What To Mine Post The Ethereum Merge?

After Ethereum successfully completed the Merge and became proof-of-stake blockchain, Ethereum mining pools depleted to zero. However, an estimated $5 billion worth of mining hardware doesn't vanish overnight.

This begs the question, where can ETH miners now go, outside of selling their hardware? That depends on the blockchain's mining compatibility and their ecosystem viability. Here are some candidates to consider.

Ethereum Merge ends ETH mining but leaves ETHW

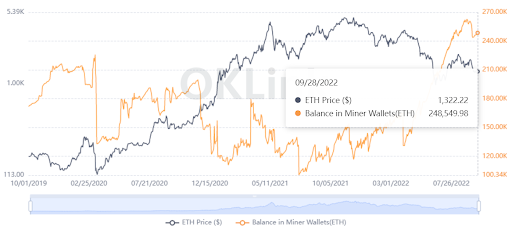

By becoming proof-of-stake, Ethereum reduced ~99% of its energy consumption, making it more enticing for ESG-oriented investors. One week after The Merge, miners exerted a 16,000 ETH selling pressure to recoup some of their losses. At the end of September, that still leaves them with over 248k ETH for investing in future ventures.

The world's largest crypto exchange, Binance, was the first to step in and offer a proof-of-work mining pool for EthereumPoW (ETHW) miners. This is the pre-Merge Ethereum, just like Ethereum Classic (ETC) is the original Ethereum. Until the end of October, ETHW miners get to enjoy zero-fee mining.

#Binance launches the Ethereum Proof-of-Work $ETHW Mining Pool!

— Binance (@binance) September 29, 2022

Mine $ETHW with #Binance Pool and enjoy zero fees on all your earnings 🤝

Read more ➡️ https://t.co/gwe0eKb1Pt pic.twitter.com/J6jFOpljzG

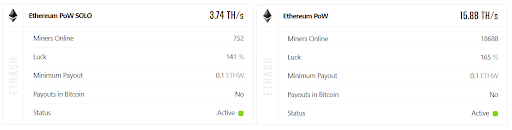

On 2miners.com mining aggregator, EthereumPoW yields a 0.1 ETHW minimum payout. Depending on solo or pooled mining, miners get to pick their luck threshold.

All luck percentages above 100% translate to more consistent rewards because the pool needs fewer shares than expected according to the network's difficulty. For example, a six-sided dice role yielding number 6 would translate to a 16.6% luck chance. But, if a miner has six GPUs to mine with, they get to roll the dice six times.

Therefore, a solo miner has six times less chance to win 1 ETHW, presently priced at $11.76. If the solo miner were to join a pool with the 6-GPU miner, they would receive ~$2, while the 6-GPU miners would get ~$10. On their own, miners can get that reward, but it would take much longer.

Of course, miners have to test their chances against the network's difficulty, which is a wall miners overcome with their own hashrate powers. For ETHW, a high-end GPU like RTX 3080 delivers 100 MH/s at 250W power draw. With present price and block reward of 2 ETHW, this setup would leave one on the brink of profitability, at -0.5$ per day, if the electricity cost is $0.14 per kWh.

Top 3 Altcoins to mine after Ethereum

While Binance Pool profitability for ETHW is yet to be revealed, there are existing alternatives that could take advantage of GPU-focused mining hardware. Here are some of the top candidates. When accounting for mining profitability, we assume that electricity cost sits at $0.14 per kWh, which is the average in the US.

1. Ethereum Classic (ETC)

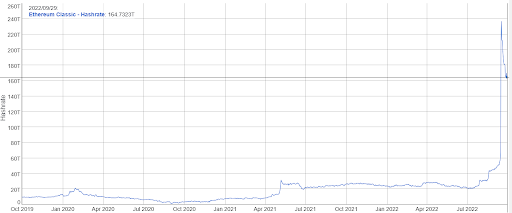

Given its origin, Ethereum Classic is the perfect candidate for Ethereum mining migration. While it doesn't have as many dApps as Ethereum, it still covers all categories, from DeFi to blockchain gaming. Because it is fully compatible with ETH miners, ETC received a hashrate boom this year, having slumped since to 164 TH/s.

Ethereum Classic block reward is 3.2 ETC, typically mined in pools offered by Ethminer, NBminer, Claymore Miner, and FinMiner. 2miners holds the bulk of the hashrate pools at 16.2 TH/s, with an average 406% luck rate across 20k miners.

Interestingly, ETC can be exchanged within Exodus' in-built wallet exchange anonymously, which is another boost for privacy-oriented miners.

2. Monero (XMR)

Both Bitcoin and Ethereum boast their transaction transparency. Anyone can use their respective blockchain explorers to link a wallet's address to a specific transaction. But, what if you want financial privacy?

This is where Monero comes in as a privacy coin. Although Monero prefers CPU mining after the RandomX upgrade in 2019, it is also doable to use GPU-focused mining, if one can get the cards at a discount. For instance, AMD Radeon VII can deliver 1,740 H/s, drawing merely 135W.

CudoMiner is the go-to mining client for Monero, but 2miners is also very popular, providing enticing 460% luck on average for a block reward. Current Monero block reward is 1.26 XMR, with one XMR priced at $150.

Other popular pools for XMR mining are MineXMR, Nanopool and SupportXMR. Year-to-date, Monero (XMR) has performed better than Bitcoin (BTC), at -40% vs. -60% respectively. This indicates ample demand for privacy coins.

3. Litecoin (LTC)

Bitcoin's younger brother, Litecoin, was designed with low transaction fees in mind. While ASIC mining rigs are superior for LTC mining, it can also use GPUs. With that said, amid the current bear market slump, unless your electricity cost is near-zero, LTC profitability without ASIC rigs is extremely difficult.

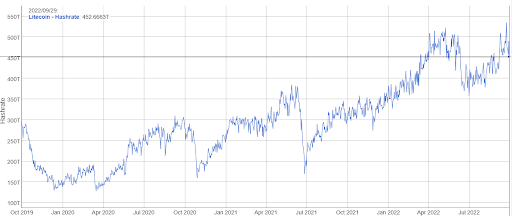

Nonetheless, Litecoin hash rate was also boosted after the merge, presently holding at 452 T/Hs.

Bearing risky profitability in mind, LTC mining delivers 12.5 LTC per block. Like Bitcoin, Litecoin employs a halving mechanism to mitigate demand, so that reward will be halved in four years. The most popular places to mine Litecoin are Easy Miner, CGMiner Litecoin, Awesome Miner, and MultiMiner. All of them offer GPU/CPU mining flexibility.

Is Altcoin Mining profitable?

Since January 2022, the total crypto market cap has melted by $1.2 trillion. With so many altcoins down between 40-90%, profitable mining is exceedingly difficult to find. Specifically, GPU-based mining. While ASIC miners are still profitable, GPU miners will have to settle for ETC and ETHW for the foreseeable future.

© Copyright IBTimes 2024. All rights reserved.