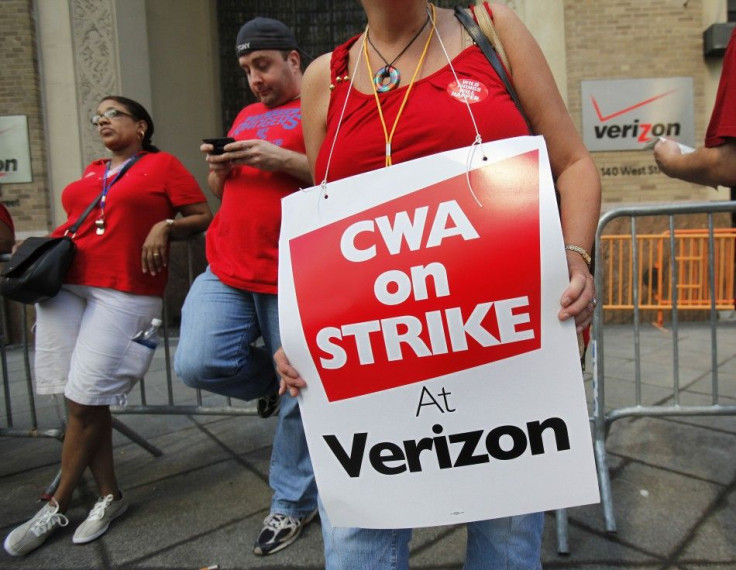

Verizon Strike 2011: Stock Rising Despite Work Stoppage

The strike certainly hasn’t hurt the stock price any.

Before Thursday’s massive sell-off in the stock market, shares of Verizon Communication (NYSE: VZ) had climbed steadily since 45,000 workers declared a strike against the company.

From the first trading day after the strike was announced, August 8, through the close of business on August 17, Verizon shares rose 7.52 percent. Even if one includes Thursday trading session – when Verizon stock fell 1.5 percent – shares are still up 5.9 percent

Coincidence?

Robert Phillips, managing principal at Spectrum Management Group in Indianapolis, suggests two important factors are likely at play here.

One, as worries about the economic health of the U.S. intensify (along with fears over a host of other troublesome issues, including a deepening debt crisis in Europe and the recent debt-ceiling fiasco in Washington), jittery investors are likely seeking safe-havens -- particularly dividend-paying stocks, like Verizon.

Like virtually all utility companies, Verizon provides a very high annual dividend yield -- on the order of 5.6 percent.

“With the yield on the 10-Year Treasury yield at historic lows – around 2 percent -- and so much economic uncertainty in the air, investors are desperate for cash flow yield, which stocks like Verizon provide,” he said.

However, that’s not to say that the strike is not also playing a role in the recent rally.

Phillips suspects that Verizon shareholders may be anticipating that the strike will be resolved relatively quickly -- the unions will probably lose their battle against the company and be forced to grant the estimated $1-billion in concessions as demanded by management.

Also, it is important to note that virtually all the strikers work for the landline segment of the company, which is rapidly losing customers and market share. (The booming wireless business has almost no unionized workforce).

In the event the company is victorious against the unions (and, among other things, forces these workers to start contributing to health care premiums), the bottom line would be boosted.

In addition, given the relentless decline in the landline business, some cost-cutting measures will probably ensue -- which would, again, benefit the bottom line (i.e., earnings and stock prices).

“In a weak economy, unions have very little leverage,” Phillips said. “And since the strike is being conducted by an especially weak and shrinking part of the business – landline – they have virtually no leverage. Unions really can’t hold companies hostage like this in this environment. I think investors realize this and are expecting the company’s management to prevail.”

Moreover, a strike at Verizon would not significantly disrupt its operations because of the nature of the business. The striking landline workers have been replaced by temporary workers or by management who are being asked to perform such services. (Of course, the wireless business continues to buzz along in a flourish).

It is wholly unlike automobile companies where strikes have an immediate (that is, negative) impact on production, which, eventually, hurts revenues, earnings and stock prices.

However, during Verizon’s previous strike in 2000, an 18-day work stoppage reportedly affected the service of about 28 million customers and cost the company $40 million in revenue. Of course, at that time, the landline segment comprised a much larger portion of the company’s business than today.

The fact that Verizon stock has been climbing while thousands of workers are on strike again illustrates how the interests of shareholders and company employees are often diametrically opposed.

Phillips also believes Verizon shares are currently undervalued – the stock is trading at a forward P/E of about 13.5.

“As long as you have very low interest rates, the company is likely to grow synonymously with the economy, say 3 percent to 4 percent per year,” he said. “Plus, with the dividend yield of well over 5 percent, Verizon is a pretty decent buy.”

Interestingly, according to Yahoo Finance, institutional holders own about 54 percent of Verizon shares outstanding – which is somewhat low for widely-held tech stocks.

For example, International Business Machines Corp. (NYSE: IBM) has 61 percent institutional ownership; while for Hewlett-Packard Co. (NYSE: HPQ), the figure is 75 percent.

Phillips believes this is due to the fact that Verizon is the descendant of various other telecom companies (including Bell Atlantic, NYNEX, etc.), which can ultimately trace their origins to the break of the telephone companies in the early 1980s.

As a result, Verizon likely “inherited” a large number of retail shareholders from its predecessor companies.

It’s unclear whether this makes the stock more volatile relative to its peers or not.

© Copyright IBTimes 2024. All rights reserved.