U.S. Gold Coin Sales Aren’t Too Bright In New Year

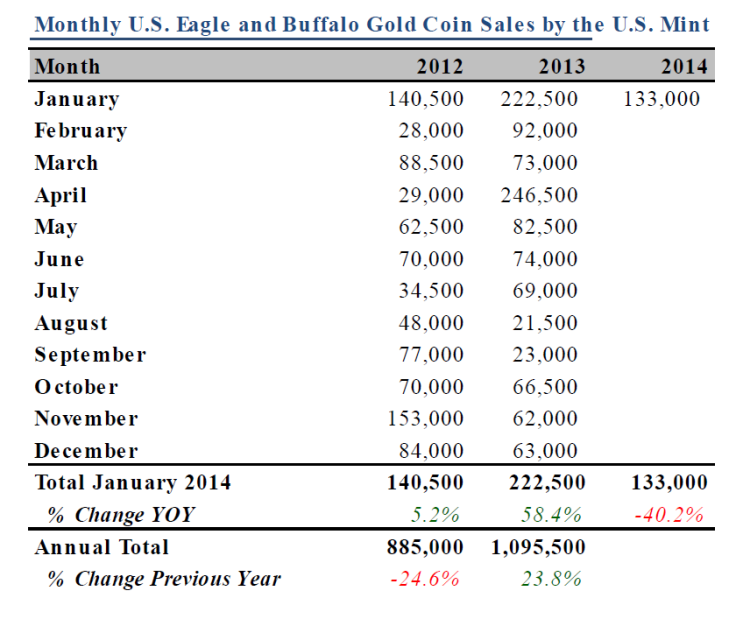

Even as mints worldwide run overtime, U.S. gold coin sales actually fell 40 percent in January from a year earlier, recent U.S. Mint data show.

Sales by the U.S. Mint to gold dealers fell to 133,000 ounces from 222,500 a year ago. That’s still a strong monthly showing, but also falls below January 2012’s sales of 140,500 ounces.

January is typically a bountiful month for gold dealers, as consumers stock up on new coin designs and gifts for later in the year. Investors have predicted strong gold coin sales this year, highlighting that retail market as a strength in an otherwise gloomy gold environment.

Lesser sales suggest that gold dealers now hold ample stocks, New York’s CPM Group wrote in a Feb. 6 precious metals report. They may offload that inventory onto consumers in coming months -- that is, if consumers are buying.

Some gold dealers saw softer sales in January, although gold coin sales are still soaring by historical standards.

“When gold goes down and drops, there’s lots of sellers, but when it starts to stabilize and go back up, there are less buyers,” Morgan Gold CEO David Cloyed told IBTimes.

Sales of coins minted before 1933, a leading indicator for broader coin sales, have slowed significantly since November and have stayed muted, according to Cloyed. That specialist market only accounts for a small percentage of the gold coin trade.

“What the U.S. Mint produces is additional supply to the existing market. The existing market has gotten 1 million to 1.4 million ounces of new gold from the Mint over the past four years,” Morgan Gold strategist and former U.S. Mint Director Edmund Moy explained to IBTimes.

In years where market risk is low, the Mint sells 200,000 to 300,000 ounces of gold per year to dealers. Even with lower gold demand recently, amounts annually distributed to dealers still far outweigh figures from off-risk years, said Moy.

“Mint figures tend to be volatile at a time when the Mint changes over from 2013 to 2014,” Alan Mandel, a precious metals analyst for gold retailer HTDT Gold, told IBTimes. “I suspect February bullion coin sales generally will be higher.”

“No one has returned to sell their gold coins back to us” over the past year, continued Mandel. “I suspect this is the same all over. Sales may slow, but the coins are hoarded.”

Gold edged higher early in 2014, nearing a key $1,300 per ounce mark on Wednesday’s trading. The metal hasn’t traded above $1,300 since November. Many Wall Street analysts remain bearish on gold’s prospects for 2014 and beyond. Some analysts see the metal trading at less than $1,000 per ounce in coming months.

© Copyright IBTimes 2024. All rights reserved.