US Oil Companies Ease Off Drilling Rigs As Lower Crude Prices Force Production Slowdown

U.S. energy companies are easing off on the creation of oil wells as crude prices hover around six-year lows, according to drilling data released Wednesday. The slowdown in production is costing the American economy thousands of jobs and could halt the U.S. oil boom until prices recover.

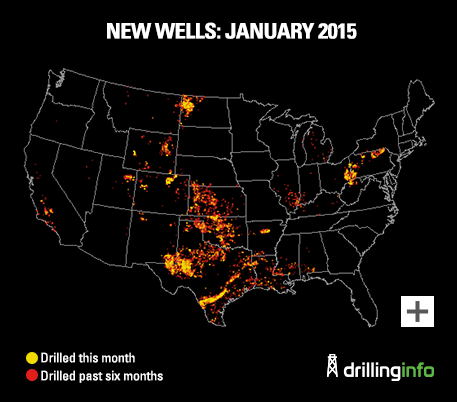

Oil companies drilled 28 percent fewer wells in January across the continental U.S. than they did last June, an analysis by Rice University’s Baker Institute for Public Policy found. Oil prices per barrel have plunged by more than one-half since last summer -- from $100-plus then to about $50 now -- as the global crude supply outstrips demand.

Wells drilled in January can produce about 515,000 barrels of oil a day, or 8.5 percent less crude than wells drilled in June, according to Drillinginfo Inc., which supplied data for the report. In the past month, oil production has continued to drop, falling by about 9 percent in January as the number of oil rigs and new permits for drilling steadily decline, the Drillinginfo Index said.

The data came on the heels of a Tuesday announcement by the Halliburton Co., a Houston oil-field services firm, that it plans to cut between 5,200 and 6,400 jobs as oil and gas production slows. The cuts represent from 6.5 percent to 8 percent of the company’s 80,000-person workforce.

“Unfortunately, we are faced with the difficult reality that reductions are necessary to work through the challenging market environment,” Halliburton representative Emily Mir told reporters in a statement.

Baker Hughes Inc. said last month that it would cut 7,000 jobs worldwide because of lower oil prices. Globally, the world’s top four oil-field services companies have slashed a combined 30,000 jobs in recent weeks.

The scaling back of U.S. energy production is a victory for the Organization of Petroleum Exporting Countries, led by Saudi Arabia. The oil cartel has so far declined to curb its own production, a move that would shore up crude prices and allow North American firms to maintain market share. OPEC said Monday it now expects countries outside the cartel to grow production by just 850,000 barrels a day in 2015, down from its previous forecast of 1.27 million barrels a day.

© Copyright IBTimes 2024. All rights reserved.