U.S. Economy Contracts In Q1; Outlook Murky As Unsold Goods Accumulate

The U.S. economy contracted slightly more than previously estimated in the first quarter as the trade deficit widened to a record high and a resurgence in COVID-19 infections curbed spending on services like recreation.

The Commerce Department's third estimate of gross domestic product on Wednesday also showed some underlying softness in the economy, with consumer spending revised lower and inventories higher than reported last month.

This is a potential red flag for domestic demand and the economic outlook amid recession jitters as the Federal Reserve aggressively tightens monetary policy to tame inflation. Fed Chair Jerome Powell told a European Central Bank conference on Wednesday that "there is a risk" the U.S. central bank could slow the economy more than needed to control inflation.

"The biggest effect from this report is that it leaves inventories in a more overbuilt position than previously thought, putting second-quarter GDP into negative territory pending what tomorrow's data reveal about May consumption and consumer inflation and April revisions to the same," said Chris Low, chief economist at FHN Financial in New York.

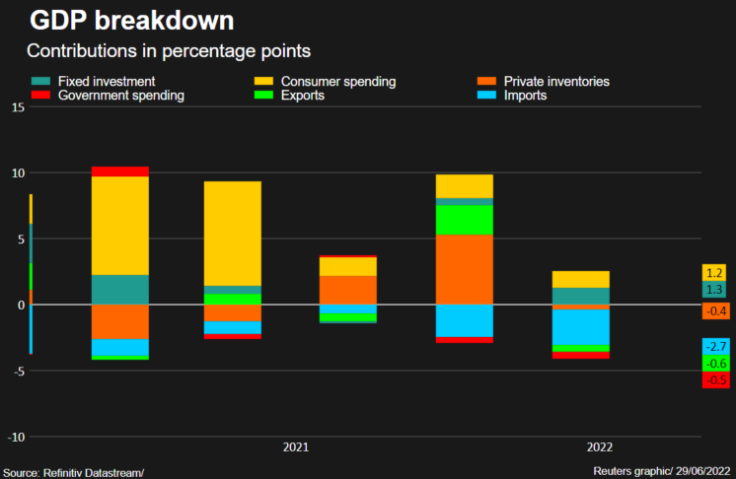

Gross domestic product fell at a 1.6% annualized rate last quarter, revised down from the 1.5% pace of decline reported last month. That was the first drop in GDP since the short and sharp pandemic recession nearly two years ago. Trade subtracted an unrevised 3.23 percentage points from GDP.

Economists polled by Reuters had forecast the pace of contraction would be unrevised at a 1.5% rate.

The economy was initially estimated to have contracted at a 1.4% rate. It grew at a robust 6.9% pace in the fourth quarter. GDP was 2.7% above its level in the fourth quarter of 2019.

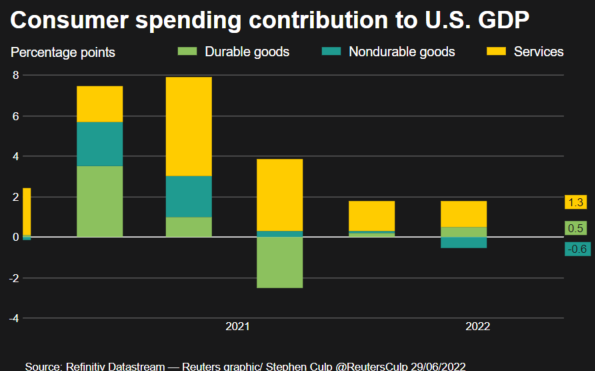

Consumer spending, which accounts for more than two-thirds of the economy, grew at a 1.8% rate instead of the 3.1% pace reported last month. The downgrade reflected revisions to services, now estimated to have increased at a 3.0% rate instead of the previously reported 4.8% pace.

Spending on recreation, financial services and insurance as well as healthcare was downgraded. Outlays on goods meant to last three years or more increased at a 5.9% pace, slashed from the previously reported 6.8% rate. That reflected downgrades to motor vehicles and recreational goods spending.

Stocks on Wall Street were mostly lower. The dollar rose against a basket of currencies. U.S. Treasury yields fell.

GDP consumer spending

INVENTORIES PILING UP

The moderate pace of spending left inventories significantly higher than estimated in May. Business inventories increased at a $188.5 billion rate, rather than the $149.6 billon pace reported last month. The accumulation was in the retail sector, mostly in general merchandise stores.

Major retailers like Walmart and Target have reported they are carrying too much merchandise.

Slower consumer spending was partially offset by stronger business investment in equipment, whose growth pace was raised to 14.1% from 13.2%. As a result, growth in final sales to private domestic purchasers, which excludes trade, inventories and government spending, was cut to a 3.0% rate last quarter.

This measure of domestic demand was previously reported to have risen at a 3.9% rate.

Revisions to corporate profits were minor. The saving rate was unrevised at 5.6%. The increase in personal income was little changed from May's estimate.

But interest on assets was trimmed. That led to the rise in gross domestic income (GDI), an alternative measure of economic growth, being pared to a 1.8% rate from the 2.1% pace estimated last month. GDI advanced at a 6.3% rate in the fourth quarter.

GDP contributors

The economy appears to have rebounded from the first-quarter slump, with consumer spending accelerating in April. Business spending on equipment remained solid through May, while the goods trade deficit narrowed significantly as exports hit a record high. But the bounce is losing momentum because of the Fed's aggressive posture.

The U.S. central bank this month raised its policy rate by three-quarters of a percentage point, its biggest hike since 1994. The Fed has increased its benchmark overnight interest rate by 150 basis points since March.

Retail sales fell in May, while housing starts and building permits declined. Consumer confidence hit a 16-month low in June. May's consumer spending report on Thursday could shed more light on second-quarter growth prospects, which range from as low as a 0.3% rate to as high as a 2.9% pace.

"It is extremely unlikely the economy is in recession now, however, despite the decline in first-quarter GDP and apparent weakness in output growth in the current quarter," said Scott Hoyt, a senior economist at Moody's Analytics in West Chester, Pennsylvania. "Job growth remains strong, investment is growing, both households and business have strong balance sheets."

© Copyright Thomson Reuters 2024. All rights reserved.