Warner Bros. Discovery Is Cutting Its Freshest Content; Here's Why That's A Smart Move

KEY POINTS

- Warner Bros. Discovery has axed two HBO Max movies that were almost complete

- Some suggest it was done for tax purposes

- Saving money and investing in better movies is good for stakeholders and fans

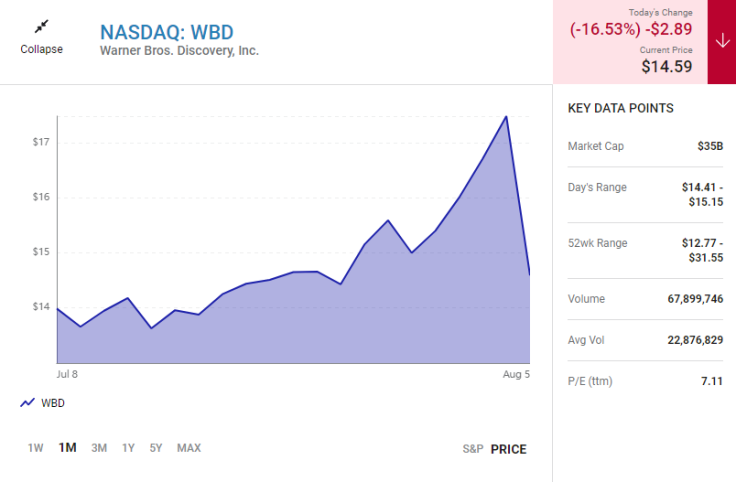

Warner Bros. Discovery (WBD -16.53%) has garnered a lot of attention after the company canceled the release of two HBO Max projects that were in the last stages of production. The first is Scoob! Holiday Haunt, a roughly $40 million animated film centered on Scooby-Doo and several other Hanna-Barbera characters. The second is Batgirl, a $90 million feature-length movie starring Leslie Grace as the DC Comics character and, according to reports, Michael Keaton returning to the role of Batman.

At the time of this writing, Warner Bros. Discovery has provided little insight into its decision to shelve Batgirl, saying only that it reflects "leadership's strategic shift as it relates to the DC Universe and HBO Max." It has said even less about the Scooby-Doo project. However, some are speculating the move was ultimately about reducing Warner Bros. Discovery's tax burdens. If that's correct, then from a financial standpoint, it might be the right call, even if it does damage the entertainment company's standing with some movie fans.

Warner Bros. is on a mission to cut costs

Warner Bros. Discovery was formed in spring 2022 from a $43 billion merger between WarnerMedia and Discovery. WarnerMedia brought with it franchises such as Looney Tunes and The Matrix, as well as streaming service HBO Max. Discovery entered the partnership with brands such as Shark Week, Deadliest Catch, and the Discovery Channel.

But perhaps most informative is that WarnerMedia came with tens of billions of dollars in debt, while Discovery came with David Zaslav -- a president and CEO long regarded for his financial common sense.

Before the merger closed, Zaslav was open about his strategy for Warner Bros. Discovery: He wanted to see at least $3 billion of cuts at the company within the first 12 months. The executive wasn't explicit about how that would shake out, saying the plans were "not perfect." Nonetheless, within weeks of Warner Bros. Discovery forming, projects were being dropped.

CNN+ was the first big victim of the Zaslav era. The $100 million streaming service launched in late March 2022, only to be shut down a few weeks later. Next on the chopping block were a slew of regional HBO Max originals that were initially intended to appeal to various European markets. At the time, Zaslav said, "It's not about how much, it's about how good."

A movie more valuable if it's never seen

When news first emerged that Batgirl would no longer be released, there were suggestions it was because the unfinished movie had received poor scores from a test audience. Considering Zaslav's earlier statement about quality content, that would be a plausible (if harsh) explanation.

Warner Bros. Discovery had reportedly overspent on the project, and fixing plot issues might well have required reshoots that typically cost millions. Reshoots for the 2017 DC film Justice League reportedly cost WarnerMedia $25 million -- and that's not including the additional $70 million that was later spent on the HBO Max exclusive, Zack Snyder's Justice League.

Subsequent reporting on Batgirl has suggested that the quality of the movie wasn't the issue, but rather executives decided they could leverage it to reduce Warner Bros. Discovery's future tax burdens. Financial experts have suggested Warner Bros. can write off its investment in the movie and use the deduction against profits from other projects. It's feasible that both explanations could be true: Batgirl tested badly and the company is in money-saving mode.

From the perspective of shareholders, the company probably made the right call. With talk of a recession on the horizon and a vast majority of U.S. households already signed up to at least one streaming service, in the near term at least, things are likely to be tough in the entertainment space for a while yet. And though it's arguable that Zaslav and the rest of the Warner Bros. Discovery decision makers could be cutting too much too quickly, their choices at least suggest they have long-term ideas for what belongs on HBO Max.

For fans who were looking forward to Batgirl (and those involved in the film's production), Warner Bros.' actions are disappointing. And for a company that is custodian to many pop culture properties, upsetting fans is ultimately a risk to the bottom line.

But if Zaslav's stated commitment to quality leads to better movies overall, then it will ultimately be good for Warner Bros. Discovery fans and shareholders alike.

This article originally appeared in The Motley Fool.

Tom Wilton has business dealings with Netflix but holds no financial position in any stocks mentioned. The Motley Fool has positions in and recommends Netflix and Walt Disney. The Motley Fool recommends the following options: long January 2024 $145 calls on Walt Disney and short January 2024 $155 calls on Walt Disney. The Motley Fool has a disclosure policy.