U.S. Growth Funds Squeezed By Rate Hike Worries

U.S. growth funds are experiencing massive outflows this year due to rising interest rates, with the Federal Reserve's resolve to keep hiking to tame inflation potentially spurring even more selling.

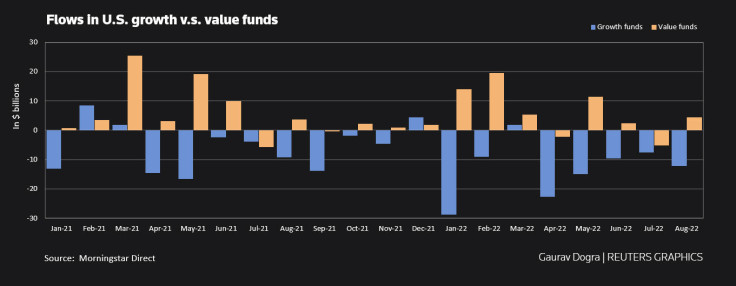

According to Morningstar data, U.S. growth funds recorded net outflows of $12.3 billion in August, taking net sales for the year to $103.3 billion.

At the same time, U.S. value funds, which invest in companies with cheaper valuations and stable growth, attracted $4.32 billion in August, the most in three months and taking total purchases this year to $49.5 billion.

GRAPHIC: Flows in US growth vs value funds

"Growth and value stocks typically have different profiles, with growth often doing best in periods of positive, upward trending markets, and value often providing protection in more negative or downward trending markets," said Don Klotter, Head of EFG Asset Management.

"In addition, there has been a massive compression in price-earnings (P/E) ratios, and this is a much more negative impact on growth stocks compared to value," he added.

Analysts also noted a preference for value funds given their higher exposure to the energy sector and the likelihood of stable dividends.

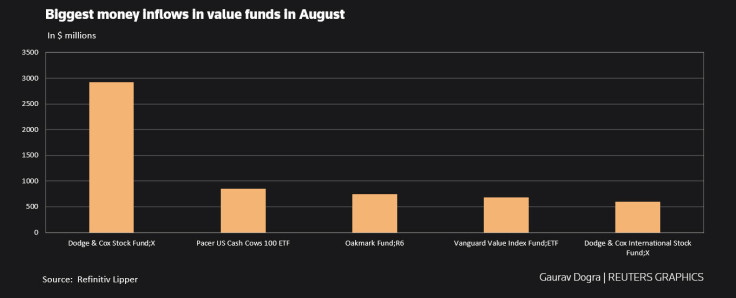

Among U.S. value funds, the Dodge & Cox Stock Fund;X received $2.92 billion of net inflows in August, while Pacer US Cash Cows 100 ETF drew a net $851 million.

GRAPHIC: Biggest money inflows in value funds in August

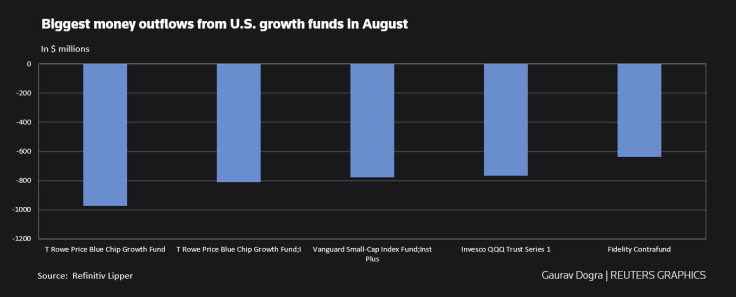

The T Rowe Price Blue Chip Growth Fund led growth fund outflows, at a net $971 million, while Vanguard Small-Cap Index Fund; Institutional Plus < LP40188608> witnessed net sales of $776 million.

GRAPHIC: Biggest money outflows from US growth funds in August

The easy monetary regime of the past decade had boosted growth stocks, with lower rates polishing future cashflows and earnings.

Since the end of 2009, the S&P 500 Growth Index has risen about 324%, compared with a 155% rise in the S&P 500 Value index.

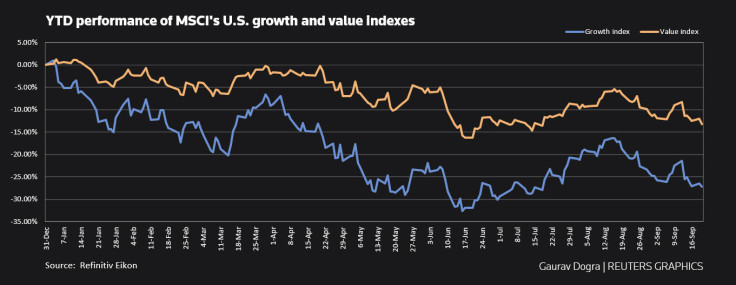

However, looking just at this year, the growth index has declined 27% to the value index's drop of 13.4%.

The price-to-earnings (P/E) ratio of the MSCI USA value index is at a 52% discount to the ratio of the MSCI USA growth index. That compares with a 10-year average discount of 34%.

GRAPHIC: YTD performance of MSCI US growth and value indexes

"We haven't really been in an economic cycle since 2009, given the artificially low rates the Fed has used to stimulate growth in the economy," said Jim Polk, head of equity investments at Homestead Advisers.

"If we're now seeing a more typical economic cycle, where the Fed raises rates to curb inflation, often leading to a recession then, coming out of the recession, value stocks which are more economically sensitive should outperform growth."

© Copyright Thomson Reuters 2024. All rights reserved.