US Job Growth Falters In May - Is QE3 By Fed Up Ahead?

A third straight month of disappointing job data clearly suggests that U.S. labor market conditions are deteriorating again, which economists say will undoubtedly prompt more speculation that a third round of quantitative easing is coming soon.

It definitely raises concerns over the so-called recovery, the trajectory of this recovery. And it opens a Pandora's Box over what a solution is, said Alex Hamilton, an analyst with Early Bird Capital.

Nonfarm payrolls increased by 69,000 in May, the Labor Department said on Friday. That's the smallest gain in a year and less than half of the consensus forecast. Economists polled by Reuters had expected nonfarm payrolls to increase by 150,000.

Global stocks fell deep in the red.

Our reaction is a bit of shock because these numbers came in well, well below estimates, said David Abuaf, chief investment officer of Hefty Wealth Partners. There tends to be a lot of bearish sentiment out there, so we are certainly concerned.

Stocks plummeted Friday on the jobs report, with the Dow Jones Industrial Average erasing all its gains for the year and the yield on the 10-year U.S. Treasury note sinking to another record low of 1.46 percent.

This [report] is [very revealing about how] the underlying trend is weak [as opposed to it being] a 'weather payback,' Abuaf said.

The unemployment rate rose to 8.2 percent from 8.1 percent in May -- its first increase in 11 months -- as people re-entered the workforce.

The pace of job creation is considered central to President Barack Obama's re-election chances in November, when the economy is likely to be the top issue for voters.

I think it's going to be very difficult for Obama to win this election if the election is decided by economic issues, said Christopher Low, chief economist for FTN Financial. And that's the reason the White House is putting so much effort into changing the subject to other things.

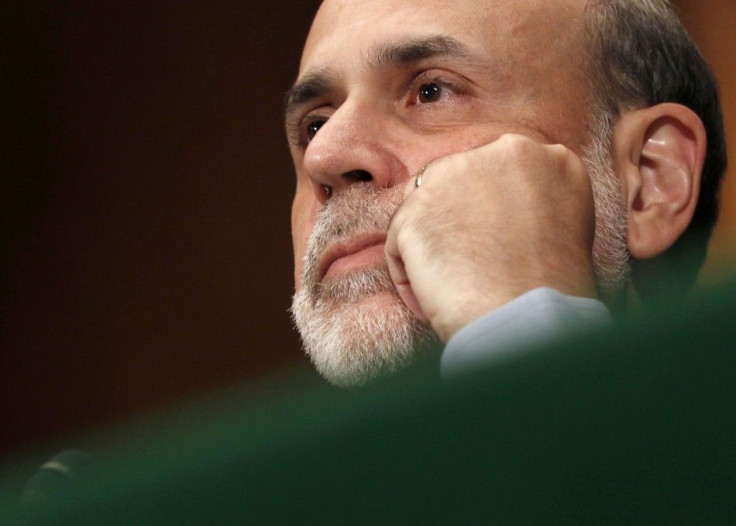

Given the marked slowdown in employment growth, Fed Chairman Ben Bernanke's congressional testimony on the economic outlook next Thursday is now going to be watched closely for any hint that QE3 is coming.

We think it is increasingly likely the Fed will announce another round of QE at the August 1 or Sept. 13 meeting, Michelle Meyer, senior U.S. economist at Merrill Lynch, wrote in a June 1 note. The Fed will not sit idle as the economy slows.

Worrisome Trend

While March and April's initial estimates disappointed the market, at least there was hope for upward revisions.

Friday's report, however, showed that employers added 49,000 fewer jobs than previously estimated in March and April, putting a stop to that trend.

More importantly, the direction of the revision is indicative of the trend in the jobs market and the U.S. economy. Net revisions were very negative during the financial crisis in the fourth quarter of 2008 but turned positive as the economy began to heal.

A government report on Thursday showed that the U.S. economy expanded at a 1.9 percent annualized rate in the first quarter, below the initial estimate of 2.2 percent and much slower than the 3.0 percent pace recorded in the fourth quarter.

May has been a pretty horrible month, Abuaf said. We are close to being flat on the year.

© Copyright IBTimes 2024. All rights reserved.