US Jobs Report December 2013: Unemployment Rate Drops To 6.7%, Nonfarm Payrolls A Big Miss But Won't Affect Fed Tapering Time Table

December’s much-weaker-than-expected job growth should be taken with a grain of salt, economists say, and one month's worth of data should not stop the Federal Reserve from making another reduction of its asset purchases at the January policy meeting.

The U.S. economy added 74,000 jobs in December, the smallest increase since January 2011, the Labor Department said Friday. That’s a far cry from the 196,000 jobs Wall Street expected.

“It’s certainly disappointing, but I don’t think it’s indicative of what’s going on in the economy,” said Gus Faucher, senior economist at PNC Financial Services Group. “I would expect when we get the revisions next month, and in particular when we get the annual benchmark revision from the Bureau of Labor Statistics, job growth in December will look significantly higher.”

November was revised to 241,000 from 203,000, while October's gain was unchanged at 200,000.

December’s figures are a big disappointment, but the long-term trend remains steady. For all of 2013, the average pace of monthly gains was 182,000, down slightly from 183,000 in 2012, but higher than the 175,000 jobs added in 2011.

The unemployment rate in December fell to 6.7 percent, the lowest since October 2008, as more people dropped out of the labor force. Economists were looking for the jobless rate to hold steady at 7 percent.

The labor force participation rate, which gauges the proportion of the working-age population in the labor force, slipped to 62.8 percent, down 0.8 percent from a year ago, and the lowest since February 1978.

Here is the BLS labor force participation rate projections from 2004-present graphed against reality. SCARY. pic.twitter.com/UXBygkk4WU

- Zachary Goldfarb (@Goldfarb) January 10, 2014Of the 74,000 jobs created in December, 55,000 were in retail, above its average of 32,000 in 2013. Health care was down 6,000, a huge drop from its 2013 average of adding 17,000 jobs. Manufacturing added 9,000 and construction was down 16,000.

The unseasonably severe winter weather last month probably played a part in the disappointing December jobs number. BLS said 273,000 people didn’t work in December because of the weather, the most since 1977, and well above the 166,000 long-term averages for the final month of each year.

“The 16,000 decline in construction payrolls and the dip in average weekly hours worked are … indications that bad weather played a role,” Paul Ashworth, chief U.S. economist at Capital Economics, said in a note.

Average hourly wages rose 2 cents to $24.17 while the average workweek dipped 0.1 hour to 34.4 hours.

Six-Year Anniversary

Heidi Shierholz, an economist at the Economic Policy Institute, released a new paper on Thursday detailing how the labor market fared since the Great Recession officially began in December 2007. December’s jobs report marks the six-year anniversary of the Great Recession’s beginning and the four-and-a-half-year anniversary of its end.

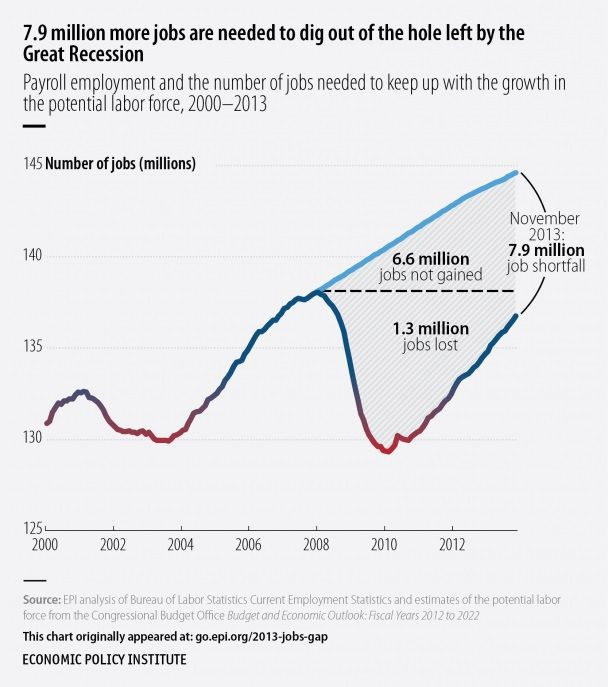

According to Shierholz, the total “jobs gap”-- the number of jobs needed to return the U.S. economy to pre-recession health -- is 7.9 million jobs.

“At 200,000 jobs per month, pre-recession labor market conditions would not be regained for another five years,” Shierholz wrote. “To regain pre-recession labor market conditions in two years, we would need to add 400,000 jobs per month.”

She also emphasized that most of the improvement in the unemployment rate since its peak of 10 percent in the fall of 2009 has not been driven by increased employment, but rather by potential workers dropping out of, or never entering, the labor force because job opportunities are very weak.

Based on Shierholz’s calculation, if all of these missing workers were actively seeking work, the unemployment rate would be 10.3 percent instead of 7.0 percent (at the end of November 2013).

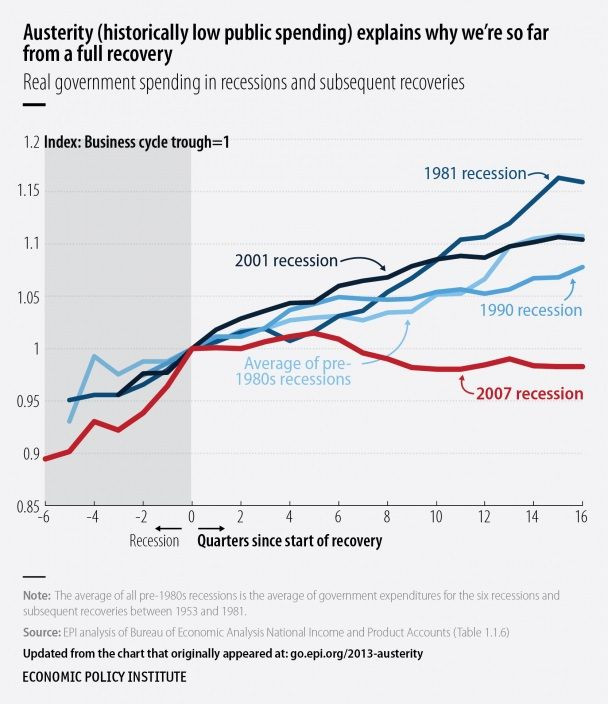

A key driver of this broad-based weakness is austerity in the public sector, Shierholz said.

Fed Tapering

“I think the Fed made the correct decision [to start tapering at its December meeting]. Even including December, job growth over the past year or so has been pretty strong,” Faucher said. “I think the labor market is strong enough to withstand slightly higher long-term rates, particularly because the Fed is going to keep short-term rates low for another couple of years. And once we get the revision, it’ll look better.”

The minutes from the Dec. 17-18 meeting of the U.S. Federal Open Market Committee, after which the central bank announced its plan to reduce monthly asset purchases by $10 billion to $75 billion, showed that many members wanted to “proceed cautiously” in the first cut to QE and that further reductions should be undertaken in “measured steps.”

Faucher thinks the Fed will not respond to just one month of data.

“When they decided not to reduce purchases in September, they’ve had a couple of good months but they decided to wait. So they did and they moved in December,” he said. “They are not going to freak out by one month’s data and they will continue to gradually reduce their purchases over the course of this year.”

“At the end of the month we will have the first read on the fourth-quarter GDP, which I think will be a strong number. Given that, I would expect even with the weak December jobs report number, the Fed would reduce asset purchases again at its policy meeting later this month by another $10 billion,” Faucher said.

The U.S. Senate on Monday voted 56-26 to approve Janet Yellen as the next Fed chair, after Ben Bernanke finishes his second term at the end of this month. Yellen, 67, has been the Fed's second-in-command since 2010. She is the first woman to lead the Fed in its 100-year history.

As Bernanke’s successor, Yellen will face challenges including managing the process of ending quantitative easing, as well as deciding when and how to ease off short-term interest rates.

Her first meeting as chair is scheduled for March 18-19.

© Copyright IBTimes 2024. All rights reserved.