US Stock Futures Point To Lower Open Ahead Of Jobless Claims Report, Home Sales Data, As Investor Sentiment Remains Down On Fed Bond-Buying Comments, Chinese Data

U.S. stock index futures point to a lower open on Thursday, as investors wrestle with the implications of the Federal Reserve winding down its stimulus program, and weak Chinese manufacturing data that underscored investors' concerns about the health of the world's second-largest economy.

Futures on the Dow Jones Industrial Average were down 0.64 percent, futures on the Standard & Poor's 500 Index were down 0.92 percent while those on the Nasdaq 100 Index were down 1.01 percent.

China's manufacturing PMI sank to a nine-month-low of 48.3 in June in comparison to a final reading of 49.2 in May, a release by Markit said on Thursday. A reading below 50 indicates contraction in manufacturing activity.

Investors will also watch the Labor Department's weekly jobless claims report and existing home sales data, which are due at 8:30 a.m. EDT and 10:00 a.m. EDT respectively.

Economists polled by Reuters predict that jobless claims, which measure the number of individuals who filed for unemployment insurance for the first time last week, are likely to edge up to 340,000 for the week ending June 15, from 334,000 in the previous week.

The National Association of Realtors' existing home sales report, which measures the change in the annualized number of existing homes sold during the previous month. Analysts estimate sales of previously-owned U.S. homes will rise to 5 million in May, up from April’s 4.97 million.

In addition, investors are also likely to focus on Markit’s manufacturing PMI, to be released at 8:58 a.m. EDT, and the Philadelphia Federal Reserve Manufacturing Index, expected at 10:00 a.m. EDT.

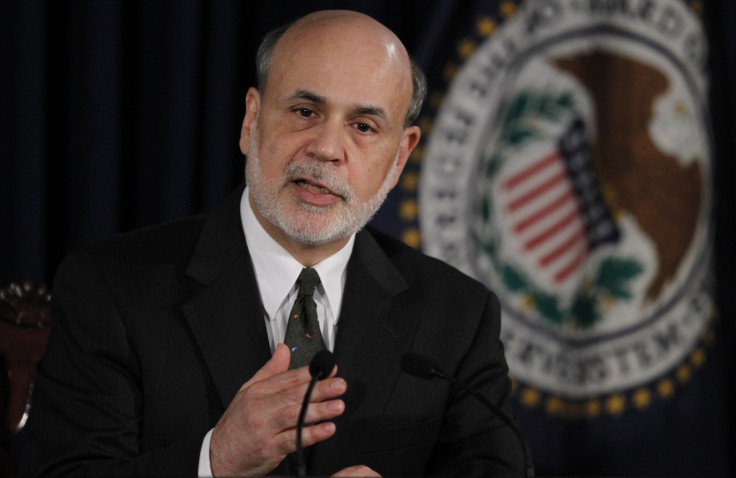

In a press conference held on Wednesday after the Fed’s two-day policy meeting, Chairman Ben Bernanke said the Fed is optimistic about the economic recovery and that the bank might start tapering its monthly bond-buying program “later this year” and wind it up altogether by mid-2014, if the economy recovers as projected by next year.

Markets around the world reacted sharply to Bernanke’s comments, which triggered a sell-off, as investors feared that the Fed’s withdrawal of its bond-buying program could trigger an outflow of funds from emerging markets.

In Europe, London’s FTSE 100 was down 2.47 percent, Germany's DAX-30 plunged 2.52 percent, while France's CAC-40 declined 2.53 percent.

In Asia, China's Shanghai Composite index plunged 2.77 percent, Japan’s Nikkei ended down 1.74 percent and Hong Kong’s Hang Seng declined 2.88 percent. South Korea’s KOSPI declined 2.00 percent and India’s BSE Sensex ended down 2.74 percent.

On Wednesday, the Dow Jones Industrial Average lost 206.04 points, or 1.35 percent, to end at 15,112.19. The S&P 500 Index fell 22.88 points, or 0.39 percent down, to 1,628.93. The Nasdaq Composite Index dropped 38.98 points, or 1.12 percent, to end at 3,443.20. Treasury yields touched a 15-month-high, and the dollar strengthened against all major currencies.

© Copyright IBTimes 2024. All rights reserved.