US Election Uncertainty Turns Focus On Fed

With America's knife-edge election yet to be called, and the Covid-19 pandemic surging across the nation, analysts will be watching the Federal Reserve on Thursday for signs of whether it may step in again to help the US economy survive the coronavirus downturn.

As state officials continue to tally the ballots, Democratic challenger Joe Biden appears well-positioned to unseat President Donald Trump, but with Republicans poised to retain control of the Senate, it has become less likely Congress will end months of gridlock and approve another giant spending package to help workers and businesses.

The Fed's rate-setting Federal Open Market Committee (FOMC) opened its second day of deliberations Thursday, but is unlikely to offer many specifics in its statement scheduled for release at 1900 GMT, besides repeating its commitment to keep the benchmark borrowing rate at zero for the foreseeable future.

Fed Chair Jerome Powell could take the opportunity at his press conference following the meeting to signal a willingness to find new tools to help the economy, after the bank earlier this year pumped trillions of dollars of liquidity into the financial system and cut the lending rate.

The central bank chief has been increasingly vocal in his calls for Washington to spend more to help support the recovery after most provisions of a massive stimulus measure passed in March expired.

However, Congress failed to reach an agreement on a new spending bill before the election, and Kathy Bostjancic of Oxford Economic told AFP its prospects after the election are unclear.

"I do think that given the size and scope of prospective stimulus has been diminished, though not entirely extinguished," she said.

The risk of another economic downturn has increased due to the surge in Covid-19 cases, which hit new records in recent days.

Bostjancic said the Fed "will maintain and possibly amplify its extremely dovish guidance and indicate it could do more without announcing any new measures" while "Powell should also continue to call emphatically for more fiscal stimulus."

Republican Senate Majority Leader Mitch McConnell, who won reelection, said Wednesday he wants to quickly approve new legislation in the "lame duck" session marking the final weeks of the current Congress, but in the past he has favored only limited spending programs.

"A split Congress will likely lead to a less-than-robust next round of household and business welfare payments and that, too, could weigh on the recovery," economist Joel Naroff said.

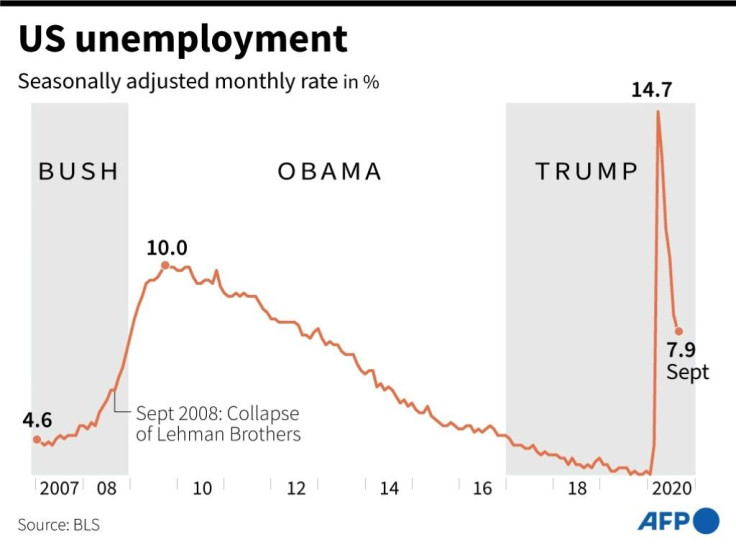

The world's largest economy posted a solid rebound over the summer after Congress approved a $2.2 trillion stimulus package, but key provisions, including additional unemployment benefits and grants for businesses, have expired, and recent data have shown hiring gains and other activity are slowing.

New applications for jobless benefits last week were barely changed from the prior week, holding at 751,000, according to Labor Department data released Thursday. Private hiring data for October was also below expectations.

Those indicators add to economists' fears that job gains will slow further.

"The initial unemployment number not falling as much as expected is just the tip of the iceberg, as the economy's ability to add jobs and keep people off assistance is quickly weakening," said Robert Frick, corporate economist at Navy Federal Credit Union.

The Fed has pumped trillions of dollars in liquidity into financial markets and provided lending backstops to ensure corporations have access to funding.

Powell has said the Fed has more tools at its disposal, though whether those would have the same efficacy as a fiscal package is unclear: a program for small- and medium-sized businesses has made only 400 loans so far.

The central bank could increase already huge purchases of government and private debt, and potentially create a new financing vehicle for state and local governments which face intense budget pressures.

© Copyright AFP 2024. All rights reserved.