What Big Companies Are Saying About The Global Economy: China Up, Europe Down

We are now knee-deep in fourth-quarter earnings season. And for the most part, U.S. companies are announcing better-than-expected results.

Of the 174 companies in the S&P 500 that have reported earnings so far, 68.4 percent have come in above analyst expectations, according to Thomson Reuters data. That’s a higher proportion than over the past four quarters and above the average since 1994.

But the most important part of this quarterly ritual is what companies are saying about the global economy.

A growing number of companies in the S&P 500 index appear to be seeing improving conditions in China, while reporting lower revenue growth in their European markets.

While China’s economy expanded in 2012 at the slowest rate in 13 years, it ended the year with a strong rebound in the fourth quarter, breaking a streak of seven consecutive weaker quarters. Hence, strategists are convinced that the Chinese economy is unlikely to encounter a "hard landing" this year.

Meanwhile, the European Union recorded a decrease in gross domestic product of 0.1 percent in the third quarter of 2012, after a 0.2 percent contraction in the prior quarter. Economists polled by Bloomberg expect the euro area economy to shrink by another 0.1 percent in the last three months of 2012. The EU’s statistics office is due to publish GDP data for the fourth quarter on Feb. 14.

Things aren’t much rosier in the U.S. Growth in the U.S. economy turned negative in the fourth quarter for the first time since the aftermath of the financial crisis in 2009.

Here’s what Corporate America is saying about the global economy in their earnings press releases and conference call transcripts.

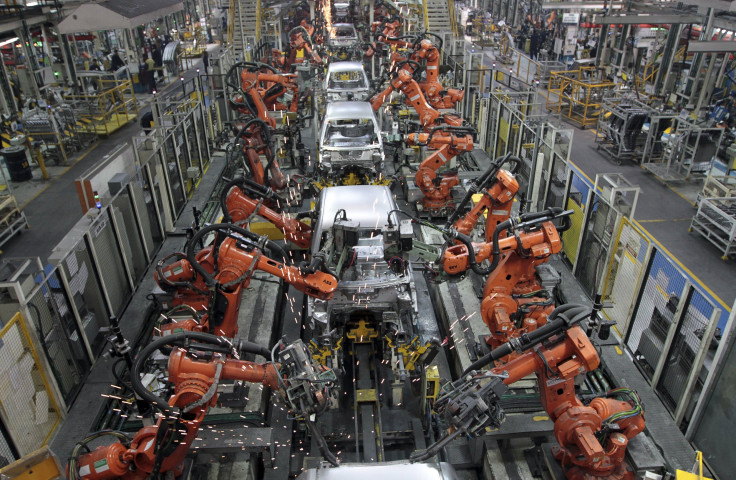

Caterpillar Inc. (NYSE:CAT) sees stronger China growth

“Our outlook assumes that Chinese government will maintain pro-growth policies throughout 2013, and we’re expecting the economic growth in China to be near 8.5 percent, a more favorable environment for construction and higher commodity demand.” (Source: Earnings call transcript.)

Coach Inc. (NYSE:COH) confirms that China’s appetite for fancy handbags is intact

"We achieved our strongest top line growth in China, which remains our largest geographic opportunity, given both the size of the market and the rate of growth. During the fourth quarter, our sales again rose sharply, up nearly 60 percent year-over-year, consistent with the prior quarter and fueled by distribution and significant double-digit same-store sales growth.”

“We're committed to opening about 30 new locations a year. Finding the right people to manage and staff our stores to provide the right Coach in-store experience constrains us from more rapid distribution growth. In FY '13, we again expect to open about 30 new stores, bringing the total to around 125 locations at the end of the year. In total, square footage in China is expected to grow about 35 percent in FY '13. And we expect sales to total at least $400 million, driven by both distribution and comparable location sales.” (Source: Earnings call transcript.)

Parker-Hannifin Corporation (NYSE:PH) says Europe’s problems won’t go away anytime soon

“Europe is really in the tank. I mean, I don't know how else to put it ... They are definitely in recession in Europe, there's no question about it … and I'm not sure when we're going to really dig out of that over there. So we're basically taking actions there, restructuring things and trying to get our costs in line to basically deal with this for the long term if it continues.” (Source: Earnings call transcript.)

Verizon Communications Inc. (NYSE: VZ) says uncertainty from Washington exacerbated its loss

“During the quarter, we continued to see delays in new contracts and investment decisions, as enterprises exercised caution with regard to the fiscal cliff, potential tax reform and other government policy changes. This uncertainty created a wait-and-see approach that clearly impacted new business in 2012. We continue to believe that as these factors evolve, companies will be in a better position to make decisions about their capital commitments. We remain hopeful that enterprises will renew their investing activities in 2013.”

“In terms of profitability, we did not see the margin improvement we were expecting in the second half of 2012, due primarily to the length of the time it took to reach an agreement with our unions and also to the significant business disruption caused by the challenges of Sandy.” (Source: Earnings call transcript.)

Lockheed Martin Corporation (NYSE:LMT) is deeply concerned about lower military spending

“We remain deeply concerned that sequestration could occur as the default outcome, if negotiations failed to produce an agreement.” (Source: Earnings call transcript.)

Alcoa Inc. (NYSE:AA) forecasts boost in global aluminum demand

“This year, we believe the [aluminum] demand is going to grow by 7 percent. This is 1 percent up from what we saw last year and when you go through this slide you see that, which is a breakdown on regions, you see that this is pretty much supported by all regions. I mean, obviously China sticks out. China, we believe, will rebound to 11 percent growth. We also see good growth in places like Russia, Brazil, India, Middle East.” (Source: Earnings call transcript.)

Apple Inc. (NASDAQ:AAPL) is investing heavily to keep up with demand for its key products

“We expect to spend about $10 billion in CapEx this fiscal year that will be up little under $2 billion year-over-year. We expect to spend a little bit under $1 billion in the retail stores. And the other $9 billion is spent in a variety of areas. We are buying equipment that we will own that we will put in partners’ facilities. Our primary motivation there is for supply, but we get other benefits as well. We are also adding to our datacenter capabilities … and in facilities and in infrastructure. So, that’s where the capital is going.” (Source: Earnings call transcript.)

© Copyright IBTimes 2024. All rights reserved.