping $100 a barrel for the first time since 2014, and stock prices slid by around 2% in early U.S. trading.

(Graphic: U.S. oil prices surge after Russia invades Ukraine -

)

Investors all but ruled out a larger half-percentage-point rate increase at the Fed's March meeting, with CME Group's widely followed FedWatch tool signaling at one point the probability of that large a hike had been cut by two-thirds overnight to less than 10%. A quarter-point increase is still anticipated as the Fed begins to lift its target policy rate from the near zero level set at the outset of the pandemic.

Richmond Federal Reserve President Thomas Barkin said on Thursday U.S. interest rates should move higher because "underlying demand is strong. The labor market is tight. Inflation is high and broadening."

Despite the events in Ukraine, "I don't think you are going to see much change to the underlying logic...But this is uncharted territory so we will have to see where the world goes."

Fed officials were beginning to think through the implications even before the attack. Atlanta Fed President Raphael Bostic said his staff had begun analyzing the potential impact, particularly any potential blow to business investment if global conditions worsen.

A few hours before the invasion was reported, San Francisco Fed President Mary Daly said that with U.S. inflation as high as it is and the labor market strong, the Fed should go ahead with rate hikes even with the uncertainty of a Ukraine-Russia conflict. "I really don't see, unless things get materially worse...that this is going to have an effect" on the Fed's decision to start raising rates in March, she said at an event Wednesday in Los Angeles.

But officials may now tread a touch more carefully until the breadth of Russia's actions, and how they affect oil prices, financial markets, and the broader economy, become clearer.

"We think probably now we have reached a tipping point where this is a situation that could start to have impacts on confidence...we know that it's affecting financial markets," said Jennifer McKeown, Head of Global Economics Service at Capital Economics.

It is unlikely to derail tightening plans, but "central banks are probably more likely now to be starting to err on the side of caution and worry about the adverse effects on their economy."

How the United States and Europe respond to Russia's actions will factor in as well, adding to what could, on net, deal central banks the worst of both worlds in the form of even higher inflation and slowing growth. Indeed, the immediate economic risk appears larger for Europe than the United States, with European Central Bank policymakers convening Thursday in a previously scheduled "informal" gathering that may become a crisis meeting.

Still, the crisis threatens to delay the resolution of prominent factors that have fanned U.S. inflation higher such as global supply bottlenecks, which could keep price pressures high while denting growth prospects.

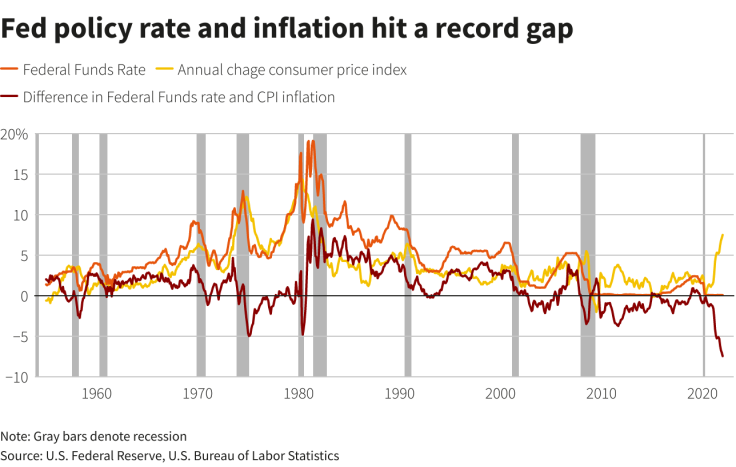

(Graphic: Fed policy rate and inflation hit a record gap -

)

Beyond the very near term, "the impact of the stagflationary shock is ambiguous and could be net hawkish," ISI Evercore analysts wrote. "Both the adverse sides of the macro distribution move up: the right tail risk of continued excess inflation in the medium term and the left tail risk that efforts to curb this inflation...end up causing a recession."

"In the context of the sizeable disruptions to supply chains and energy prices already, this will...complicate the policy response of central banks," wrote analysts with TD Securities. "The Fed and the U.S. may be removed enough to keep to hiking as planned, though risks shift in terms of 25 (basis point) increments rather than anything more aggressive."

© Copyright Thomson Reuters 2024. All rights reserved.