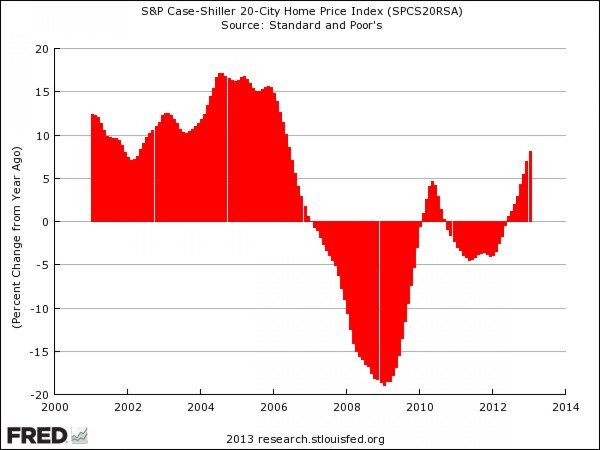

US Home Prices Jump Most In 7 Years In February On A 9.3 Percent Gain As Inventories Remain Low, Distressed Sales Decline

U.S. home prices surged 9.3 percent during the 12 months ended in February -- the biggest such gain in almost seven years -- as distressed sales declined and inventories remained thin, according to the latest S&P/Case-Shiller index of home prices in the nation's 20 biggest cities.

It was the best performance of the widely followed metric since May 2007.

The index, which was released Tuesday, showed that all 20 cities covered by the indices posted year-over-year increases for at least two consecutive months. In 16 of the 20 cities, annual growth rates rose from the last month; Detroit, Miami, Minneapolis and Phoenix saw slight annual deceleration ranging from minus 0.1 to minus 0.4 percentage points.

Phoenix continued to stand out with an impressive year-over-year return of 23 percent, while Atlanta and Dallas had the highest annual growth rates in the history of these indices since 1992 and 2001, respectively.

“Despite some recent mixed economic reports for March, housing continues to be one of the brighter spots in the economy," said David M. Blitzer, chairman of the Index Committee at S&P Dow Jones Indices, said last month.

"The 2013 first-quarter GDP report shows that residential investment accelerated from the 2012 fourth quarter and made a positive contribution to growth. One open question is the mix of single family and apartments; housing starts data show a larger than usual share is apartments.”

Analysts polled by Thomson Reuters I/B/E/W expected, on average, the 20-city composite index to rise by 9 percent.

“Rising home prices are good for the economy,” Harm Bandholz, chief U.S. economist at UniCredit Group in New York, told Blooomberg News before the report. “This affects a good part of the U.S. population, allowing them to borrow against their houses and enabling some who have been underwater to refinance. That’s very important.”

The release Tuesday of the S&P/Case-Shiller data follows by one day a report from the National Association of Realtors, or NAR, that pending home sales in March rose 1.5 percent to 105.7, its highest level since April 2010. The NAR also said the number of signed contracts rose 7 percent from the year-earlier level.

The retail cost of houses grew during the 12 months that ended in January by 8.1 percent for the 20-city composite index and 7.3 percent for the 10-city composite. All 20 cities posted year-over-year gains with Phoenix leading the way with a 23.2 percent increase. Nineteen of the 20 cities showed acceleration in their year-over-year returns.

“Home prices continue to show solid increases across all 20 cities,” Blitzer said. “The 10- and 20-City Composites recorded their highest annual growth rates since May 2006; seasonally adjusted monthly data show all 20 cities saw higher prices for two months in a row -- the last time that happened was in early 2005.”

Also in January, S&P/Case-Shiller said that despite posting a positive double-digit annual return, Detroit was the only city to show a deceleration. After 28 months of negative annual returns, New York came into positive territory in January.

© Copyright IBTimes 2024. All rights reserved.