What the Federal Reserve’s Beige Book Says About US Economy: Auto Sales, Manufacturing, Real Estate, Employment And Agriculture

Eight times a year, the Federal Reserve releases the Beige Book, a snapshot of business conditions in each of the Fed’s 12 regional bank districts. Although the findings are anecdotal and can be somewhat obscure, it has become an important part of the information discussed by the Federal Open Market Committee – the Fed’s policy-setting body.

The Beige Book is updated two weeks before each FOMC meeting in Washington. That makes it relatively current compared with many other economic indicators, which can lag a month or more behind the period they report on. The policymakers are scheduled to meet on March 19-20.

Here’s a rundown of some nuggets from Wednesday’s Beige Book. The report can be used to get a feel for the direction of the U.S. economy, which at the moment, is kind of meandering along. Directly quoted from the report:

- 1. Auto sales were strong in most districts.

Most districts reporting on auto sales noted solid or strong increases in sales, with the exception of mixed activity in the St. Louis district and a seasonal slowdown in the Dallas district.

Cleveland auto dealers credited milder-than-normal weather and pent-up demand for the robust sales growth. New auto sales remained solid in the San Francisco district, driven by demand to replace older vehicles and low financing rates. Chicago and Minneapolis contacts reported an increase in activity for auto service departments due to inclement weather.

Auto dealers in the Philadelphia district attributed the strong sales in New Jersey to the continued effect of Hurricane Sandy.

The New York district reported wholesale and retail auto credit conditions as positive, with one contact noting increasingly aggressive lenders. Most districts’ contacts were cautiously optimistic about future auto sales.

- 2. But rising gasoline prices and fiscal policies have restrained consumer spending in several districts.

Retailers pointed to the negative impacts on household budgets from rising gas prices, the end of the payroll tax holiday and the Affordable Care Act as explanations for the slower pace of retail sales. REUTERS/Brendan McDermid

Consumer spending expanded in most districts, but several districts reported mixed or lower activity among non-auto retailers.

Sales strengthened in the Philadelphia and Richmond districts, and retail sales were higher than a year ago in the Boston, St. Louis and Minneapolis districts.

San Francisco reported modest growth in sales, Dallas noted flat to slightly higher sales activity, and New York said retail sales were strong in January but slowed in February primarily due to weather.

The Chicago district said consumer spending increased at a slower rate, while Cleveland and Atlanta noted mixed sales activity. Kansas City said retail sales decreased since the previous survey period and were expected to remain flat in the months ahead.

Retailers pointed to the negative impacts on household budgets from rising gas prices, the end of the payroll tax holiday and the Affordable Care Act as explanations for the slower pace of retail sales.

Contacts in the Boston, New York and Minneapolis districts said severe weather depressed sales somewhat.

- 3. Tourism remained solid in most districts, thanks to increased snowfall during the winter ski season.

A ski resort in Minnesota reported that lift ticket sales and lodging were well ahead of last year, although not close to historical records. Boston and Atlanta noted a strong increase in international visitors, especially from Europe.

Philadelphia said tourist activity was solid in the Pocono Mountains ski resorts, but some revenues were lost when schools canceled winter break to make up for missed days during Hurricane Sandy.

Contacts in the Richmond district mentioned increased activity along the outer banks of North Carolina, and San Francisco reported solid growth of visitor counts and occupancy rates in Hawaii.

Travel was reported as robust in the New York district, particularly in Manhattan, as well as at hotels in the outer boroughs that are still occupied by displaced residents, utility workers, insurance adjusters and others due to Hurricane Sandy.

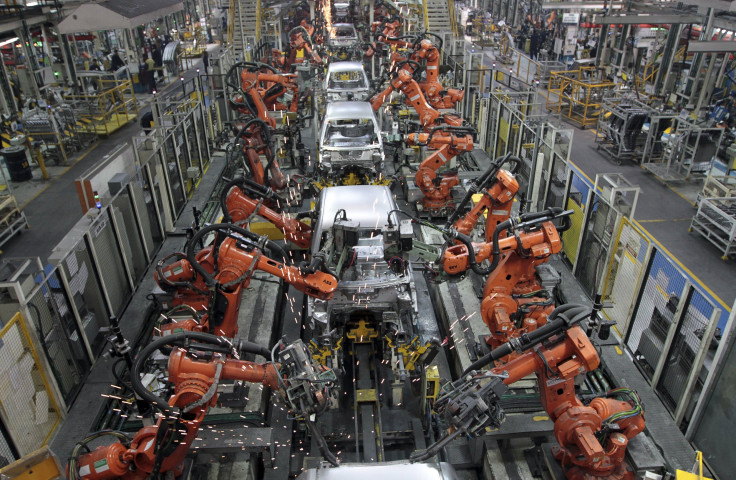

- 4. Manufacturing activity improved in nearly all districts, but the increases were generally modest.

Boston, New York, Cleveland, Richmond, Atlanta, Chicago, St. Louis, Minneapolis and San Francisco reported some increases in factory activity, but the majority noted that the pace of recovery was slow.

Conditions were mixed in the Philadelphia and Dallas districts, and manufacturing activity in the Kansas City district weakened. Contacts in the Cleveland, Richmond, Chicago and Kansas City districts cited concerns over government regulation and fiscal uncertainty as a reason for slow growth.

Auto production increased in the Cleveland, Chicago and St. Louis districts, and a Minneapolis contact noted that production increased faster than expected, spurring plans to renovate their plant. Philadelphia and Dallas reported that food manufacturing activity also exceeded expectations during the current period. Manufacturing related to residential construction was a source of strength for many districts.

Expectations for future factory activity were generally more optimistic compared with the previous survey. Contacts in the Boston, New York, Philadelphia, Cleveland, Atlanta, St. Louis, Kansas City and Dallas districts expected activity to improve over the next few months across a wide variety of industries.

- 5. Home prices edged higher in the majority of districts.

A newly built single-family home that is sold is seen in San Marcos, Calif., Jan. 30, 2013. Privately owned homebuilders are seizing on a housing supply crunch to tap the stock market as more Americans, buoyed by an improving economy, seek to buy their first home or move into bigger premises. REUTERS/Mike Blake

Residential real estate activity continued to strengthen in most districts, although the pace of growth varied.

Contacts in the Boston, St. Louis, Minneapolis, Kansas City, Dallas and San Francisco districts noted strong growth in home sales, while New York and Chicago reported slight improvements.

A realtor in the Richmond district indicated that low interest rates continued to motivate home buyers, and potential buyers in the Philadelphia district expressed greater confidence, including entry-level purchasers who had been increasingly opting to rent since mid-summer.

Home prices edged higher in the majority of districts, with lower inventories generally cited as the primary cause. Inventories declined in nearly all districts, with realtors in several districts concerned about the impact on future sales volume.

- 6. In most districts, it has become easier to get a loan.

Bank of America. Reuters

Loan demand was steady or increased across all the districts that reported, mainly driven by refinances due to continued low interest rates. Borrowing standards were reported to have been loosened in some districts.

- 7. Agricultural conditions deteriorated in a number of districts due to the drought.

A yellow flower is seen in the bed of a dried-up pond on the outskirts of Kunming, southwest China's Yunnan province July 8, 2007. REUTERS/Stringer (CHINA)

Across the country, agricultural conditions varied with weather patterns.

Persistent drought contributed to poor crop and pasture conditions in the Kansas City and Dallas districts while recent precipitation improved soil moisture levels in the Atlanta and Chicago districts.

Kansas City and Dallas indicated that drought-related herd reductions pushed cattle supplies to historic lows, and Chicago, Kansas City and Dallas reported weaker agricultural export activity.

- 8. Not a whole lot of improvements in the labor market.

Unemployed person seeking a job. Reuters

Labor market conditions generally improved, although several districts reported restrained hiring.

Many districts reported a rise in temporary employees, while staffing contacts in the Boston district noted an increase in the placement of permanent and temporary-to-permanent workers.

Employers in several districts cited the unknown effects of the Affordable Care Act as reasons for planned layoffs and reluctance to hire more staff.

© Copyright IBTimes 2024. All rights reserved.