US Government Spending Spree: Deficit Approaches $1T

The 2019 U.S. deficit inched toward $1 trillion, up $205 billion from last year despite continued economic growth, upending President Trump’s promise to eliminate federal debt within eight years.

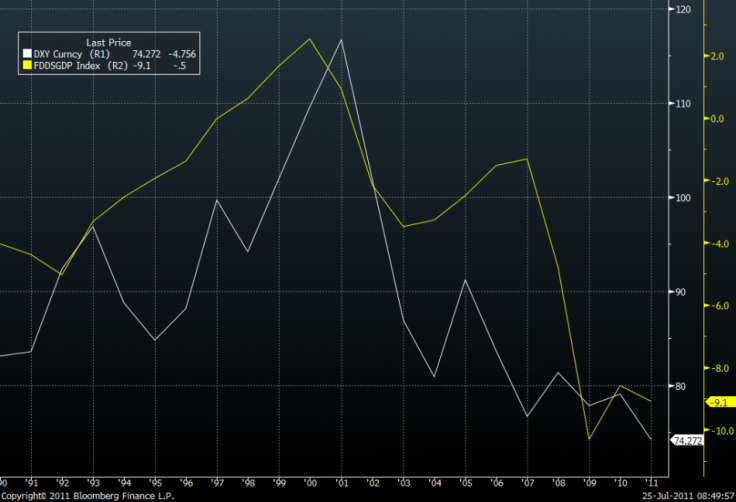

The U.S. Treasury reported the deficit hit $984 billion in fiscal 2019, which ended Sept. 30, representing 4.6% of gross domestic product, up from 3.6 from the previous year. It was the highest dollar amount since 2012 but $16 billion less than what was projected in July.

“President Trump’s economic agenda is working: The nation is experiencing the lowest unemployment rate in nearly 50 years, there are more jobs to fill than there are job seekers, and Americans are experiencing sustained year-over-year wage increases,” Treasury Secretary Steven Mnuchin said in a press release.

The ballooning deficit, which has nearly doubled since Trump took office, can largely be attributed to the $1.5 trillion tax cut enacted by the Republican-controlled Congress at the end of 2017 and two congressional spending bills. The Congressional Budget Office has projected a $1 trillion deficit as early as fiscal 2020, which began Oct. 1.

Deficits usually shrink during times of economic growth and the current expansion is in its 11th year. In 2009, it reached $1.4 trillion as the Obama administration and Congress took emergency action to shore up the financial system and pull the economy out of recession. By the time Barack Obama left office, the deficit had been reduced to $585 billion and the Republican-controlled Congress berated him for not reducing it further.

“Instead of getting our fiscal house in order and preparing for the next downturn, our leaders continue to binge on debt-fueled tax cuts and spending hikes rather than showing the leadership necessary to set our fiscal path,” Leon Panetta, budget director in the Clinton administration and a member of the Committee for a Responsible Federal Budget, said in a statement.

Government receipts totaled nearly $3.5 trillion, up $133 billion from 2018, largely due to higher social insurance and retirement receipts, net individual income tax receipts, customs duties (up 70% as a result of the trade war with China), net corporate income tax receipts and excise taxes. Outlays totaled $4.4 trillion, up $339 billion from 2018.

“Contributing to the dollar increase over FY 2018 were higher outlays for Medicare, Social Security, defense and interest on the public debt,” Treasury said.

Borrowing totaled $1.05 billion, pushing total debt to $16.8 trillion, Borrowing as a percentage of GDP rose to 79.1%.

© Copyright IBTimes 2024. All rights reserved.