US Fed Members 'More Concerned,' Say Recession Risks Rising: Minutes

American central bankers have grown more fearful, saying a global slowdown and President Donald Trump's trade wars could drag down hiring and the broader economy with it, meeting minutes showed Wednesday.

While the outlook remains good for the moment -- with strong jobs markets, historically low unemployment and the general public continuing to loosen purse strings -- weaker recent economic data have put clouds on the horizon, the minutes from the Federal Reserve's September 17-18 meeting showed.

"Participants generally had become more concerned about risks associated with trade tensions and adverse developments in the geopolitical and global economic spheres," according to the minutes.

Several noted that models gauging recession probabilities had "increased notably in recent months."

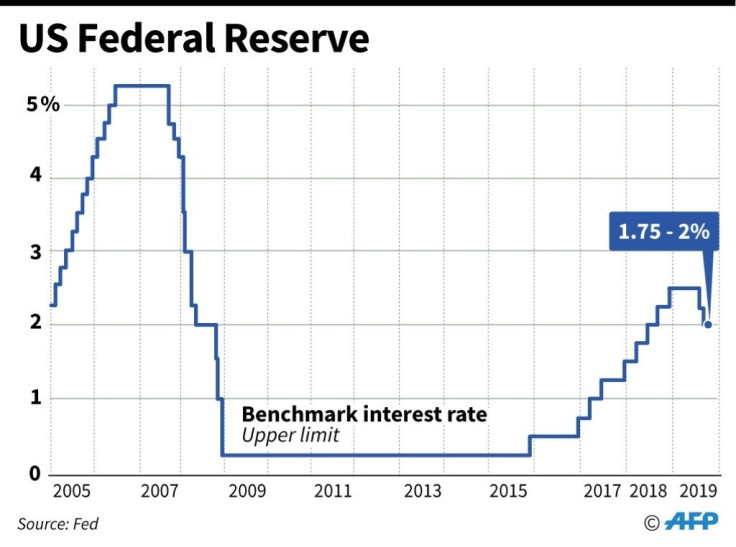

At the September meeting, a majority of Fed policymakers voted to cut interest rates and markets expect them to do so again later this month, acting to cushion the world's largest economy as exports weaken, industrial costs rise, foreign demand sinks and growth trends downward.

But members of the central bank are grappling with a complex economic picture, the minutes showed, as ominous developments creep into what has otherwise been a sunny vista of steady expansion and job creation.

While some policymakers have grown more anxious, a minority oppose rate cuts, saying the economy's current health does not justify them.

Economic forecasters expect third quarter GDP growth will prove the slowest of the year so far but remain solid, a view shared by members of the Fed's interest-rate-setting Federal Open Market Committee, according to the minutes.

'Clearer picture'

"Participants agreed that consumer spending was increasing at a strong pace," they said.

But several noted that skittish companies had stopped investing, which ultimately could cause "slower hiring, which in turn, could damp the growth of income and consumption."

"Participants generally judged that downside risks to the outlook for economic activity had increased somewhat since their July meeting," the minutes said.

Indeed, a "clearer picture" was emerging of a drawn-out decline in business spending, a recession in manufacturing and a steep fall-off in exports.

The trade war has left companies and farms uncertain of where they can source products, what prices they will pay, who their customers will be and how much they can sell -- causing business investment to tumble this year.

As exports have fallen and factories have entered a prolonged slump, this has left consumer spending as the main pillar supporting growth and made the economy increasingly vulnerable, economists say.

The minutes also made clear that, for policymakers, weakening growth and recession were a far greater concern than inflation, which has run cooler than the Fed would like for much of the past decade.

Top Chinese trade officials on Thursday are due to resume talks with their US counterparts in Washington, with mounting speculation the two sides will strike a partial bargain that averts further escalation without resolving Washington's extensive grievances.

Following the September Fed meeting, the Commerce Department reported that in August annual growth in consumer spending had been the weakest in nearly a year.

Labor Department figures also released Wednesday showed softening demand for workers that month as well.

Meanwhile, indicators tracking manufacturing and services industries, as well as business and consumer confidence -- so-called "soft" indicators often seen as a harbinger for weakness in hiring and spending -- continued to worsen.

On the other hand, unemployment in August fell to its lowest level in 50 years, demand for housing is rising and the pace of hiring, while slower, remains more than strong enough to absorb new entrants into the labor market, economists say.

Wall Street appeared unmoved by the news, with stocks closing higher on optimism about this week's trade talks.

The Fed is next due to meet on October 29-30 and as of Wednesday futures markets put the odds of another 25-basis-point rate cut at 80 percent.

© Copyright AFP 2024. All rights reserved.