U.S. Home Builder Sentiment Plunges, Services Activity In New York Region Stalls

U.S. home builder sentiment plummeted in July to its lowest level since the early months of the coronavirus pandemic, as high inflation and the steepest borrowing costs in more than a decade brought customer traffic to a near standstill.

At the same time, a gauge of activity in the services sector activity in the U.S. Northeast turned negative this month for the first time in a year, and firms there do not see an improvement over the next six months.

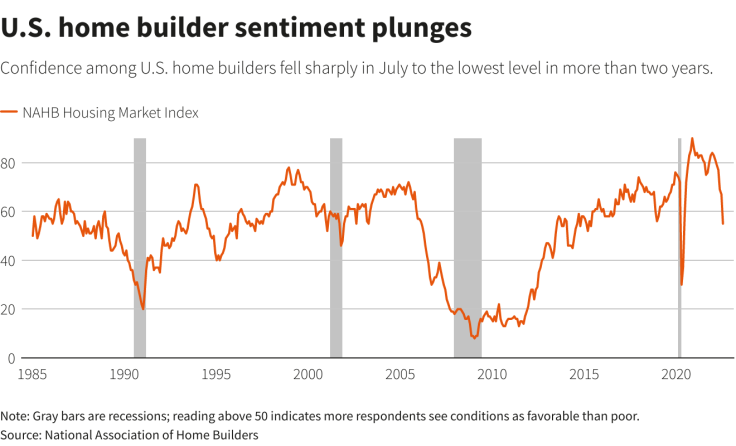

The National Association of Home Builders/Wells Fargo Housing Market Index fell for a seventh straight month to 55, the lowest level since May 2020, from 67 in June, NAHB said in a statement on Monday. Readings above 50 mean more builders view market conditions as favorable than poor.

July's reading was below all 31 estimates in a Reuters poll of economists, which had a median expectation for a decline to 65. Moreover, the 12-point drop was the second-largest in the history of the series dating to 1985, exceeded only by the 42-point plunge in April 2020 when most of the country was under a COVID-19 lockdown.

"Production bottlenecks, rising home building costs and high inflation are causing many builders to halt construction because the cost of land, construction and financing exceeds the market value of the home," NAHB Chairman Jerry Konter, a home builder and developer from Savannah, Georgia, said in a statement. "In another sign of a softening market, 13% of builders in the HMI survey reported reducing home prices in the past month to bolster sales and/or limit cancellations."

The component for current sales of single-family homes fell to 64 from 76. The gauge of single-family sales expectations for the next six months fell to 50 from 61, while the prospective buyer traffic index tumbled to 37 from 48.

GRAPHIC: U.S. home builder sentiment plunges

RATE HIKES START TO BITE

NAHB's report is the first of a slate of data due this week on the flagging health of a housing market that had boomed through much of the pandemic. Americans in search of more living space, often outside of cities, and flush with cash from pandemic relief payments, big stock market gains and access to mortgages sporting record-low interest rates thanks to Federal Reserve rate cuts had sent the housing market into overdrive and house prices surging beginning in the summer of 2020.

Now, much of that is rapidly reversing as the Fed, facing inflation running at its highest pace in four decades, has begun to raise rates and is far from done on that front. The U.S. central bank has lifted its benchmark overnight interest rate by 1.50 percentage points this year from the near-zero level and could hike it by another 2 percentage points or more by year's end.

The Fed hopes its rate hikes - and a reduction in its nearly $9 trillion in holdings of U.S. Treasury and mortgage-backed securities - will cool the hot consumer demand that for a variety of reasons is outstripping the supply of goods and services and driving inflation higher.

The housing market is particularly interest-rate sensitive and so far stands out as the sector most visibly affected by the Fed's policy shift. Home borrowing costs have surged this year, with the contract rate on a 30-year fixed-rate mortgage recently approaching 6%, the highest in 14 years, according to the Mortgage Bankers Association.

On Tuesday, the Commerce Department is expected to report that housing starts edged up last month from the lowest pace in more than a year, though some economists see any improvement as short-lived.

"We look for housing starts to lose some momentum in the second half of 2022 with starts averaging around 1.5 million in Q4, but the deterioration in builder sentiment lends a downside risk to the forecast," Nancy Vanden Houten, lead U.S. economist at Oxford Economics, wrote in a note.

In addition to the weakness in the new home market recently evident in the NAHB and housing starts data, sales of existing homes have fallen for four consecutive months through May and data due on Wednesday from the National Association of Realtors is expected to show that decline continued in June, with a sales pace seen at the lowest since June 2020.

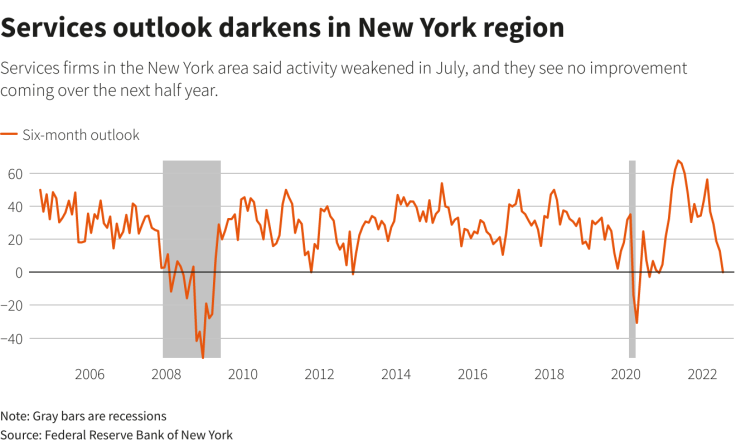

Meanwhile, a survey from the Federal Reserve Bank of New York showed activity in the services industry in its region - covering New York state, northern New Jersey and southwestern Connecticut - declined in July for the first time in more than a year.

And while services employment growth remained positive and firms reported some early signs of relief from high inflation, executives in the industry reported the darkest six-month outlook since November 2020.

"Firms believe activity will not increase over the next six months," the report said.

GRAPHIC: Services outlook darkens in New York region

© Copyright Thomson Reuters 2024. All rights reserved.