US 2013 July Auto Sales Forecast: Up 15.5% To 1.33M Units; Incentive Spending Up 7.6%; SAAR At 15.8M; Compacts, Crossovers, Trucks Lead Sales Surge

[UPDATE, Aug. 1, 2013, 3 p.m. EDT] The results: GM and the combined Detroit Three; Ford; Chrysler; Volkswagen. Click here for Toyota, Honda and Nissan.

Original story begins here.

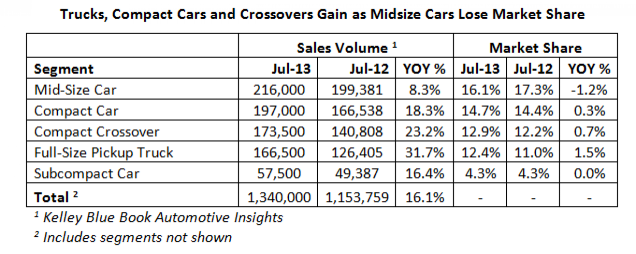

U.S. auto sales in July are expected to be up between 15.2 and 16.1 percent to around 1.33 million units amid higher incentive spending as dealers try to clear out inventory during the summer sell-down season.

“Consumer confidence has a played a key role in the ongoing recovery and currently is at the highest levels seen since January 2008,” said Alec Gutierrez, senior market analyst for automotive pricing company Kelley Blue Book, or KBB. “With modest improvements in unemployment and housing expected to continue through the rest of the year, confidence likely will follow suit, driving new-car demand along with it.”

The world’s top auto makers will report July U.S. sales figures on Aug. 1.

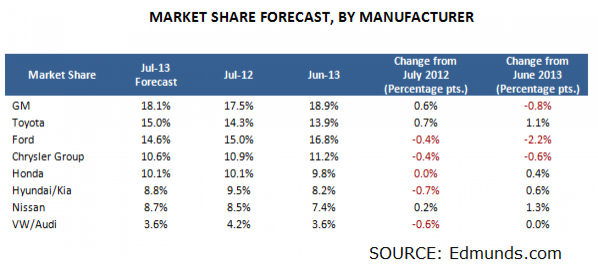

KBB raised on Thursday its annual U.S. auto sales volume estimate to 15.6 million from 15.3 million. Three major auto market analysis companies, KBB, TrueCar and Edmunds.com, expect July’s seasonally adjusted annual rate to stand at 15.8 million, down from 15.9 million in June, though they vary in their estimated year-over-year growth and sales volume.

KBB thinks July’s sales will be up 16.1 percent, delivering the highest year-over-year increase in 2013, while TrueCar and Edmunds expect 15.3 percent and 15.2 percent growth respectively.

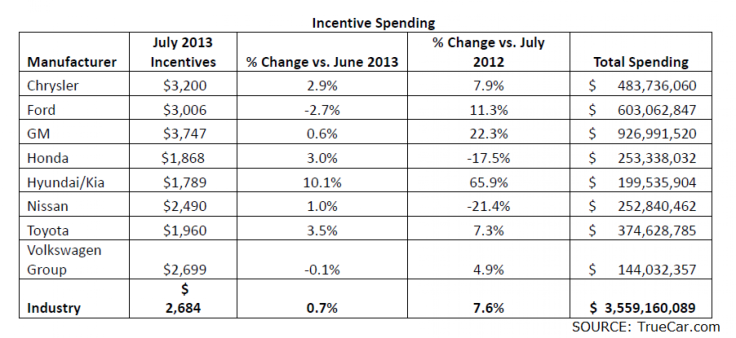

Automakers are spending considerably more on incentives this year than last. According to TrueCar, the average incentive in July will be $2,684 per unit sold, 7.6 percent higher than June 2012 but less than a percentage point higher than June.

“Incentives are up almost 8 percent in July as the summer sell-down season begins, dealers have more vehicles to clear out from lots than last year,” Kristen Andersson, analyst for TrueCar.com, said. “Hyundai/Kia is aiming to stay competitive by increasing incentives to their highest levels in almost three years."

Edmunds.com points to low fleet sales, such as bulk purchases from car-rental companies, in July. But the good news is that consumers are taking up the slack.

“Retail sales are stepping up as the driving force for the auto industry,” Jessica Caldwell, Edmunds.com senior analyst, said. “When people jump back into the market, it’s great news not just for the automotive sector, but for the entire U.S. economy.”

© Copyright IBTimes 2024. All rights reserved.