Warren Buffett And Bitcoin Predictions: How Berkshire Hathaway CEO's Words Impact Markets

When Warren Buffett talks, people tend to listen. The billionaire is one of the wealthiest people in the world and is considered one of the most successful investors of all time—a fact that may be concerning for those who are all in on cryptocurrency, as Buffett is decidedly not.

The so-called “Oracle of Omaha” has had plenty to say about Bitcoin and cryptocurrency over the last few years, and none of it is good. Buffett has become one of the most high-profile skeptics of Bitcoin, and while the cryptocurrency experienced a considerable amount of growth in the last year, the market still reacts when Buffet speaks.

Buffett first took notice of Bitcoin in 2014 as the currency was springing toward a value in the $650 range. During an appearance on CNBC’s morning show “Squawk Box,” Buffett was asked about the cryptocurrency and effectively panned the concept, telling people to “stay away from it,” and calling it “a mirage, basically,"

“It's a method of transmitting money. It's a very effective way of transmitting money and you can do it anonymously and all that. A check is a way of transmitting money, too. Are checks worth a whole lot of money just because they can transmit money? Are money orders?” Buffett said during the appearance.

“I hope bitcoin becomes a better way of doing it, but you can replicate it a bunch of different ways and it will be. The idea that it has some huge intrinsic value is just a joke in my view."

Bitcoin investors dismissed Buffett’s critique, claiming he had no understanding of the technology behind Bitcoin. Marc Andreessen, a Silicon Valley venture capitalist who has invested heavily in Bitcoin, responded by saying Buffett and others like him are “old white men crapping on new technology they don't understand.”

Better to have the support one a person like Buffett than to lose it, though, as Bitcoin value dropped shortly after the famous investor’s words made the rounds in the community. Bitcoin dropped from being valued at $630 the day of Buffett’s “Squawk Box” appearance to about $570 a week later. Bitcoin’s dive continued, dropping as low as $420 in the weeks that followed before beginning another upswing.

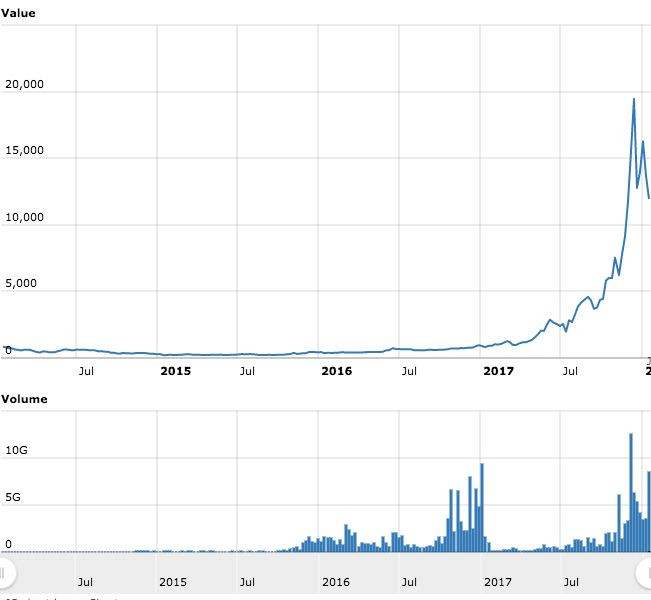

Buffett remained mum on Bitcoin for some time after that interview as clearly the topic wasn’t of particular interest to him and the cryptocurrency market hadn’t moved much until its value began to skyrocket in 2017.

In mid-October 2017, Buffett reportedly tackled the topic of Bitcoin again while holding court with college students during a question and answer session at an event he was hosting in Omaha, Nebraska. During the conversation with students, Buffett was asked about Bitcoin, which had increased in value nearly 10 fold since his comments in 2014.

Despite the massive gains Bitcoin produced, Buffett remained unmoved by the notion that cryptocurrency had an inherent value that would make it worth investing in.

According a MarketWatch, Buffett said, “You can’t value bitcoin because it’s not a value-producing asset.” He noted there’s no telling just how high Bitcoin’s price will go but described it as a “real bubble in that sort of thing.”

He also took issue with initial coin offerings (ICOs) during the conversation. ICOs are essentially fundraising rounds in which a company offers investors a token currency that in theory will increase in value over time.

“People get excited from big price movements, and Wall Street accommodates,” Buffett said of the concept.

The Bitcoin market was completely undeterred by Buffett’s words of warning. Within a week of the investor’s unchanged opinions being made public, Bitcoin gained nearly $2,000 in value. Shortly after, the cryptocurrency started a seemingly impossible streak of growth that carried on for weeks and would carry Bitcoin to the $10,000 mark and beyond.

Shortly after Bitcoin broke the $10,000 barrier for the first time in late November 2017, Buffett again spoke about cryptocurrency—though he did so during an apparent sit-down with pop singer Katy Perry. While Perry shared on Instagram that the two discussed cryptocurrency, she didn’t provide any insight into what Buffett told her—though it was likely in line with his previous statements.

Buffett’s next public statement on cryptocurrency came in a conversation with the Washington Post published on Dec. 18—around the same day that Bitcoin reached its peak price of nearly $19,500.

During the interview, Buffett qualified Bitcoin as the type of asset that “you hope like hell that someone will pay you more for it.” Despite the cryptocurrency’s new record-high value and run of several months of nearly unfettered growth, Buffett remained pessimistic about the cryptocurrency.

“I will say this, it will come to a bad ending,” he said.

Buffett’s words alone are not likely to have moved the market for Bitcoin and there were few people who believed the cryptocurrency’s growth would continue without correction, but the timing for Buffett’s critique couldn’t have been better. It aligns almost exactly with a drop that saw Bitcoin fall back below $15,000 and hit as low as $14,084 shortly after his statement.

Bitcoin recovered from that fall and nearly bounced back up to record levels again at the start of 2018 before again being met with a considerable amount of doubt from the world’s most successful investor.

During an appearance on CNBC’s “Squawk Box” on Jan. 10, Buffett was once again asked about cryptocurrencies. He said his investment firm will “never have a position in them” and warned investors in Bitcoin and other altcoins that he believed their gains would be short-lived.

“I can say with almost certainty that they will come to a bad ending," Buffett said during the appearance.

Once again, Buffett may simply be blessed with the gift of good timing, but shortly after his latest critique of Bitcoin, the cryptocurrency experienced one of its steepest drops to date. After hovering around the $14,000 mark for several days, Bitcoin dropped below $10,000 for the first time in over a month.

The cryptocurrency has recovered some of its value and stabilized again near $11,000. Many are still in for the ride with Bitcoin, and it has proven that it will likely be a rocky one. While the technology may be exciting—if not totally understood—for many, investors looking for a more stable and reliable experience are likely going to want to avoid Bitcoin. In those cases, Buffett’s words on cryptocurrency are likely worth heeding.

© Copyright IBTimes 2024. All rights reserved.