Verizon CEO: Stock Dividends Are How Verizon Benefits ‘Ordinary Americans’

After presidential candidate Bernie Sanders visited a picket line in Brooklyn to support striking Verizon workers Wednesday, Verizon CEO Lowell McAdam took to LinkedIn to rebut the socialist senator’s attacks on the company’s tightfisted bargaining stance and corporate practices.

“The senator’s uninformed views are, in a word, contemptible,” McAdam wrote.

His post took issue with Sanders’ implication that Verizon paid little in the way of taxes — the company’s effective income tax rose from 20 percent in 2013 to 35 percent in 2015 — before laying out what Verizon does to “benefit America.”

“In the last two years, Verizon has invested some $35 billion in infrastructure — virtually all of it in the U.S. — and paid out more than $16 billion in dividends to the millions of average Americans who invest in our stock.”

But for the workers picketing outside the Brooklyn facility where Sanders appeared, it wasn’t clear how dividends and other shareholder payouts benefited “average Americans.”

“We’re not part of that,” said Daisy Jefferson, an administrative assistant at a Verizon facility and a shop steward for the Communications Workers of America who was striking in Brooklyn Wednesday. “Maybe in his eye, that top 1 percent might be ordinary Americans, but the 99 percent down here that you see on the street — it’s not us.”

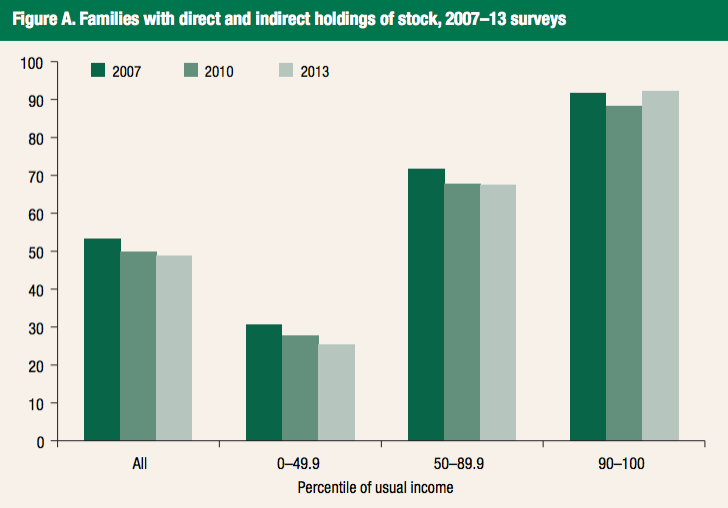

Indeed, just 15 percent of households in the U.S. directly hold stocks. When you include indirect holdings — through mutual funds or retirement accounts — still just under half of American households have stock market holdings.

The data, from the Federal Reserve’s Survey of Consumer Finances, show a wide and growing gap between those who benefit from the shareholder payouts McAdam hailed and those who do not. The share of families in the lower half of the income spectrum that hold any stock decreased from 48 percent in 2007 to 40 percent in 2013.

For the top 10 percent of families, meanwhile, the stock holding rate held steady at nearly 95 percent. That segment of the population owns more than 80 percent of the stock and mutual fund market.

Many of the Verizon workers on strike Wednesday do earn pensions that are widely invested across the stock market. But direct awards of company stock aren’t part of their contract.

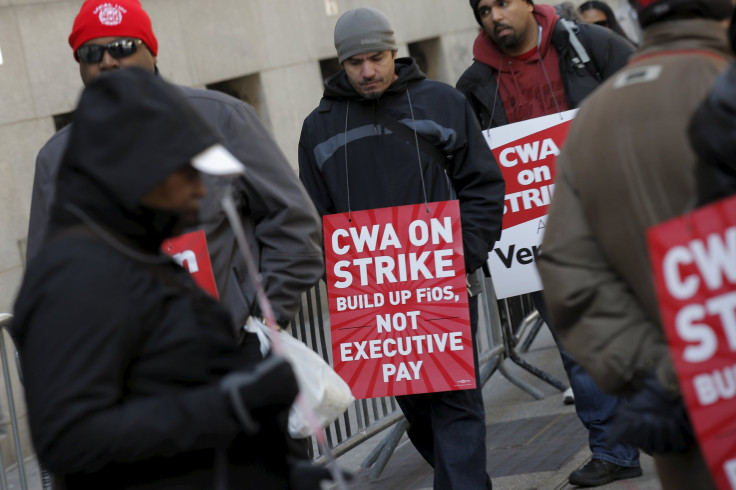

The issues that brought some 36,000 workers to picket lines across the northeast weren’t related to dividends or stock awards, however. Union representatives have decried the company’s push to make jobs more mobile, which would force some workers to move cities for months at a time. They’re also rejecting what they see as plans to shift more call center work to cheaper overseas units.

The company argues that it has negotiated in good faith, offering salary increases and continued benefits. “We’ve worked diligently to try and reach agreements that would be good for our employees, good for our customers and make the wireline business more successful,” Verizon Chief Administrative Officer Marc Reed said in a statement. “Unfortunately, union leaders have their own agenda rooted in the past and are ignoring today’s digital realities.”

The workers on strike belong to Verizon’s wireline division, which includes landline telephone and FiOS internet service. As McAdam noted in his rebuttal to Sanders, these sections of the telecom industry have lost significant market share to wireless technologies and, since 2010, have shrunk by half as a portion of Verizon’s business.

Still, Verizon has remained immensely profitable. The company pulled in $17.9 billion in net income in 2015, much of which ended up back in the hands of shareholders. In February of last year, Verizon authorized a $5 billion share buyback program, a corporate finance strategy that benefits shareholders by concentrating ownership in fewer hands.

In all, Verizon paid out $13.5 billion, or three-quarters of its income, to shareholders in 2015. Fran Shammo, Verizon’s chief financial officer, boasted of the numbers on a call with investors in January. “We are committed to returning value to shareholders,” he said.

Those shareholders include top Verizon executives, whose pay derives largely from stock awards. In 2015, the company’s top 5 executives earned $31 million in stock awards alone.

Workers at Verizon, meanwhile, are eligible for corporate profit sharing payments tied to the company’s annual returns; but according to union negotiators, the company has threatened to eliminate those for the coming year if an agreement is not reached.

For José Téllez, a call center worker in Brooklyn, the math doesn’t square. “It seems like the company is making a lot of money, yet they don’t want to share the wealth.”

© Copyright IBTimes 2025. All rights reserved.