US Hardest-Hit Amid $5.6B Losses Last Year In Security Incidents Linked To Crypto: FBI

KEY POINTS

- Most of the victims were elderly consumers, with losses in the said age group crossing $1.6 billion

- Most of the complaints last year were related to investment frauds

- Californians lost more than $1.1 billion to incidents with a crypto nexus, the FBI said

The cryptocurrency industry is known for its vulnerability to security breaches and issues, but 2023 was particularly significant for the industry, as data showed that the U.S. logged the most security complaints linked to cryptocurrency in a year that saw losses pass $5.6 billion.

The FBI revealed that its Internet Crime Complaint Center (IC3) received over 69,000 complaints from the public regarding financial fraud related to the use of cryptocurrency "such as Bitcoin (BTC), Ether (ETH), or Tether (USDT)."

Billions Lost, Mostly to Crypto Exploitation

Of the massive amounts lost to security incidents in the crypto sector, 71% were lost to "exploitation of cryptocurrency," the FBI said in a Monday report. Furthermore, 10% of losses in tech or customer support scams and government impersonation scams, as well as call center frauds, were associated to crypto.

"The decentralized nature of cryptocurrency, the speed of irreversible transactions, and the ability to transfer value around the world make cryptocurrency an attractive vehicle for criminals, while creating challenges to recover stolen funds," said Michael D. Nordwall, assistant director of the FBI's Criminal Investigative Division.

Investment Fraud Proliferates, Elderly Hit Hardest

The most reported issues in relation to crypto last year was investment fraud, and the year's total losses marked a staggering 45% spike since 2022.

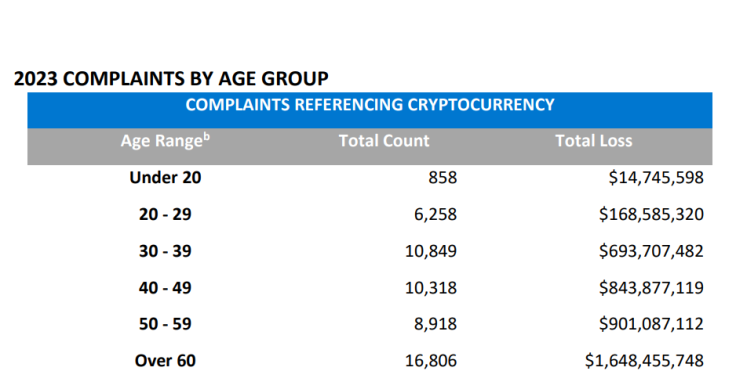

A chart showed how several age groups were affected by crypto security incidents. It also stated that among the most affected were crypto holders over 60 years of age. A total of 16,806 elderly individuals were victimized and losses surpassed more than $1.6 billion.

By comparison, there were 858 reports of affected people under the age of 20, and losses were at $14.7 million among the said age group.

Attacks Were Diversified

The report highlighted how crypto fraudsters and exploiters diversified their attacks last year. Most were still in investment-related frauds, but there were also other means through which exploiters pilfered assets from victims.

The agency received more than 8,000 complaints related to tech support scams, and 8,716 complaints were on personal data breach. More than 8,600 reports were related to extortion.

Romance-related complaints also proliferated last year, with 3,749 complaints recorded. There were 2,266 reports of exploiters impersonating government employees, and 667 complaints on phishing activities were recorded.

In investment scams, a staggering $3.9 billion was stolen from victims, while personal data breaches resulted in nearly $500 million in losses. Most of the affected victims were from California, Florida, Texas, New York, and Washington. Californians lost over $1.1 billion to crypto-related incidents last year.

Of the top 20 countries that saw complaints with a cryptocurrency nexus, the United States logged the highest number of complaints (57,762). By comparison, Canada, which is on top 2 of the list, logged 1,236 complaints.

Crypto Security Issues Linger

The FBI noted that criminals exploit cryptocurrencies because of their decentralized nature. The agency said the lack of financial intermediaries to validate and facilitate transactions makes the industry a melting pot for characteristics that "support illicit activities."

It also reiterated that there is difficulty in tracing funds that are facilitated by exchanges based overseas, especially in jurisdictions where anti-money laundering laws are not as stringent as those in the U.S.

© Copyright IBTimes 2024. All rights reserved.