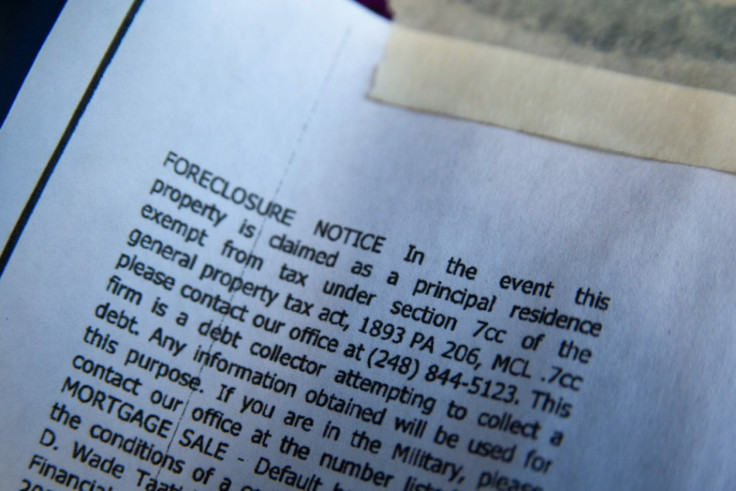

U.S. Foreclosures Down in November, But Auctions Hit 9-Month High: RealtyTrac

Overall U.S. foreclosure activity fell in November compared to the previous month, but auctions hit a nine-month high, according to RealtyTrac.

Foreclosure filings, which include defaults, auctions and repossessions (REOs), totaled 224,394 in November, a 3 percent decrease from the previous month and 14 percent below November 2010. One in every 579 U.S. households had a foreclosure filing.

Scheduled foreclosure auctions hit a nine-month high of 96,540 in November, reflecting many properties scheduled to be sold after an increase in defaults in August. Auctions were up 13 percent from October but were down 17 percent from the previous year.

Despite a seasonal slowdown similar to what we’ve seen in each of the past four years, November’s numbers suggest a new set of incoming foreclosure waves, many of which may roll into the market as REOs or short sales sometime early next year,” said James Saccacio, co-founder of RealtyTrac, in a statement.

As lenders resolve paperwork irregularities related to foreclosures, such as robosigning, more foreclosure activity is expected to occur, although the entire backlog of foreclosures is expected to take years to resolve.

“Overall foreclosure activity is down 14 percent from a year ago, the smallest annual decrease over the past 12 months, and some bellwether states such as California, Arizona and Massachusetts actually posted year-over-year increases in foreclosure activity in November, said Saccacio.

Auctions increased from the previous month by 63 percent in California, 56 percent in Washington, 53 percent in Ohio, 44 percent in New Jersey and 38 percent in New York.

Default notices were filed for the first time against 71,730 properties, an 8 percent decrease from the previous month and a 9 percent drop from November 2010.

Lenders repossessed 56,124 homes in November, down 17 percent from the previous month and also a 17 percent decline from last year. It was the lowest level of activity since March 2008.

Nevada, California and Arizona -- regions particularly hit hard by the speculative real estate boom -- had the highest foreclosure rates among states. Nine California cities, along with Las Vegas, had the highest metro foreclosure rates. One in every 120 housing units had a foreclosure filing in Stockton, Calif., which had the country's highest foreclosure rate for the second month in a row.

California, Florida and Michigan had the highest total foreclosure activity.

The report cover 2,200 counties and over 90 percent of the country's population.

© Copyright IBTimes 2024. All rights reserved.