Wal-Mart Stores (WMT) Earnings: If Wage Increase Hurts Retailers Like Walmart, Then Don’t Tell Investors

When Wal-Mart Stores announced last month the second phase of its two-stage wage hike for more than 1.2 million of its U.S.-based Walmart and Sam’s Club store hourly employees, there seemed to be little consensus on whether the move would harm or help working poor Americans.

On the one hand are people like fast-food industry executives and laissez-faire libertarians decrying the wage floor as a job killer that hurts low-income Americans more than helps them. On the other hand are the service industry unions and liberal labor economists who argue wage-floors hikes don’t go far enough and that boosting the spending power of these workers actually benefits the economy.

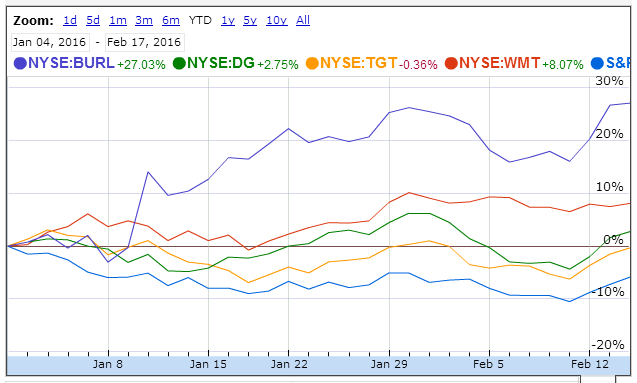

But if the share prices of discount retailers since the start of the year is any indication, investors may believe that more money in the pockets of the working poor will lead to more revenue for companies that cater to this demographic. While Wal-Mart’s stock price has fallen 23 percent over the past 12 months, it and other retailers catering to low-income customers have seen their shares rally since minimum wages were increased in 14 states at the start of the year.

“The dollar stores, Wal-Mart, Target, they benefit more directly and dramatically,” Harley Shaiken, a professor at University of California, Berkeley, told Bloomberg. “At the low end of the wage market, people are scraping by. They get more money, they spend it,” said the professor who studies labor economics and supports minimum wage increases.

Wal-Mart itself pointed to its “new associate wage structure” and other programs benefiting its lower-tier employees for $1 billion in charges in the first nine months of last year. An additional $1.5 billion dollars is expected to eat into the company’s revenue this year, the company has said.

But despite boosting pay for most of its U.S. employees from an average of $13 to $13.38 for full-timers and from $10 to $10.58 for part-timers (well below the Labor Department’s average for retail workers of $14.99), Wal-Mart continues to be an immensely profitable enterprise. The company earned $16.4 billion in profit on $485.7 billion in revenue in its last fiscal year, ending in January 2015, up from $16 billion on $476.3 billion in revenue during the previous fiscal year.

On Thursday, however, the world’s largest retailer is expected to post relatively weak earnings results for the fourth quarter of fiscal 2016, which ended in January.

Analysts surveyed by FactSet expect earnings of $1.46 per share, down from $1.61 last year. Sales are expected to decline to $130.5 billion from $131.6 billion for the same period last year.

The company has been struggling to return to growth as customer traffic in its core U.S. market has declined. It’s spent more than $1 billion over the last year to growth its e-commerce operations against the threat from Amazon.com. The company expects to report relatively flat growth for fiscal 2016, which ended last month, and a modest 2 percent to 3 percent annual growth through its fiscal year 2018.

Last month the retailer announced it was closing 269 stores, including all of its 102 small-format neighborhood stores, known as Walmart Express, after the failure of its four-year pilot in this retail niche.

© Copyright IBTimes 2024. All rights reserved.