US August Jobs Report 2013 Preview: Will Fed Taper QE If Nonfarm Payrolls Improved, Unemployment Rate Unchanged?

(UPDATE Sept. 6: August Jobs Report: 169k Nonfarm Payroll Growth, Unemployment Rate Drops To 7.3%)

For the Federal Reserve, the labor market remains front and center. Friday’s August employment report will be crucial in determining the likely outcome of the September Federal Open Market Committee meeting.

“Friday’s jobs report will be very important,” said Jerry Webman, chief economist at Oppenheimer Funds.

“If it is an extremely low number, five digits rather than six, I think they [the Fed] would have to come back and say … ‘we would expect to taper later than what we had been signaling the market,’” Webman said. “Right now, the most likely course is for them [FOMC members] to do what they said they are going to do and begin to ease off the asset purchases in September.”

Nonfarm payrolls rose by 175,000 in August after a 162,000 gain in July, according to economists polled by Thomson Reuters. Private payroll probably grew by 170,000, compared with 161,000 in July.

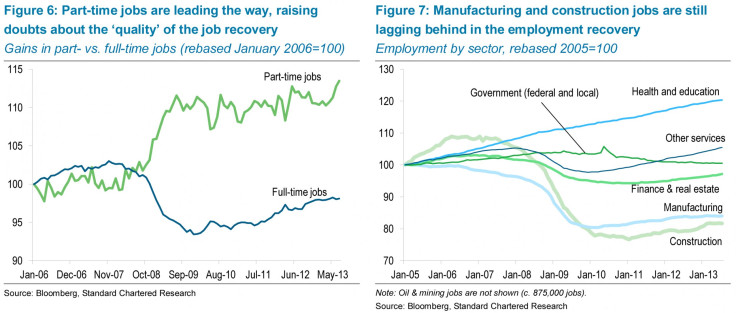

Through July, job gains this year have averaged 192,430 a month, up from 180,330 in the second half of last year. Of the 8.8 million jobs lost during the 18-month recession that ended in June 2009, 6.7 million had been recovered.

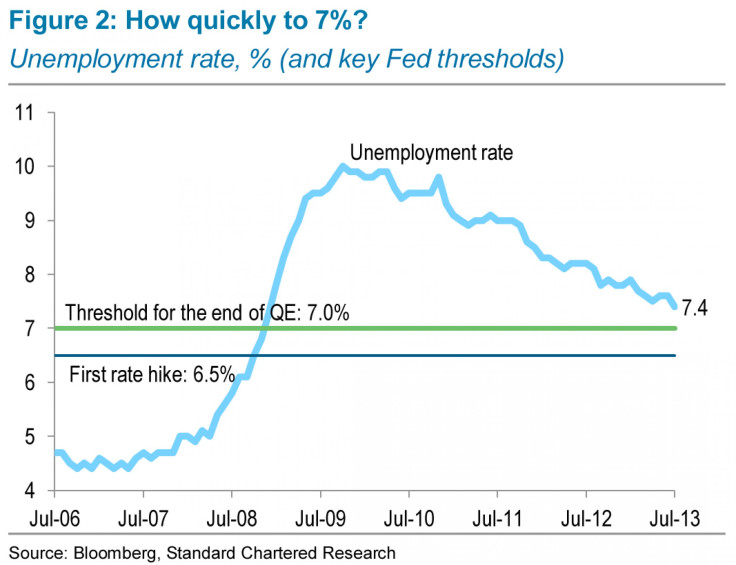

With modest job growth and a steady labor force participation rate, economists expect the unemployment rate to remain at 7.4 percent for August.

The latest data also show that fewer workers are losing their jobs. In August, the four-week average of initial jobless claims fell to a six-year low of 330,000.

Economists also expect average weekly hours to hold steady at 34.4. “Employment growth this year has be dominated by part-time hiring, and if that trend continues in light of business concerns about Obamacare, it should restrain average hours,” Michael Hanson, U.S. economist at Bank of America Merrill Lynch, said in a note to clients.

In addition, economists look for a modest rebound in average hourly earnings of 0.2 percent after a surprising 0.1 percent decline in July.

Frustrated with the slow U.S. economic recovery, the Fed is now buying $40 billion in mortgage-backed securities and $45 billion in Treasuries per month to support broader investment, hiring and growth. The quantitative easing program has more than tripled the Fed’s balance sheet to $3.2 trillion.

The central bank has set its conditional thresholds for the end of QE and for the first rate hike based on the unemployment rate (7.0 percent and 6.5 percent, respectively).

Will The Fed Taper In September?

The Fed’s Sept. 17-18 meeting comes at a very awkward time and risks are building up.

The recent data have been weak. In the past three quarters, gross domestic product growth has accelerated from 0.1 percent to 1.1 percent to 2.5 percent. The economy seems to have the kind of growth momentum the Fed is looking for. However, since the Fed met at the end of July, more than half of the growth indicators and three-quarters of the inflation indicators have come in below consensus expectations. Bank of America Merrill Lynch’s Ethan Harris forecasts third-quarter GDP growth will slow to 1.7 percent. Even with the better second-quarter GDP number, the FOMC will probably revise lower its growth and inflation forecasts at the September meeting.

The budget battles will be in full force. Congress will be back in session on Sept. 9. Last week the U.S. Treasury informed Congress that the federal government will run out of money if the debt ceiling is not raised by mid-October. While investors, consumer and business confidence have become relatively immune to threats of shutdown, Harris thinks an actual shutdown -- lasting more than a couple of days -- could cause a significant risk-off trade in the markets and could curb some hiring and investment plans.

Interest-sensitive sectors feeling the pain. The Fed’s tapering talk has caused about a 100 basis points rise in longer term interest rates, which could lead to weakness in interest-sensitive sectors such as autos, housing and capital goods investment. Recent housing data have shifted from steady strength to mixed: The homebuilder survey hit a new cyclical high in July, but the pace of housing starts has flattened out in recent months, and mortgage applications for both refinancing and purchasing have been slipping since May. A Reuters survey published last Wednesday forecast the 30-year fixed mortgage rate averaging 4.17 percent in 2013, jumping to 4.90 percent in 2014. In the May poll, economists had forecast it averaging 3.58 percent this year.

Geopolitics heating up. Oil prices have already picked up, to $117 per barrel from $105 a few weeks ago, and the crisis in Syria will likely escalate in September. According to Capital Economics economist Paul Dales’ calculation, such a rise in the oil price is consistent with gasoline prices increasing from $3.60 a gallon to around $3.80. “Just to buy the same amount of gasoline, households would have to cut spending on other items by $20 billion a year, or 0.2 percent,” Dales said in a note to clients.

Emerging market sell-off. Expectations that the Fed is about to end the flood of cheap money has triggered a sell-off in emerging market assets. The concern is that weaker growth in emerging markets will also hit growth in the U.S.

However, Dales doubt that the events of the past few weeks will prompt the Fed to conclude that the economic outlook has weakened significantly. “While the tapering of QE3 is not a done deal, we don’t think these factors will dramatically alter the Fed’s thinking,” Dales said, adding that the downside risks to the outlook are more likely to prompt the Fed to taper QE3 in smaller steps rather than not taper it at all.

Barclays analysts led by Nicholas Strand expect the Fed to taper both Treasury and agency MBS purchases to $35 billion per month at the September FOMC meeting.

© Copyright IBTimes 2024. All rights reserved.