US February Jobs Report 2014: Unemployment Rate Ticks Up To 6.7%, Nonfarm Payrolls Rise By 175k

After two months of huge disappointment, the stronger-than-expected February jobs report now pretty much guarantees that the Federal Reserve will maintain the pace of tapering at its March 18-19 meeting.

Employers added 175,000 jobs in February, the Labor Department said Friday, even as the inclement weather kept millions of Americans from getting to work. Wall Street called for a 149,000 gain for last month.

“With this employment number, it makes a $10 billion taper when the Fed meets this month, all but guaranteed,” said Stuart Hoffman, chief economist at PNC Financial Services.

Data from the previous two months were revised higher. Employers added 129,000 jobs in January, up from 113,000, and 84,000 jobs in December, up from 75,000. After revisions, payrolls grew an average of 129,000 a month in December, January and February, slower than the average for the last year of 189,000 a month.

Private employment, which excludes government agencies, rose by 162,000 in February after 145,000 the prior month.

The jobless rate in February climbed 0.1 percentage point to 6.7 percent, slightly higher than the 6.6 percent economists expected, while the labor force participation rate remained the same at 63 percent.

Here are six takeaways from the employment report:

1. Yes, it is the weather, not fundamental weakness.

“The question this winter has been, whether it’s the weather or not,” Hoffman said. “And I think it’s the weather and not fundamental weakness in the economy.”

“This makes me believe that the spring months will probably average better than 200,000 each month,” Hoffman added.

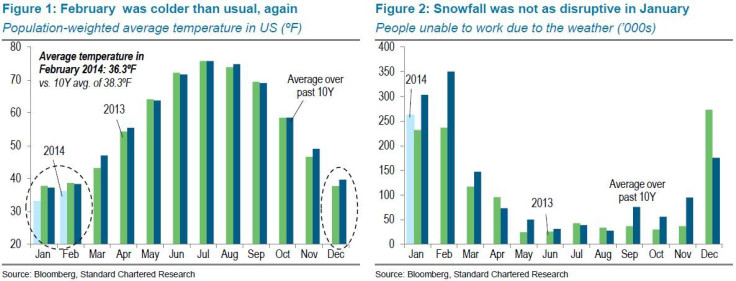

Harsh weather in February, particularly during the survey’s reference week, when a snowstorm hit the East, muddied the reading. The snowstorm was particularly brutal for the Southeast, as many businesses were forced to shut operations.

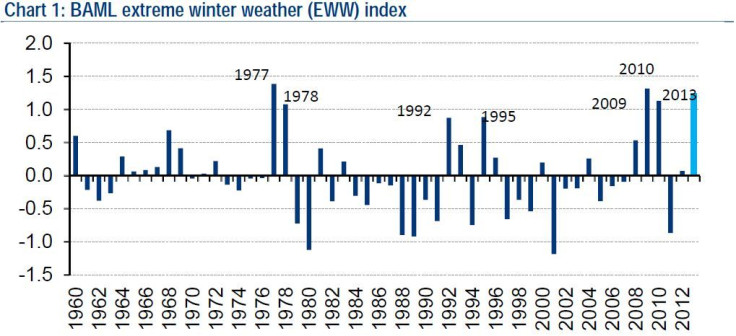

Bank of America Merrill Lynch’s analysis suggests that this winter is the third most severe, just behind 1977 and 2009.

Bad weather can affect the payroll count if employees didn’t receive compensation for the entire pay period that included the 12th of month. The report showed 601,000 Americans weren’t at work because of weather during the survey week, the most since 2010.

Hours worked also reflected the weather effect. The average workweek for all employees dropped to 34.2 hours in February, the lowest since January 2011, from 34.3 hours.

Almost 6.9 million people worked less than a full week, the most since record-keeping began in 1978.

2. Winners and losers.

The figures showed hiring at professional and business services increased by the most in a year, while payrolls also rebounded in education and health services.

Employment in the leisure and hospitality sector rose by 25,000 jobs. “Travel and tourism were reported to be strong across most of the districts, with the heavy snowfalls benefiting ski resorts in some parts of the country,” said Christopher Low, chief economist for FTN Financial.

Government agencies, factories and construction firms also added to headcounts last month.

The information sector axed 16,000 jobs, while retailers cut 4,100 jobs.

3. Encouraging earnings growth.

We are making decent progress on wages. Average hourly earnings for all employees were up 2.2 percent over the past year. That is outpacing inflation a bit over 1 percent.

“This is encouraging because we have actual earnings growth,” Low said. “We haven’t had that through most of the expansions.”

Faster employment growth and better wage gains will boost consumer confidence, which could translate into more consumer spending, which accounts for almost 70 percent of the economy.

4. The uptick in the unemployment rate is nothing to worry about.

The unemployment rate rose to 6.7 percent in February, from 6.6 percent, as 264,000 Americans entered the labor force, while the job growth increased by just 42,000. The labor force participation rate held steady at 63 percent in February.

“The run-up in the unemployment is not a negative number, it’s just backing up a little bit because we’ve finally gotten some labor force growth,” Hoffman said.

“Clearly, it was still a weak winter for jobs. But we’ve finally had a couple months of labor force growth and that’s a good sign. People are feeling better about the economy and you see that in some of the confidence numbers about the job market,” Hoffman said.

5. Fed to stay on its taper path.

The central bank is currently in the process of winding down its bond-buying program. Since it started the tapering process in December, the Fed cut the monthly pace of bond-buying by another $10 billion to $65 billion at its January meeting.

Fed Chairwoman Janet Yellen, who will oversee her first policy meeting this month, signaled during her testimony to the Senate Banking Committee last week that the Fed is aware of the soft patch in economic data of late, but believes that bad weather played a role.

“Unseasonably cold weather has played some role,” Yellen said in response to a question from the Senate Banking Committee. “What we need to do, and will be doing in the weeks ahead, is to try to get a firmer handle on exactly how much of that set of soft data can be explained by weather and what portion, if any, is due to softer outlook.”

Until Fed officials know more, they are unlikely to change their tapering timetable. Yellen’s comments suggest that the Fed will likely trim QE again to $55 billion at this month’s meeting.

“February employment report signals that the U.S. has returned to moderate job growth and that better economic data lie ahead once weather effects subside,” said Barclays’ Michael Gapen.

Low noted that today’s report is going to make Yellen’s job challenging. “I think what today’s jobs report does is that it just sort of widens the divisions within the Fed,” Low said.

“There’s a group within the Fed that is focused on financial stability and that group includes not just three of the Fed’s Board of Governors, but also an increasingly vocal group of regional Fed presidents,” Low said.

“Decent data, but still not great, is going to fuel the calls within the Fed for rate hikes,” Low said. “While at the same time, I think Yellen is going to see her mission as to continue to support the economy.”

“It’s really easy to make policy when the economy is strong, and it’s easy when the economy is weak. But lukewarm is tough,” Low said.

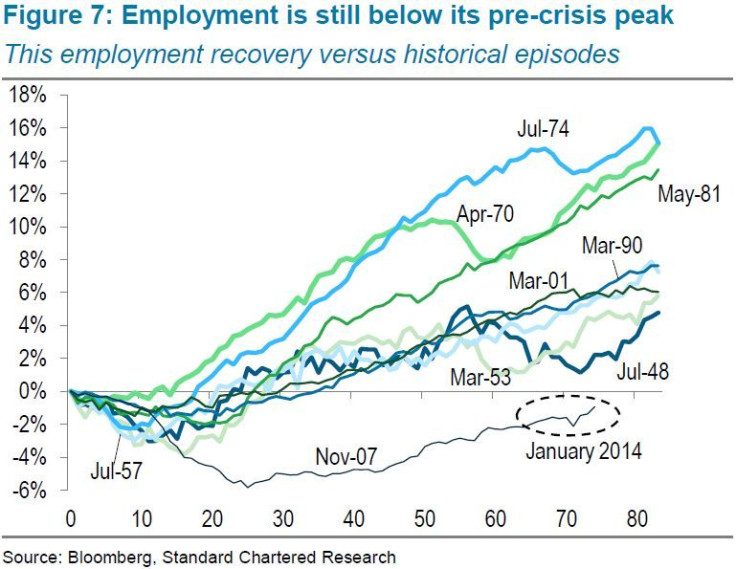

6. Employment will recover to pre-recession level this fall.

More importantly, investors should also take a step back and be mindful of the broader picture.

Hoffman has been predicting that employment will get back to its pre-crisis peak by this fall. “We are not that far below, we are only about 1 million or so,” Hoffman said.

“I wouldn’t say this is a victory, because it took us from 2007 to 2014 to get back to that level, it just still shows how weak the recovery has been,” Hoffman said.

© Copyright IBTimes 2024. All rights reserved.