US Treasury Making Serious Money From Aid To Banks As The Big Financial Institutions Keep Benefiting From Financial Crisis Response

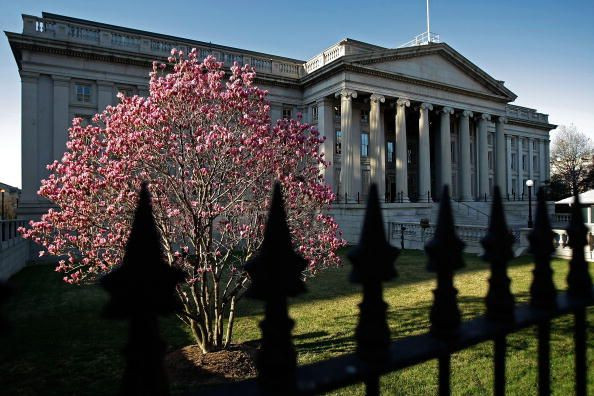

The U.S. Treasury is doing quite nicely on the money it loaned to -- or invested in, depending on one's perspective -- banks in the months following the financial crisis.

The details were outlined in the monthly TARP report to Congress.

Under the program known as the Capital Purchase Program (CPP), one part of the Troubled Asset Relief Program (TARP) established in response to the crisis, Treasury purchased troubled banks' preferred stock to the tune of $204.9 billion over roughly five months, ending in February 2009. As of January 2012 the government had netted $211.5 billion from it, exceeding the $204.9 billion it invested. The $6.6 billion profit is about half of what the Treasury expects to get back over the lifetime of CPP.

Overall TARP has given out about $608 billion in funds to 936 recipients, but only $367 billion has been returned. Further, Washington also received $183 billion in dividends, interest and other fees from borrowers. That leaves the government -- or taxpayers -- still short by $57.8 billion, and if one counts the total principal amount loaned, the government is still owed about half of what it loaned.

Below are the largest investments the government made via the CPP program (in millions).

1. Popular Inc. (NASDAQ:BPOP) San Juan, PR $935.0

2. First BanCorp (NASDAQ:FBNC) San Juan, PR $254.3

3. Cathay General Bancorp (NASDAQ: CATY) Los Angeles, CA $129.0

4. Anchor BanCorp Wisconsin Inc. Madison, Wis. $110.0

5. Hampton Roads Bankshares, Inc. (NASDAQ: HMPR) Norfolk, VA $80.3

6. CommunityOne Bancorp. (NASDAQ:COB) Charlotte, NC $51.5

7. U.S. Century Bank (NASDAQ:NCBC) Miami, FL $50.2

8. Crescent Financial Bancshares Inc. Cary, NC $42.8

9. Reliance Bancshares Inc. (OTC:RLBC) Frontenac, MO $40.0

10. Bridgeview Bancorp Inc. Bridgeview, IL $38.0

© Copyright IBTimes 2024. All rights reserved.