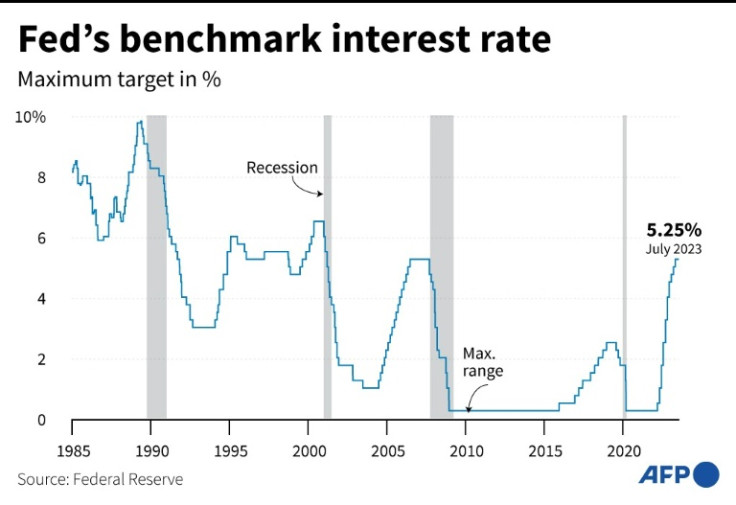

US Federal Reserve Lifts Interest Rates To 22-year High

The US Federal Reserve announced a fresh quarter percentage-point hike to its benchmark lending rate on Wednesday to tackle inflation, while keeping the option open for more such moves in the coming months.

The Fed last month halted its aggressive campaign of monetary tightening after 10 consecutive rate increases to give policymakers more time to assess the health of the world's largest economy.

At the June meeting, members of the rate-setting Federal Open Market Committee (FOMC) nevertheless indicated they see possibly two additional interest rate hikes this year.

Wednesday's, the 11th since the US central bank launched its cycle of monetary tightening in March last year, raises the Fed's benchmark lending rate to a range between 5.25 and 5.5 percent -- its highest level in 22 years.

Since the June decision to pause rate hikes, inflation has continued to fall, although it remains above the Fed's long-term target of two percent.

Meanwhile, unemployment has remained close to historic lows, while economic growth for the first quarter has been revised up sharply on resilient consumer spending data.

The more positive economic news has increased the chances of a so-called "soft landing," in which the Fed succeeds in bringing down inflation by raising interest rates, while avoiding a recession and a surge in unemployment.

Given the near-unanimity of expectations for a hike on Wednesday, analysts and traders will be closely scrutinizing Fed Chair Jerome Powell for signs of what the central bank might do next.

"They will probably signal that they want to see the impact of the current tightening cycle and that they will probably skip raising rates in September," OANDA's senior Americas market analyst, Edward Moya, wrote in a recent note.

"They will likely be clear in suggesting that more tightening could very well happen," he added.

Sweet agreed, saying: "Odds are that Powell will signal additional rate hikes are not off the table, but the Fed will take a more cautious approach, conveying it will skip a hike in September."

Many FOMC members have publicly backed additional hikes this year -- especially if last month's positive inflation data proves to be a one-off.

"Given how far we've come, it may make sense to move rates higher but to do so at a more moderate pace," Powell told a Congressional hearing after last month's decision.

But he told a banking conference in Portugal a few days later: "I wouldn't take, you know, moving to consecutive meetings off the table at all."

"I see two more 25-basis-point hikes in the target range over the four remaining meetings this year as necessary to keep inflation moving toward our target," Fed governor Christopher Waller told a banking conference in mid-July.

While markets have more-or-less priced in a hike on Wednesday, they are less confident about the chances of another hike at the next meeting in September.

Futures traders currently assign a probability of just over 20 percent that the FOMC will raise rates further in September, according to CME Group.

© Copyright AFP 2024. All rights reserved.