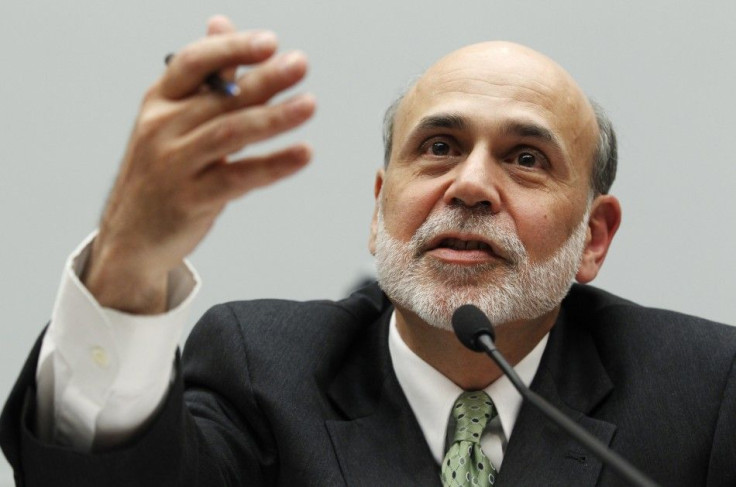

Is this the Week Fed Chairman Ben Bernanke Starts QE3?

ANALYSIS

With the U.S. economic recovery having slowed to a crawl, investors and business leaders expect U.S. Federal Reserve Chairman Ben Bernanke to use his speech Friday at the annual central bankers conference in Jackson Hole, Wyo., to both provide the Fed's evaluation of the nation's economic condition and to provide clues regarding monetary policy, including quantitative easing.

Further, institutional investors have already discounted -- or factored in -- the third round of quantitative easing from the Fed -- even though it is far from a fait accompli. Bernanke will address the Jackson Hole conference sponsored by the Kansas City Fed.

With short-term interest rates already near zero, investors want about $400 billion to $700 billion more in asset purchases by the Fed, in what would amount to a third round of quantitative easing, or QE3.

QE2 Boosted Economy

More than a year ago, the Fed implemented QE2 when it became clear the economy, due to a lack of demand, was in danger of falling into a vicious cycle of declining revenue, and declining prices -- deflation.

Deflation, a protracted, systematic decline in prices, robs companies of revenue and can lead to the dreaded deflationary spiral, in which price cuts lead to lower corporate revenue, prompting more layoffs, leading to further consumer spending declines, prompting more price cuts, and so on. Hence, deflation would hurt most corporations' top line, and that would weigh on the stock market.

Right now, the deflation risk is low and most economists seen the current U.S. consumer price condition as one of disinflation or low inflation.

That said, with 12-month, year-over-year consumer price index (CPI) inflation running at 3.6 percent, the Fed's inflation hawks will have more evidence to make their argument that a third round of quantitative easing will increase inflation to unacceptable levels.

It's hard to say we have stagflation, but we do have inflation too high for the Fed to do QE3, said Marc Chandler, global head of currency strategy for Brown Brothers Harriman & Co. in New York, told Bloomberg News.

Conversely, the Fed's price doves, or those on the Fed who favor additional quantitative stimulus, can point to the August Philadelphia Fed regional manufacturing index, commonly known as the Philly Fed Survey, which plunged to a minus 30.7 from 3.2 in July. Continued declines in the months ahead would be a danger sign for the economy

The Fed's doves can also argue that although top-line CPI has risen, the core rate -- which excludes the often-volatile food and energy component -- is running at just 0.2 percent on a 12-month basis: very low, and should be only a minor concern compared to the nation's high 9.1 percent unemployment rate and the risk of the economy tipping back into a recession, following the worst recession since the Great Depression.

Monetary Policy/Economic Analysis: New York Federal Reserve President William Dudley's take on the economy last week may have provided a clue regarding Fed Chair Bernanke's upcoming speech and economic report card. Dudley said in speech in new Jersey that the risk of a renewed recession remains quite low.

Hence, look for Bernanke to hold-off regarding QE3 at Jackson Hole. More than likely he'll note the recovery slowdown, outline that the recovery is not at stall speed, but underscore that the Fed remains prepared to take additional action if deflation pressures emerge or if the economy slows further.

Another ripple in the form of concern about Italy's or Spain's bonds and/or their impact on key European banks, may constrain credit further, prompting the Fed to take pre-emptive or prophylactic measures to keep credit markets liquid. As of now, the latest debt concerns have not caused as much market distress as the financial crisis' acute stage in 2008/2009, but it bears watching.

What could really benefit the economy -- and make Bernanke's job easier? A GDP tailwind from a substantial fall in oil prices, currently about $84 per barrel. And the U.S. economy may get just that, assuming Libya oil production starts to increase following the ouster of leader Moammar Gadhafi: output ran at about one-tenth its 1.8 million barrel per day (BPD) average during the civil war. If oil falls below $70 per barrel, that would boost U.S. GDP growth significantly.

© Copyright IBTimes 2024. All rights reserved.