When interest rates rise so do stock prices

Tom Sowanick is Co-President and Chief Investment Officer at Omnivest Group LLC, Princeton, N.J.

There are now increasing concerns that rising Treasury yields will begin to push stock prices lower and punish new entrants to the equity market. Our view is that there is still plenty of room for risk-free interest rates to rise without having a negative impact on the current equity rally.

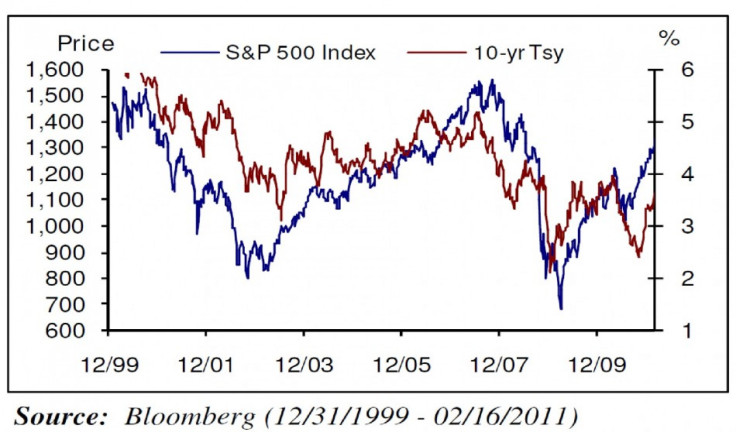

In the chart below, we illustrate the directional linkage between the 10-year Treasury yields and the price level of the S&P 500 Index, from 1999 to 2009.

Over that period, there has been a 0.85 correlation between the direction of Treasury yields and the direction of the S&P 500 Index, confirming that rising yields have normally been accompanied with rising stock prices. The opposite has also been true, where declining Treasury yields accompanied falling equity prices.

This cycle seems to be following the script of the past 10 years. The S&P 500 Index established a cyclical bottom in July 2010 and has since rallied 32.65 percent.

The 10-year Treasury yield which bottomed in early October of 2010 with a cyclical low of 2.39 percent has since then risen to 3.65 percent, resulting in a price loss of 9.53 percent.

It is our contention that the gap on the right side of the chart will narrow with Treasury yields rising towards the S&P 500 Index, as equities continue to rally further still. It may be worth remembering that when the S&P 500 Index was moving up to its all time highs in 2007, the yield on the 10-year note priced in a relatively tight range of 4.5 percent to 5 percent. This occurred while the Federal Funds rate remained steady at 4.75 percent.

We were recently asked, what would happen to stocks if the Federal Reserve made a surprise move to begin to raise interest rates.

Our answer was that this particular Federal Reserve would never surprise the market with an unexpected rate hike. A more likely approach by the Federal Reserve would be to broadcast, over a fairly long period of time, their intentions to begin raising interest rates.

In the meantime, we believe that as the Federal Reserve begins to normalize interest rates, the stock market can easily absorb a gradual rise of both Treasury yields and Federal Funds rates. We hope that, at some point, the Federal Reserve will have sufficient confidence in the strength of the economy to begin lifting interest rates.

That confidence should be shared by investors, especially those who have been willing to move away from risk-free assets.

Even though the economy may be slow in producing jobs, it is strong enough to produce very solid earnings for companies. Also, stabilization of the housing market will prove to be very supportive of the banking sector, which in turn should finally spur increased lending activity to small businesses; a key component to increasing US GDP in 2011.

© Copyright IBTimes 2025. All rights reserved.