Wednesday's Stock Market Close: US Equities Surge, Dow Jumps 1,173, On Joe Biden’s Super Tuesday Victories

KEY POINTS

- Biden won nine of 14 states on Super Tuesday,

- Mike Bloomberg quit the race, endorsed Biden.

- Yield on 10-Year Treasury sank below 1%

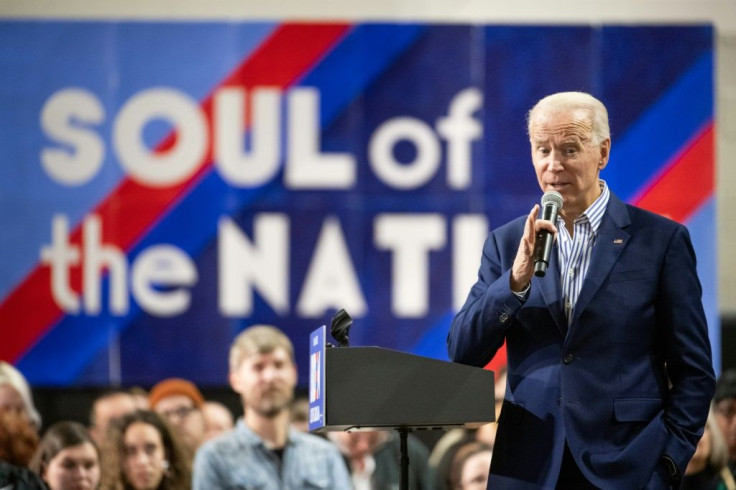

U.S. stocks surged on Wednesday as traders cheered that moderate Democratic presidential candidate Joseph Biden performed extremely well on Super Tuesday, pulling closer to the nomination ahead of progressive Bernie Sanders.

Health care stocks, which fear Sanders’ plan to create “Medicare for All”, single-payer, national health insurance program, soared. But the yield on the 10-year Treasury sank below 1%.

The Dow Jones Industrial Average surged 1,173.45 points to 27,090.86 while the S&P 500 jumped 126.75 points to 3,130.12 and the Nasdaq Composite Index gained 334 points to 9,018.09.

Volume on the New York Stock Exchange totaled 4.15 billion shares with 2,522 issues advancing, 37 setting new highs, and 459 declining, with 134 setting new lows.

Active movers were led by Inovio Pharmaceuticals Inc. (INO), Bank of America Corp. (BAC) and Advanced Micro Devices Inc. (AMD).

Former Vice President Biden won nine of 14 states on Super Tuesday, including Massachusetts, Texas, Virginia, Alabama, North Carolina, and Arkansas, while Sanders won California.

“Investors fear Bernie because he wants to cut off the head of capitalism by raising taxes significantly on the rich and using the funds to provide free everything to everybody else,” said Ed Yardeni, president and chief investment strategist at Yardeni Research. “Getting everything for free trumps freedom, according to Bernie. No wonder investors are reacting to him as though he is going to infect us all with the virus of socialism.”

Mike Bloomberg dropped out of the presidential race and endorsed front-runner Biden.

Josh Brown, CEO of Ritholtz Wealth Management CEO tweeted: “Stocks will be even more relieved at Warren’s coming concession as they are at Biden’s big showing. Wall Streeters have always secretly been more afraid of her than anyone else given her domain expertise.”

Lawmakers in Washington are preparing more than $8 billion in emergency funding for coronavirus.

The World Health Organization reported at least 93,000 people have been infected with coronavirus and at least 3,100 have died.

The World Bank approved $12 billion in emergency funding to help poorer nations with the health care costs and economic impact of the virus outbreak.

“We’re trying to reprice the entire stock market based on an unknown, the coronavirus,” said JJ Kinahan, chief market strategist at TD Ameritrade. “When we have such a large unknown, it’s going to affect people in different ways.”

The Federal Reserve’s “Beige Book” revealed that officials saw activity growing at a “modest to moderate pace.” While, the coronavirus specifically did not pose a major threat to the economy yet, business contacts said they were worried about its effects.

“There were indications that the coronavirus was negatively impacting travel and tourism in the U.S.,” the Fed report said. “Manufacturing activity expanded in most parts of the country; however, some supply chain delays were reported as a result of the coronavirus and several Districts said that producers feared further disruptions in the coming weeks.”

The Bank of Canada lowered its target for the overnight rate by 50 basis points to 1.25%.

ADP National Employment Report reported that private sector employment increased by 183,000 in February.

The Institute for Supply Management said its nonmanufacturing activity index increased to a 57.3 in February -- the highest such level since February 2019 – and up from 55.5 in January.

Overnight in Asia, markets finished mixed. China’s Shanghai Composite gained 0.63%, while Hong Kong’s Hang Seng slipped 0.24%, and Japan’s Nikkei-225 edged up 0.08%.

In Europe markets finished higher as Britain’s FTSE-100 gained 1.45%, France’s CAC-40 advanced 1.33% and Germany’s DAX rose 1.19%.

Crude oil futures slipped 0.15% at $47.11 per barrel and Brent crude gained 0.76% at $51.52. Gold futures fell 0.33%.

The euro edged down 0.31% at $1.1137 while the pound sterling gained 0.41% at $1.2865.

The yield on the 10-year Treasury dropped 1.78% to 0.992% while yield on the 30-year Treasury rose 0.31% to 1.635%.

© Copyright IBTimes 2024. All rights reserved.