US Home Prices Are Up; Here's A Snapshot Of Median Regional Prices

U.S. single-family home prices are edging up as foreclosures ease, mortgage rates fall and potential home buyers are more willing to dive back into the market.

This helped raise prices by over 7 percent nationwide last year, according to the latest figures from Standard & Poor’s/Case-Shiller. Prices are still down to roughly 2003 levels, and a lot of homeowners are still living in places that cost them more to buy than they are currently worth.

Big home improvement retailers The Home Depot, Inc. (NYSE:HD) and Lowe's Companies, Inc. (NYSE:LOW) both beat Wall Street profit forecasts in their latest quarterly earnings reports, suggesting that recent home buyers have been busy getting their new pads in order.

According to the National Association of Realtors, January’s median home prices are up across the nation by 12.3 percent, to $173,600. Meanwhile, the government reported on Tuesday that sales of new homes are up to levels unseen since July 2008, prior to the subprime mortgage meltdown. New home sales rose 15.6 percent in January.

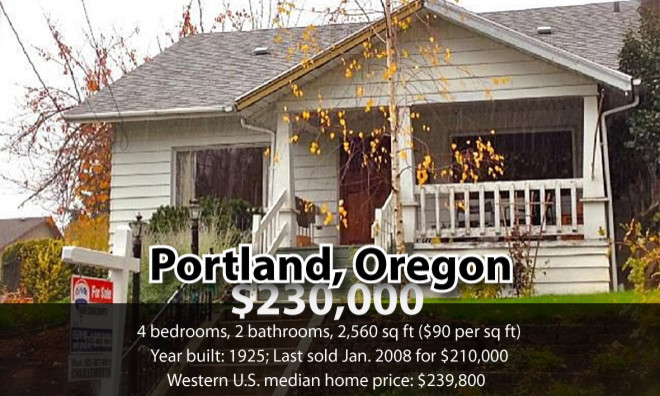

The country’s Western region, which has been battered hard by the repercussions of the 2008 subprime mortgage meltdown, is seeing a nearly 27 percent rise in year-over-year median home prices, to $239,800.

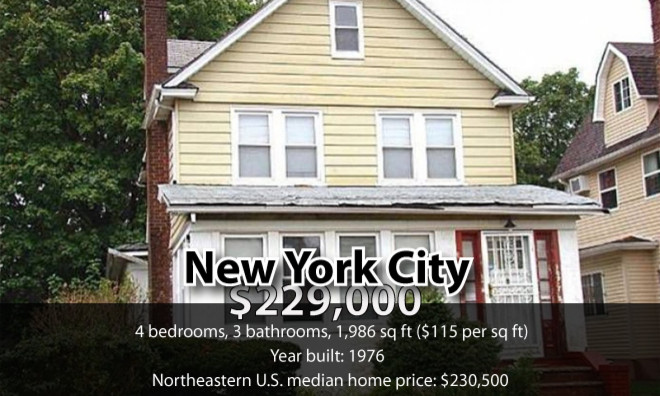

The Northeast saw the smallest growth, of 2.4 percent, to $230,500. Purchasing is up, too. Americans bought 9.1 percent more homes in January than in the same period last year. All regions saw increases in buys except the West, where the number of home purchases shrank by 5.7 percent.

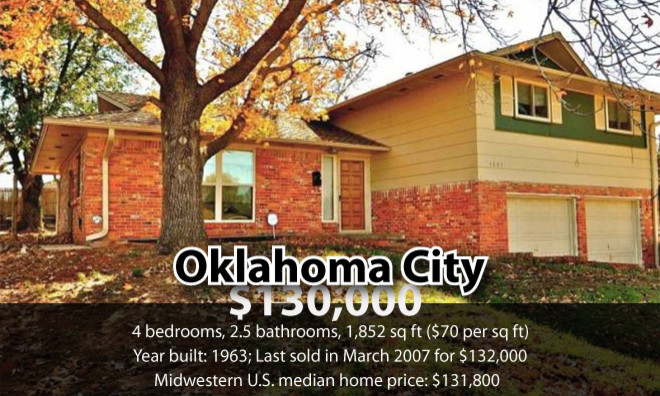

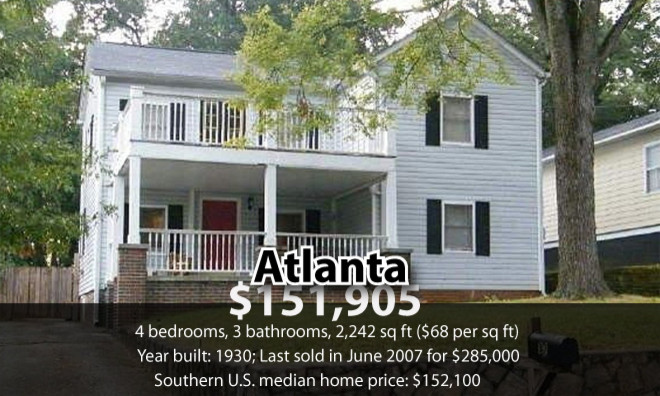

The market is far from healed, and listings consistently show homes selling at lower prices than what they were bought for. Here’s a snapshot of what the median home price per region is.

© Copyright IBTimes 2024. All rights reserved.