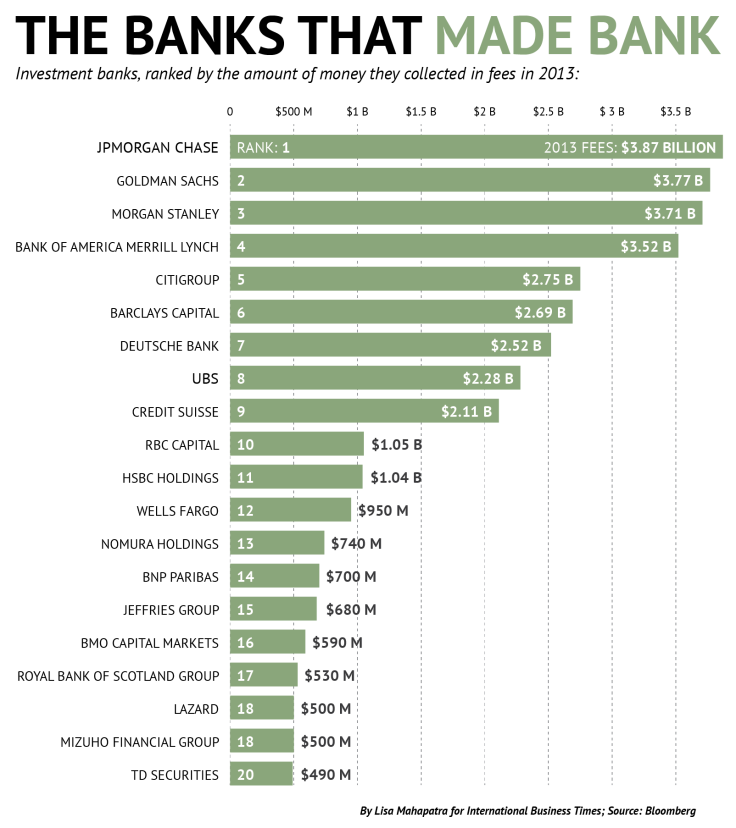

Which Investment Banks Made The Most Money Off Fees In 2013? [CHART]

Investment banking fees generated from advisory services, debt and equity issuance totaled $53.5 billion last year, according to Bloomberg, up almost 5 percent from 2012.

The top 20 banks to have made the most money made a combined total of $35 billion in just fees last year. That’s more than half of the $53.4 billion investment banking pie.

JPMorgan Chase (NYSE:JPM) topped the list, again, with Goldman Sachs (NYSE:GS) coming in second, again. It’s really no surprise that it’s the “too-big-too-fail” banks, that are making the most money. The top five banks on this ranked list tend to shuffle around within the top ranks.

It’s the bottom half of this top 20 list that have seen the most change over the past few years.

Mid-sized firms Mizuho, rank 18 and Jeffries, rank 15, made this list for the first time in 2013. Rothschild, which placed at rank 15 in 2012, fell out of the two 20 this year, as did Societe Generale, rank 19 in 2012.

Here’s how much the top paid investment banks in the world made in fees last year, in a chart:

© Copyright IBTimes 2024. All rights reserved.