US January Jobs Report Preview: Nonfarm Payrolls Growth Good Enough For The Fed To Continue Tapering, Unemployment Rate Holds At 6.7%

The sharp slowdown in U.S. job growth in December is being blamed on the extreme cold weather that hit the country, and economists expect to see some positive payback in January. But the degree is very difficult to predict, especially given that January is the month with the largest seasonal adjustment factor. (Read more: "5 Takeaways From The January Jobs Report.")

“For example, in January 2013, the economy lost 2.856 million jobs on a not seasonally adjusted basis, but gained 148,000 on a seasonally adjusted basis,” Barclays economist Dean Maki said in a note. “The large seasonal adjustment factor could add further volatility to the payroll print.”

The Labor Department will release the January employment report on Friday at 8:30 a.m. EST.

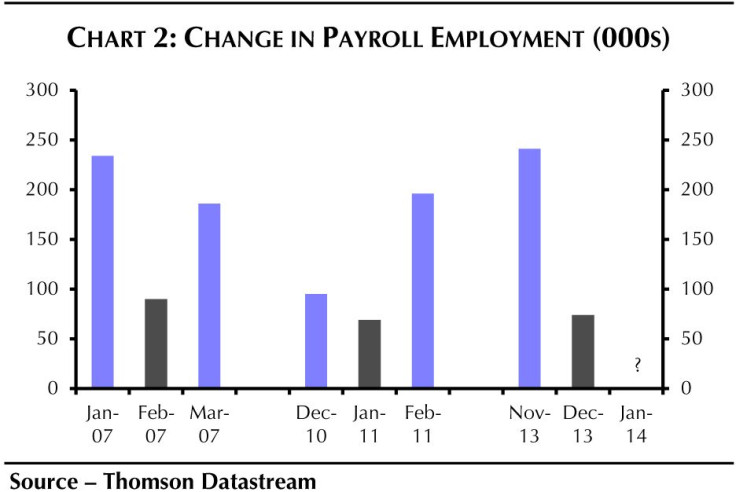

Payrolls are expected to have risen by 185,000 in the first month of this year, according to the consensus of 101 economists polled by Thomson Reuters. This is lower than the 214,000 per month average from August through November, but probably will be enough for the Federal Reserve to continue tapering. Projections ranged from 125,000 to 290,000.

The Fed cut the monthly pace of bond-buying by another $10 billion to $65 billion at its January meeting, widely matching expectations. The central bank is expected to taper again at its next meeting in March.

Meanwhile, the unemployment rate is expected to hold steady at a five-year low of 6.7 percent. Economists look for average hourly earnings to rise 0.2 percent and average weekly hours to remain at 34.4 hours in January.

Weather

At least half of the slowdown in December’s payroll growth appears to have been due to the unusually heavy snowfall that prevented some people from getting to work and stopped others from conducting normal business, Paul Dales, senior U.S. economist at Capital Economics, said.

Fewer jobs were created in the leisure, construction, manufacturing and transport sectors, which are the ones most likely to be disrupted by the bad weather.

“Admittedly, the weather has been severe in January too. But the unusually low temperatures generated by the polar vortex probably caused less disruption than the large amounts of snow that fell in December,” Dales said.

Fundamentals

Outside of the weather, other indicators are mixed.

Fourth-quarter real gross domestic product grew at a decent annual rate of 3.2 percent, following a torrid third quarter of 4.1 percent growth. The U.S. economy has “finally accelerated from fair to good, and provides evidence that this acceleration will continue into 2014,” IHS Global Insight chief U.S. economist Doug Handler said in a note. The numbers painted a rather positive picture, especially taking into account the effect of the nearly three-week federal government shutdown at the start of the quarter.

More broadly, economists’ confidence in the fundamental drivers of stronger U.S. growth remains high.

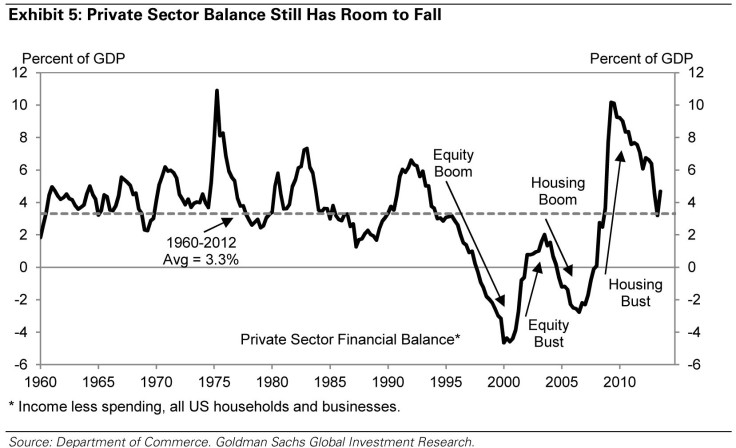

The private sector financial balance stood at 4.6 percent of GDP in the third quarter. This is still 1 percentage point above the historical average, at a time when the improvements in household wealth, credit availability and labor market conditions are starting to suggest that the balance will fall to a below-average level over the next few years, Jan Hatzius, chief economist at Goldman Sachs, noted.

“Combined with the waning fiscal drag, this should result in meaningfully above-trend growth in coming years,” Hatzius said.

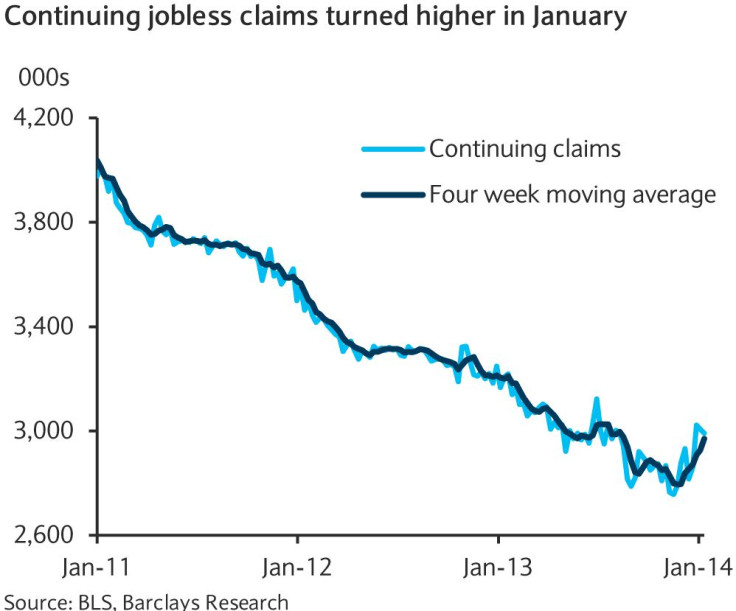

One factor leading economists to be more cautious in the short-term is the persistent rise in continuing unemployment claims. The four-week moving average of continuing claims has risen 175,000 from its recent low at the end of November.

“This type of rise is unusual during expansions,” Maki said. “The most recent time this occurred outside of recession was after Hurricane Katrina in the fall of 2005.”

“To us, the rise in continuing claims suggests that the trend in payroll growth has likely softened somewhat,” Maki added.

The ADP private payrolls are expected to rise by 180,000 in January. This would be down from a strong 238,000 clip in December, which will likely be revised down given the weak 87,000 BLS private payroll print. ADP payrolls have tended to overestimate BLS payrolls with a standard deviation of 74,000.

Meanwhile, U.S. manufacturing grew at a substantially slower pace in January as new order growth plunged by the most in 33 years, driving overall factory activity to an eight-month low.

The Institute for Supply Management’s factory index decreased to 51.3 from 56.5 the prior month. The drop in the employment index, to 52.3 from 55.8, points to a decline in manufacturing employment in January.

Population and Benchmark Revisions

“As is always the case in January, there is extra uncertainty surrounding our forecasts as the Bureau of Labor Statistics will incorporate into the data both the annual adjustments to the population estimates used in the household survey and the annual benchmark revision to the payroll figures,” Capital Economics’ Dales said.

He explained the population revision in more detail:

Every January the BLS introduces the latest population estimates into the household survey, which can affect the level of the household measure of employment and the size of the labor force. The survey covers only 80,000 households, so the aggregate readings are calculated by multiplying the sample by an estimate of the total population. Estimates of the unemployment rate should be largely unaffected because both the numerator (the number of unemployed) and the denominator (the number in the labor force) will be affected equally. Since the BLS does not revise the historical figures, this generates a discontinuity between December and January. In other words, January’s monthly changes in household employment and the labor force should be interpreted with care.

At the same time, the BLS will incorporate the results of the annual benchmark revision to past payroll figures. The preliminary revision was for an upward revision of 345,000, or 0.3 percent of payrolls. This will affect the data from April 2012 through March 2013. But this revision reflected a reclassification of certain education and health care workers who previously were not included in the establishment survey. Without that addition, the level of employment would have been revised down by 124,000. The data between March and December of last year will also be revised, but the BLS has not provided any guidance on this.

© Copyright IBTimes 2024. All rights reserved.