What Is The Bank Of England Looking At Before Rate Decision?

The Bank of England must decide next week how much higher it will raise borrowing costs as it tries to bear down on Britain's double-digit inflation rate without adding too much stress to an economy already close to recession.

BoE Governor Andrew Bailey said last week that inflation might have turned a corner after it fell in November and December, but at above 10% it is still more than five times the BoE's 2% target.

Bailey has also warned that a shortage of workers could make it harder to bring down inflation by fuelling strong wage growth and creating too much heat in the economy.

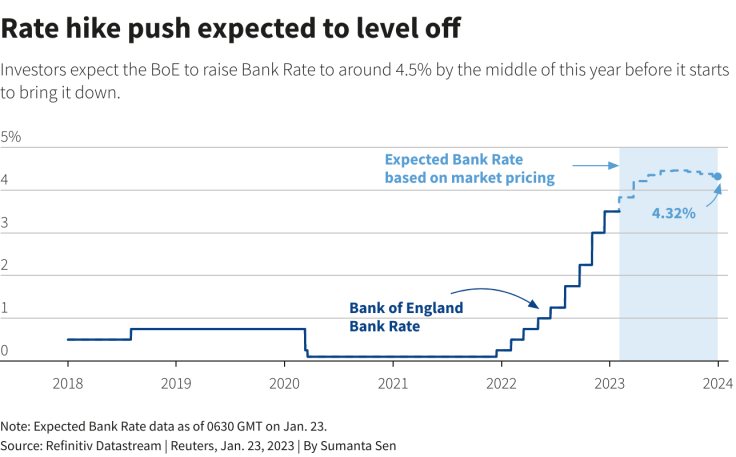

INTEREST RATES SEEN CLOSE TO PEAK

The BoE was the world's first major central bank to raise rates when it began pushing up borrowing costs in December 2021 and it is expected to announce its tenth hike in a row on Feb. 2. Investors are mostly betting on another half percentage-point increase to 4.0% and that Bank Rate will peak at 4.5% soon.

GRAPHIC: Rate hike push expected to level off -

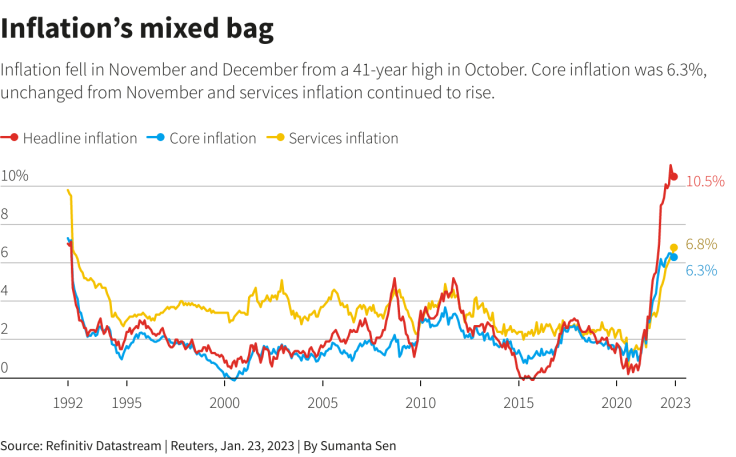

INFLATION FALLING BUT WARNING SIGNS REMAIN

Britain's main measure of inflation - the consumer prices index - hit a 41-year peak of 11.1% in October before edging down in November and December to stand at 10.5%.

The BoE predicted in its last forecasts, published in November, that CPI would slow to about 5% by the end of this year. That forecast might be lowered in next week's new projections after a sharp fall in gas prices.

But the BoE may be worried by how core inflation - which excludes volatile items such as food and energy - has not fallen, and by faster price growth in the service sector, which could mean high inflation is getting embedded in the economy.

GRAPHIC: Inflation mixed bag -

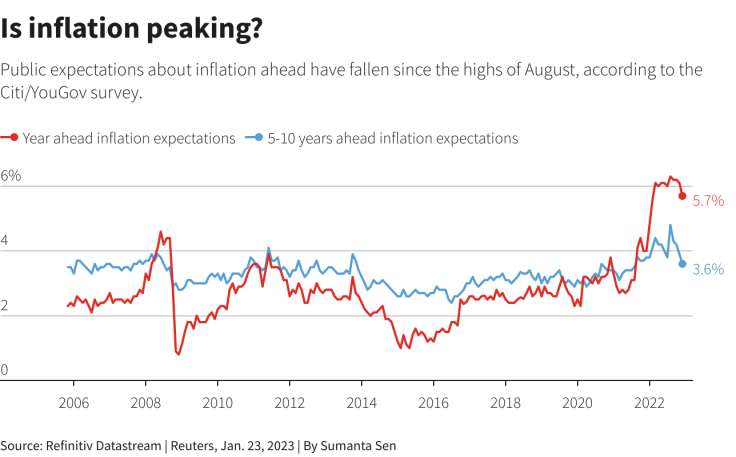

BRITONS REIN IN FUTURE INFLATION EXPECTATIONS

Bailey and his colleagues can take some comfort from signs that public expectations about future inflation are falling, potentially easing demands for higher pay. The YouGov/Citi measure of inflation expectations in five to 10 years' time - which the BoE watches closely - has fallen for four months in a row although it remains higher than before the pandemic.

GRAPHIC: Is inflation peaking? -

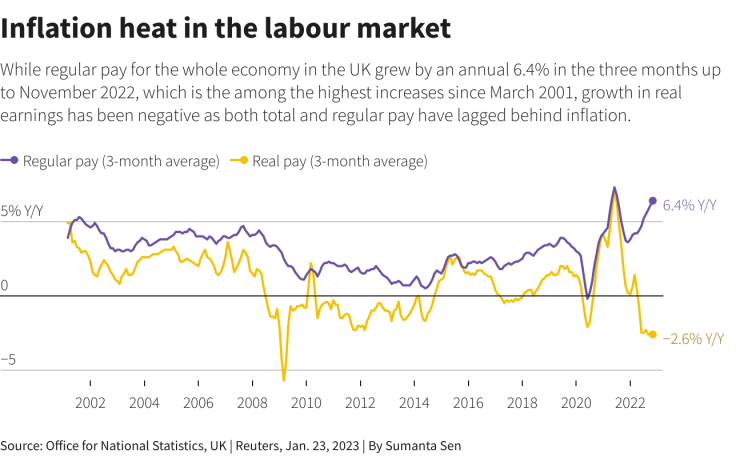

INFLATION HEAT BUILDS IN THE LABOUR MARKET

For now, however, wages excluding bonuses are rising at their fastest pace on record, other than during the COVID-19 pandemic when the data was distorted by government support. Average weekly earnings, excluding bonuses, rose by an annual 6.4% in the three months to November. But that was still not enough to protect pay from the corrosive effect of inflation.

GRAPHIC: Inflation heat in the labour market -

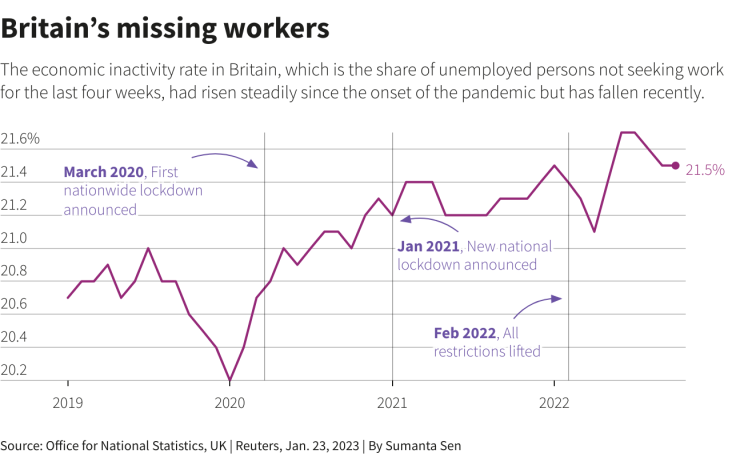

UK'S SHRUNKEN LABOUR MARKET WORRIES BOE

The BoE sees the shrinkage of the workforce as a worrying pointer for future pressure on pay. Other rich economies are also struggling with a lack of workers but Britain's problem has been compounded by post-Brexit restrictions on migrant workers from the European Union. The inactivity rate has edged down in recent months as more people look for work but it remains above its pre-pandemic level.

GRAPHIC: Strength in the labour market -

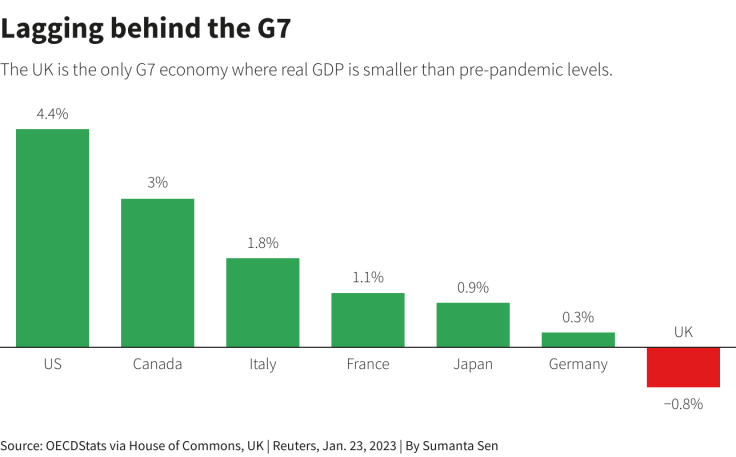

UK ECONOMY - THE G7 LAGGARD

Britain's economy seems to have dodged a recession in the second half of 2022 but economists expect it will fall into one this year, further setting back its return to its pre-pandemic size. Britain is the only Group of Seven economy yet to get gross domestic product back above its level at the end of 2019.

GRAPHIC: Low on confidence -

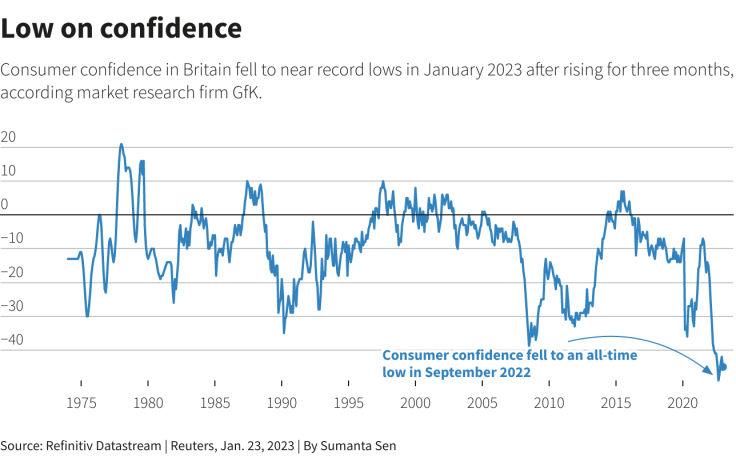

CONSUMERS STILL IN THE DUMPS

Britain's consumers are the key drivers of the economy and they seem to be in no mood to spend heavily as inflation keeps on making them poorer. The GfK index of consumer confidence fell back in January after rising for three months and was close to its lowest level since the survey began in 1974.

GRAPHIC: Not out of the woods -

(Writing by William Schomberg in LONDON; graphics by Sumanta Sen in BENGALURU; editing by Christina Fincher)

© Copyright Thomson Reuters 2024. All rights reserved.