Washington Misses Another Layup

Opinion

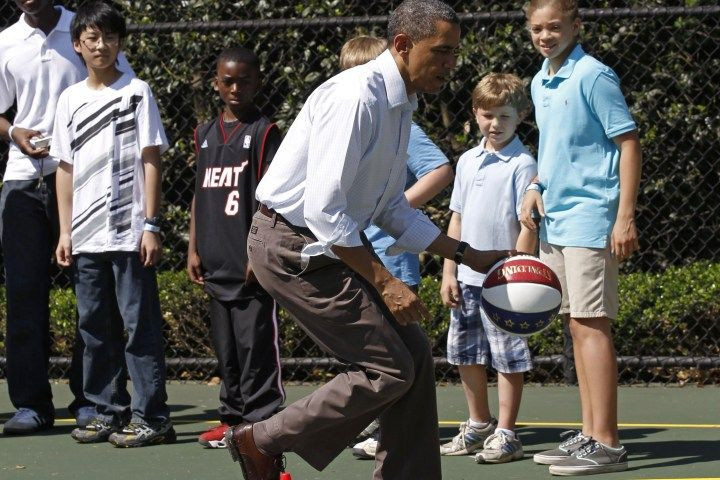

In a Monday basketball shoot-around witnessed by reporters, President Barack Obama missed 20 of 22 shots, including a layup.

On a brighter note, North Korea is restarting its shuttered nuclear facility in order to process weapons grade nuclear material to target the United States. Cyprus contagion has not abated but seems to be spreading. Factory orders fell in the U.S. and Europe. And unemployment remains little changed -- except for all those people who stopped looking for work. No wonder the S&P 500 is making new highs.

As the world runs from one man-caused crisis to another, something in our up-is-the-new-down world has to give. Either the temporary insanity suffered by the power elite worldwide will subside or the governing systems we’ve relied on to keep relative peace since World War II will break down completely.

Simply put, the highs on the S&P aren’t wrong; they are actually depressed. In fact, the S&P should be quite a bit higher. If politicians would simply get out of the way and reverse many of the “reform” measures they’ve taken over a dozen years, the index would trade as high as +1,800.

But the sad reality is that, while our politicians take jump shots, miss layups and work on their handicaps -- pun intended -- commerce suffers from lack of real leadership. Instead, business has been lulled by the only business that governments care about: lobbying.

And if the proof of the pudding is in the eating, then Wall Street’s appetite, where they really make money, is proof enough of our political failures.

“Only 8,115 deals were announced worldwide in the first quarter of this year,” the Wall Street Journal wrote about the slow pace of merger and acquisition, or M&A, activity -- “the lowest number since 2003, according to data from Thomson Reuters. And while the combined value of $542.8 billion outpaced last year’s first quarter by about 10 percent, it is still 26 percent below the level for the period in 2011.”

With stock price valuations as low as they’ve been since 1980, there is only one reason the market isn’t seeing more merger-and-acquisition deals while stocks are this cheap: uncertainty.

From health care reform that has caused the cost of medical care to rise instead of fall to governments around the world lacking the ability to restrain spending even as big budgets drive them to bankruptcy, companies face obstacles that go beyond the proverbial wall of worry and instead look more like a slippery slope.

For example, here in the U.S., the Department of Justice, or DoJ, has promised to derail more merger deals -- and that means costs for M&A are going up, too.

“There is no question that anti-trust risk in deals is greater now, which could make it appropriate to have a bigger breakup fee," said Barry Nigro, with law firm Fried Frank’s antitrust department, "The DoJ currently has six cases in active litigation; I cannot recall any time where so many have been ongoing at once.”

There used to be a time when governments sought to structure financial markets and banking in such a way as to engender confidence in the system, not to systematically erode confidence. But as events in Cyprus demonstrate, the business of governments now is government, and the rest of us can be damned for all they care.

In Cyprus today, citizens are reading about lawmakers who got favored loans from a banking system in trouble, insider dealings by political families and nepotism. A select body of politically appointed judges is investigating the charges.

"If it follows Cyprus' traditional norm, this is more for show than for substance," Hubert Faustmann, associate professor of history and political science at the University of Nicosia, said of the judges' investigation, according to the Wall Street Journal. "Cypriot scandals always go big and then tend to disappear over time. This time it might be different, but it remains against tradition of what tends to happen."

It remains against tradition here in our own Banana Republic as well.

After the meltdown of 2008, we turned to the very politicians -- Barney Frank and Chris Dodd, both of whom got favored treatment by some of the worst actors in the crisis -- to rewrite the banking laws to make sure we never faced a crisis again, a political layup if ever there was one.

But instead of remediating the crisis, they’ve introduced a “crisis without end,” with even more chances for our political masters to make a mess of more things like budgets, banking and financial markets.

People in Washington, D.C., you see, don’t get paid to fix things. They get paid to make things more complicated, less competitive and more expensive in a quest to keep the donations and lobbying-without-end going.

And as long as politicians and their surrogates can make a buck out of the man-caused crisis, expect the missed layups to never end.

John Ransom is finance editor at Townhall.com and the host of Ransom Notes, a nationally syndicated radio show covering the connection between politics and finance.

© Copyright IBTimes 2024. All rights reserved.