US Manufacturing Activity Nears Three-year Low; Price Pressures Abate

U.S. manufacturing activity slumped to the lowest level in nearly three years in March as new orders plunged, and activity could decline further amid tightening credit conditions.

The Institute for Supply Management (ISM) survey on Monday also showed a continued reduction in factory employment last month, but inflation pressures subsided, with supplier delivery performance the fastest since March 2009. Rising borrowing costs as the Federal Reserve fights high inflation have cooled demand for goods, which are typically bought on credit.

"Manufacturing activity is moving deeper into the red and the million-dollar question is whether sputtering factory output will spread to the rest of the economy," said Christopher Rupkey, chief economist at FWDBONDS in New York. "New orders are off sharply in March and that could very well lead to production shutdowns and more layoffs later on this spring and summer."

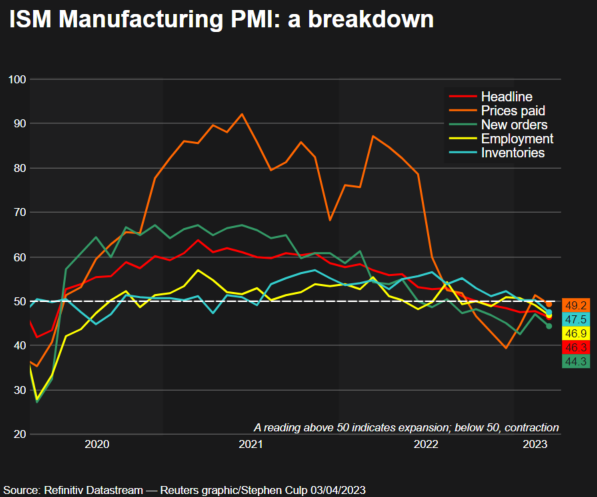

The ISM's manufacturing PMI fell to 46.3 last month, the lowest reading since May 2020, from 47.7 in February. Economists polled by Reuters had forecast the index would dip to 47.5.

It was the fifth straight month that the PMI remained below the 50 threshold, which indicates contraction in manufacturing. But so-called hard data have suggested that manufacturing, which accounts for 11.3% of the economy, continues to grow moderately.

Manufacturing expanded at a 4.5% annualized rate in the fourth quarter, the government reported last week. Reports last month also showed orders for capital goods excluding aircraft eked out a small gain in February as did manufacturing output.

According to the ISM, 70% of manufacturing gross domestic product was contracting in March, down from 82%. It, however, noted that more industries contracted strongly last month.

"The proportion of manufacturing GDP with a composite PMI calculation at or below 45 percent, a good barometer of overall manufacturing sluggishness, was 25 percent in March, compared to 10 percent in February," said Timothy Fiore, chair of the ISM Manufacturing Business Survey Committee.

Of the six largest manufacturing industries, only petroleum and coal products as well as machinery, registered growth in March. Other manufacturing industries reporting growth were printing and related support activities, miscellaneous manufacturing, fabricated metal products and primary metals.

Twelve industries reporting contraction included furniture and related products, nonmetallic mineral products, textile mills, transportation equipment and computer and electronic products as well as electrical equipment, appliances and components.

Comments from manufacturers were mostly downbeat. Transportation equipment producers said "sales are slowing at an increasing rate, which is allowing us to burn through back orders at a faster-than-expected pace."

Electrical equipment, appliances and components manufacturers reported that "new orders are starting to soften." Makers of chemical products said "sales (were) a bit down, and budgets being cut with a greater emphasis on savings."

But food, beverage and tobacco products manufacturers said "business is doing generally well, with input costs falling in some areas and rising in others."

U.S. stocks were trading mixed. The dollar fell against a basket of currencies. U.S. Treasury prices rose.

Graphic-ISM Manufacturing PMI,

NEW ORDERS PLUNGE

The ISM survey's forward-looking new orders sub-index fell to 44.3 last month from 47.0 in February. Demand could come under pressure following the recent failure of two regional banks, which stressed the financial sector. Banks have tightened lending standards, which could make it harder for small businesses and households to access credit.

According to a Goldman Sachs analysis, manufacturing could be hit hard by a decline in bank credit because firms rely on bank lending for working capital or to finance capital expenditure. But it noted that manufacturers depending on bank credit also "tend to have larger firms that, other things equal, will have an easier time finding alternative sources of capital."

Work backlogs continued to shrink last month, reflecting the collapse in demand as well as improved supply chains. The ISM survey's measure of supplier deliveries slipped to 44.8, the lowest level since March 2009, from 45.2 in February. A reading below 50 indicates faster deliveries to factories.

With supply improving, inflation at the factory gate is retreating. The ISM survey's measure of prices paid by manufacturers dropped to 49.2 from 51.3 in February.

But inflation could remain elevated. Saudi Arabia and other OPEC+ oil producers on Sunday announced further oil output cuts of around 1.16 million barrels per day. Prices for services also remain high.

The Fed last month raised its benchmark overnight interest rate by a quarter of a percentage point, but indicated it was on the verge of pausing further increases in borrowing costs because of financial markets turmoil. The U.S. central bank has hiked its policy rate by 475 basis points since last March from the near-zero level to the current 4.75%-5.00% range.

Weak demand left factories with little incentive to increase employment. The survey's gauge of factory employment fell to 46.9 from 49.1 in February.

This measure has swung up and down, making it an unreliable predictor of manufacturing payrolls in the government's closely watched employment report. Factory payrolls fell in February after rising for nearly two years.

© Copyright Thomson Reuters 2024. All rights reserved.