US Rejection Of Wall Street ‘Living Wills’ Ratchets Up Pressure On Too-Big-To-Fail Banks

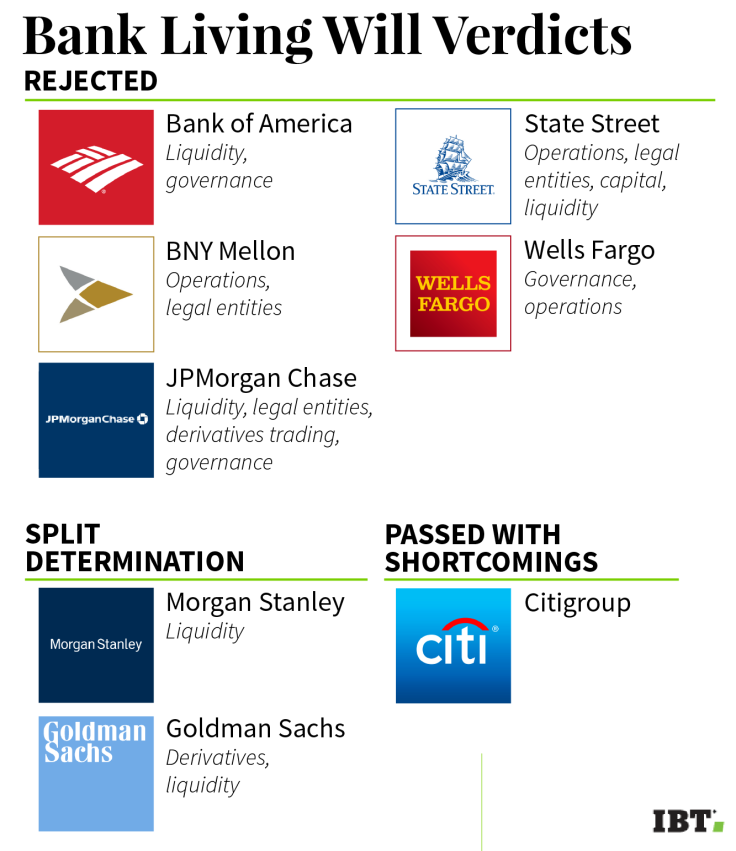

U.S. bank regulators struck a major blow against some of the largest banks in the country Wednesday, rejecting the so-called living wills of JPMorgan Chase & Co., Bank of America, Wells Fargo, State Street and Bank of New York Mellon.

The banks' resolution plans, which outline how systemically important financial institutions would navigate a bankruptcy without splintering the financial system or costing taxpayers, have become a central focus of bank reformers since the 2010 Dodd-Frank Act authorized regulators to judge the submissions.

The failing grades at five of the nation’s eight largest banks reveal newfound consensus between the two regulators responsible for the assessments, the Federal Reserve and the Federal Deposit Insurance Corporation, which had diverged in previous rounds of analysis. The stricter judgments released Wednesday are likely to add momentum to advocates of big-bank breakups, such as presidential hopeful Sen. Bernie Sanders of Vermont and Sen. Elizabeth Warren, D-Mass.

“No firm yet shows itself capable of being resolved in an orderly fashion through bankruptcy,” said FDIC Vice Chairman Thomas Hoenig in a statement. “Thus, the goal to end too big to fail and protect the American taxpayer by ending bailouts remains just that: only a goal.”

The determinations require the banks to submit corrected versions of plans originally delivered last year. If those new submissions are deemed insufficient again, regulators have the authority eventually to enforce potentially costly sanctions, ranging from higher capital buffers to increased liquidity provisions.

If the banks fail to resolve their deficiencies, the consequences eventually could include mandatory divestiture of assets — in essence, forced bank breakups.

The agencies objected to portions of the plans submitted by Goldman Sachs and Morgan Stanley, but only the FDIC delivered a ruling of “not credible” to the two big investment banks, an assessment required from both agencies to enable sanctions. In 2014, the FDIC called the plans from 11 banks not credible, while the Fed held off from making that judgment.

Citigroup escaped a negative determination from either agency, though each identified “shortcomings that the firm must address.”

‘A Major Escalation’

The rulings represent the first time that Dodd-Frank’s too-big-to-fail resolution planning process has been used as a stick against major banks. In a note to clients Wednesday, Guggenheim Partners banking analyst Jaret Seiberg called the rulings “a major escalation against the biggest banks.”

“The test got much tougher last year,” said Karen Shaw Petrou, co-founder and managing partner of Federal Financial Analytics, adding that the Fed was “not prepared to be as forgiving this time around.”

Still, although the determinations represent a break from the Fed’s prior reticence to rule against the banks, potential penalties remain a long way off. “Failing a living will does not mean that federal regulators are about to break up any of these banks,” Seiberg wrote. “There is a very exhaustive process that has to occur before any structural changes are possible.”

JPMorgan, which reported better-than-expected earnings after a tough quarter Wednesday, expressed dismay over the findings.

“Obviously we were disappointed with the determinations,” Marianne Lake, JPMorgan’s chief financial officer, told investors Wednesday during an earnings call, adding that the bank has already made progress on deficiencies highlighted by regulators. “There’s going to be significant work to meet the expectations of the regulators.”

“The liquidity of the bank is extraordinary,” Chief Executive Jamie Dimon added, enumerating sources of capital the bank holds all over the world. But he refrained from criticizing regulators, who took a different view of the liquidity at the largest American bank by assets. “They have their job to do, and we have to conform to it.”

Political Pressure

Political scrutiny had mounted in the months before the release of the determinations, which were reportedly delayed due to foot-dragging at the Fed. At a hearing in February, Warren pressed Fed Chair Janet Yellen over whether the Fed and the FDIC would release their findings jointly. Though Yellen was careful not to make any promises then, the agencies ended up coming together in their joint determinations Wednesday.

The agencies responded to the “political heat,” according to James Wigand, a former FDIC official who oversaw aspects of the resolution process and is now a partner at the advisory firm Millstein and Co. “There certainly is real pressure to demonstrate that progress is being made.”

Though less dogmatically devoted than Sanders or Warren to breaking up the biggest banks, Democratic presidential candidate Hillary Clinton has cited the section of Dodd-Frank requiring living wills as a potential avenue for breaking up the banks. Sanders has leaned more heavily on a different portion of the law as a means of splitting up banking behemoths.

But the process has also highlighted the near impossibility of requiring massive banking institutions to prepare for bankruptcy processes that are designed for firms a fraction of their size. “A bankruptcy is almost always going to be systemic," Petrou said. “No one has figured out how you can have an orderly bankruptcy.”

Dodd-Frank provides two routes by which firms deemed systemically important to U.S. financial markets can unwind in the case of insolvency, either through a receivership with the FDIC or through a Chapter 11 bankruptcy process. It’s the latter that banks are required to envision in their living will submissions.

But some doubt whether that exercise has any use, given the size and bewildering complexity of American mega-banks. “Chapter 11 of the bankruptcy code doesn’t work for large financial institutions,” Petrou said.

Stanford University finance professor Anat Admati, a vocal critic of too-big-to-fail banks, also expressed doubts about the process. “Of course this result states the obvious,” Admati told International Business Times in an email. “The whole exercise is too costly for the benefit, because [regulators] can and should immediately do something about these extremely unhealthy institutions.”

A Government Accountability Office report released Tuesday raised issues with the transparency and timeliness of the resolution planning process, particularly the monthslong delays banks have experienced in receiving feedback from regulators.

“The process could be significantly improved if regulators would make their expectations more clear up front since a more transparent process would serve everyone's interest,” Tim Pawlenty, chief executive of the Financial Services Roundtable, said in a statement Wednesday.

But regulators seemed to address some of those transparency concerns in the release Wednesday. In addition to the determinations, the agencies for the first time publicized letters outlining exactly how banks will need to remediate their submissions in October to avoid sanctions. Though redacted, the letters provide new public insight into what aspects of bank operations remain a concern to regulators.

At JPMorgan, Bank of America and State Street, the regulators voiced concerns over liquidity, or the ability of banks to turn assets into cash. Liquidity issues proved disastrous during the 2008 financial crisis, when major banks suddenly found it impossible to access capital that had previously flowed freely.

Regulators also flagged concerns over banks’ complicated legal structures and governance issues.

Seiberg, the Guggenheim analyst, noted that the changes required of the banks appear feasible. “It does appear that the banks will have the guidance required to pass in October,” he said.

“The resolution plan process is one of iterations,” Wigand said. “It will take a number of submissions to keep making progress.”

© Copyright IBTimes 2024. All rights reserved.