US Fed Set To Conclude Meeting Amid Inflation Worries

Federal Reserve officials were in the final hours of their two-day meeting on Wednesday, and while they may signal that they are monitoring price increases brought about by the US economy's reopening, analysts expect no major changes in policy.

With the country recovering from the massive economic damage caused by the Covid-19 pandemic, the Fed has made clear it will not alter its monetary policy until it sees lasting signs that both employment and inflation have regained lost ground.

However, widespread vaccination and huge amounts of government aid have allowed the world's largest economy to reopen faster than expected, meaning the time for the central bank to pull back on the low rates and asset purchases meant to support the recovery may come sooner than expected.

The Fed cut its benchmark lending rate to zero in March 2020, and has been buying $120 billion a month in bonds to provide liquidity to support the economy.

But rising prices have ignited worries that policymakers will have to reign in that stimulus sooner or faster than forecast, which could then slam the brakes on the economic rebound -- and damage President Joe Biden's policy agenda.

In testimony before Congress on Wednesday, Treasury Secretary Janet Yellen repeated the administration's line -- partially echoed by top Fed officials -- that the inflation spike will not last.

"No one wants to return to the bad, high inflation days of the 70s," Yellen told the Senate Finance Committee.

"I think this is what most economists think, that the current burst of inflation we've seen reflects the difficulties of reopening an economy that has been shut down."

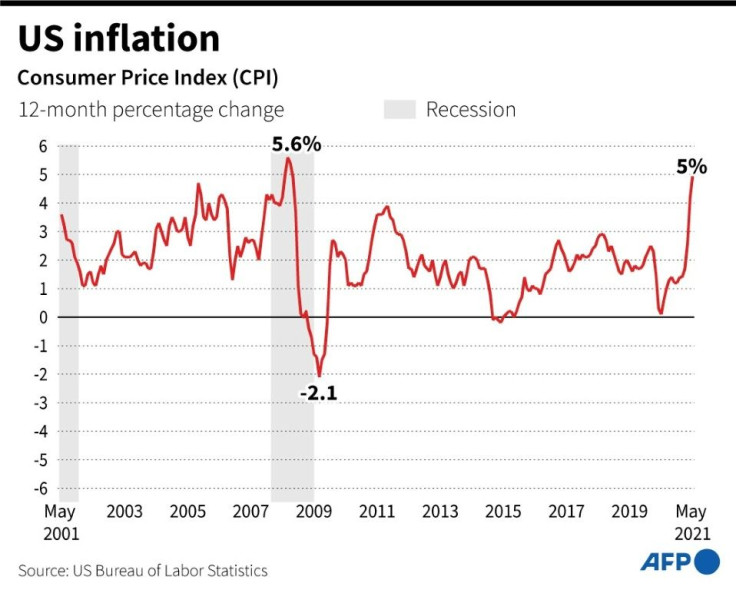

After skyrocketing as the pandemic began in March 2020, unemployment has dropped but remained at 5.8 percent in May, while consumer and producer prices have surged, to 5.0 and 6.6 percent, respectively.

Fed Chair Jerome Powell has hammered home the message that the price spikes are largely temporary, and in his press conference later Wednesday, he likely will repeat that stance, even while stressing the central bank is vigilant and will act if needed to contain inflation.

But some economists and analysts are sounding the alarm.

"If the Fed's monetary policy is truly data dependent, as the Fed says it is, it will acknowledge that the risks of a persistent rise in inflation have risen and that the prudent path of policy would be to move toward announcing that it will begin to taper" asset purchases, said Mickey Levy of Berenberg Capital Markets.

Members of the Fed's policy-setting Federal Open Market Committee (FOMC) will also offer updated economic projections, which are expected to reflect rising inflation and stronger growth, and will bring forward the date of the first expected increase in the key interest rate, possibly as soon as 2023.

The first step will be a tapering of the massive bond-buying program, and Powell could signal that officials will soon begin at least talking about the right timing for that, although most are expecting the real plan to emerge in August.

Krishna Guha of Evercore ISI said the Fed's plan is working, and markets mostly accept that much of the rising prices are temporary, giving them time to react.

However, "Patience is not immobility," Guha said in an analysis. The FOMC "wants to move methodically," starting taper discussions now for changes implemented at year-end or early 2022.

That "gives the FOMC the option to accelerate the timeline if needed to secure inflation expectations against serial upside surprises."

© Copyright AFP 2024. All rights reserved.