U.S. Fuel Prices Surge Faster Than Crude As Exports Tighten Market

U.S. fuel prices have surged faster than crude oil prices in the last month, as the United States has shipped more refined products abroad to supply European markets following Russia's invasion of Ukraine.

Traders say the world's stockpiles of fuel are not likely to increase quickly as big producers like OPEC, are increasing production slowly. The tightness in fuel markets is more alarming, they say, because it shows refiners are having trouble meeting demand even as more crude becomes available through big reserve releases.

"Things are really tight with diesel and world demand," said Aaron Milford, chief executive of Magellan Midstream Partners, in an earnings call on Thursday.

Global stockpiles of crude, gasoline, and other fuels are dwindling as demand has rebounded to pre-pandemic levels. Supplies tightened further following the invasion of Ukraine and subsequent sanctions on Russia from the United States and allies.

Washington has released millions of barrels from U.S. strategic reserves, helping control the price of crude. But inventories of products are still falling.

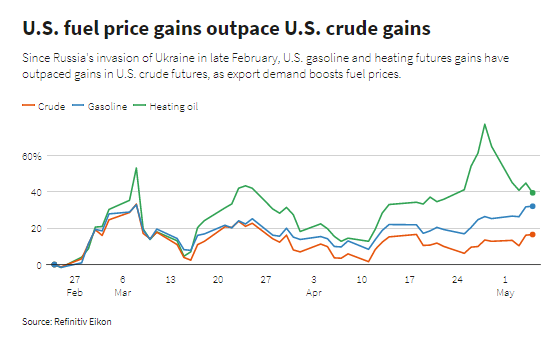

Since the invasion of Ukraine on Feb. 24, U.S. crude futures have risen nearly 17%, Refinitiv Eikon data shows, while U.S. gasoline futures have jumped over 30% and U.S. heating oil futures, a proxy for diesel, have gained by 40%.

"Generally at this time of year, products lead crude, but in this case the spread is much larger than normal. It's a sign the product market is screaming to refiners, 'Get to work, we need more supply'," said Phil Flynn, senior analyst at Price Futures Group.

Inventories are particularly tight for distillates at 105 million barrels, lowest since April 2008, according to the U.S. Energy Information Administration. Commercial U.S. crude stocks are up since late February due to releases from U.S. reserves.

U.S. refined product exports have averaged 6.3 million barrels per day (bpd) in the past four weeks, nearly the fastest rate of export in U.S. history.

U.S. crude price rises have been limited by worries about energy demand during China's prolonged COVID-19 lockdowns.

The U.S. crude discount to global benchmark Brent has narrowed to minus-$2.15 a barrel last week, smallest since November, before widening again. A narrower discount makes U.S. crude less appealing on foreign markets.

Traders say lower refining capacity, particularly on the East Coast, has tightened products markets, raising premiums on jet fuel and diesel. East Coast distillate inventories are at a record low.

"We really don't have the capacity to (export more) while at the same time not affect the domestic market," said Robert Yawger, executive director of energy futures at Mizuho. "We have increased some refinery utilization but a lot of that increase is going to the eurozone and not to New Jersey."

U.S. fuel price gains outpace U.S. crude gains

© Copyright Thomson Reuters 2024. All rights reserved.