US Market Futures Plunge As $2 Trillion Stimulus Bill Delayed And COVID-19 Deaths Climb

KEY POINTS

- Dow, S&P 500 and Nasdaq futures down

- Dow futures hit 'limit down,' triggering trading halt

- Investors flee as Dems and Republicans fight over $2 trillion economy rescue package

U.S. stock futures have plunged sharply Monday indicating another day of carnage in the markets amid the failure of Democrats and Republicans to work together and expediently pass a stimulus bill to rescue the economy from a steep downward slide.

Dow futures fell more than 900 points at the commencement of trading, hitting the so-called "limit down" and triggering a trading halt. They were down around 700 points, or 3.7%, at 5.30 a.m. EST.

S&P 500 (SPX) and Nasdaq (COMP) futures also fell around 5%, and were down 3.4% and 2.8%, respectively.

The slide in the futures markets followed after Senate Democrats blocked action on the federal government's stimulus bill Sunday, potentially placing the $2 trillion COVID-19 relief package in jeopardy. Although Senate Majority Leader Mitch McConnell, R-Ky., attempted to set up a second procedural vote at 9.45 a.m. Monday, Minority Leader Charles Schumer, D-NY., blocked that attempt too. The vote could now come hours after markets open Monday, raising the prospect that stocks could take another massive beating before the bill is eventually passed and investor confidence restored.

Schumer and Treasury Secretary Steven Mnuchin have met at least six times Sunday over the bill, and the minority leader said they were making "good progress," The Hill reported. As of 6 a.m. EST Monday, the novel coronavirus has infected more than 35,200 people in the U.S. and killed 471, according to data by the John Hopkins University.

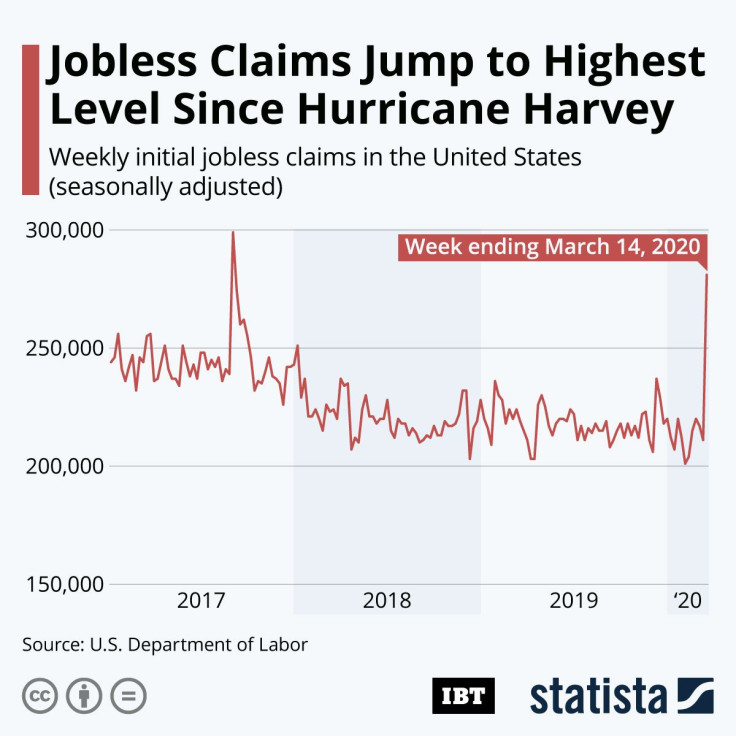

The dithering in Capitol over the relief package comes amid dire predictions for the markets and the U.S. economy. Investors have fled stocks in recent weeks as the economy stares at a recession from the massive disruptions caused by the coronavirus pandemic across world markets and industry supply chains. In a precursor to the bleak days ahead for the U.S. economy, jobless claims rose to a two-year high March 19.

Goldman Sachs economists led by David Choi said in a research note that the U.S. economy could be heading for historic unemployment, with claims hitting 2.5 million in the data due March 26.

Also, former White House communications director and investor Anthony Scaramucci told CNBC that the U.S. is in a "protracted bear market" and have room to fall at least another 10-15%. The Dow Jones Industrial Average is already down 32.81% from the beginning of the year and the S&P 500 index is down 28.66%.

Markets across Asia were left reeling as the negative news from the U.S. on the deadlock over the stimulus bill fed into already gloomy investor sentiment, even as the global death toll from the coronavirus pandemic crossed 14,400.

The Hang Seng Index ended Monday down 4.9%, Sydney fell 5.6%, Shanghai lost 3.1% and Taiwan was down 3.7%. Indian markets were forced to a trading halt and slid even lower when trading resumed.

The Nikkei, however, closed 2% higher as the yen fell against the dollar and boosted markets.

European stocks mirrored the gloom in Asia, with the pan-European STOXX 600 and London’s FTSE 100 were both down. Germany’s DAX fell despite expectations of a major stimulus, and so did France’s CAC 40.

© Copyright IBTimes 2024. All rights reserved.